How to Margin Trade on Binance | Differences from Futures | Fees

In this blog post, we will explore how to margin trade on Binance, the differences from futures trading, and the fees involved. Margin trading provided by Binance is a leveraged trading method that allows users to trade with a larger amount than the funds they own. It has become one of the trading methods that investors familiar with spot trading consider for higher profits. However, there are often cases where unexpected losses occur due to a lack of clear understanding of the differences between margin trading and futures trading, or a failure to properly understand the fee structure of each trading method.

How to Margin Trade on Binance

The method for performing margin trading on Binance is as follows:

1. Sign up for a Binance account

To proceed with margin trading, a Binance account is required, and KYC authentication must be completed. Please sign up through the fee discount link below.

2. Deposit to Binance

Please purchase coins from Upbit, Bithumb, etc., and deposit them to Binance.

3. Transfer funds

Now, let's transfer Tether (USDT) to the margin account. We will borrow TFUEL coins to open a short position, so the reason for transferring Tether (USDT) to the margin wallet is because collateral is needed to borrow the coins. Click the Wallet menu at the top right of the site, and then select 'Overview'. Then, click the 'Transfer' button at the top right.

We will proceed with the transfer from Fiat and Spot to Isolated Margin. Enter the amount to transfer and then click 'Confirm'. The margin item will be 'TFUEL (Theta Fuel)'. This is because Theta Fuel is not included in futures trading, so you must use margin trading to open a short position.

4. Open a short position

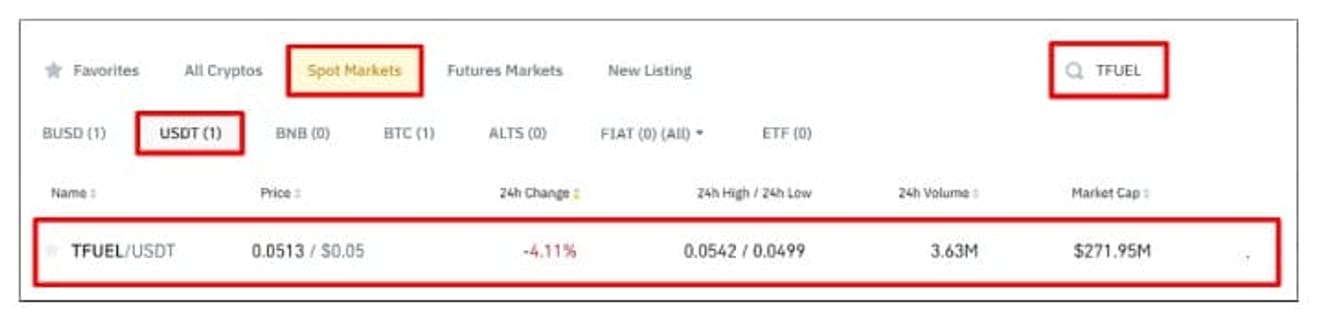

Margin trading is actually borrowing coins, so trades are made on the spot market, not the futures market. Therefore, we will first move to the TFUEL/USDT spot market. Since there is high interest in short positions, we will focus on short positions. Enter 'Markets' from the top menu of Binance, then search for 'TFUEL' and click the 'TFUEL/USDT' row in the Spot Markets → USDT tab.

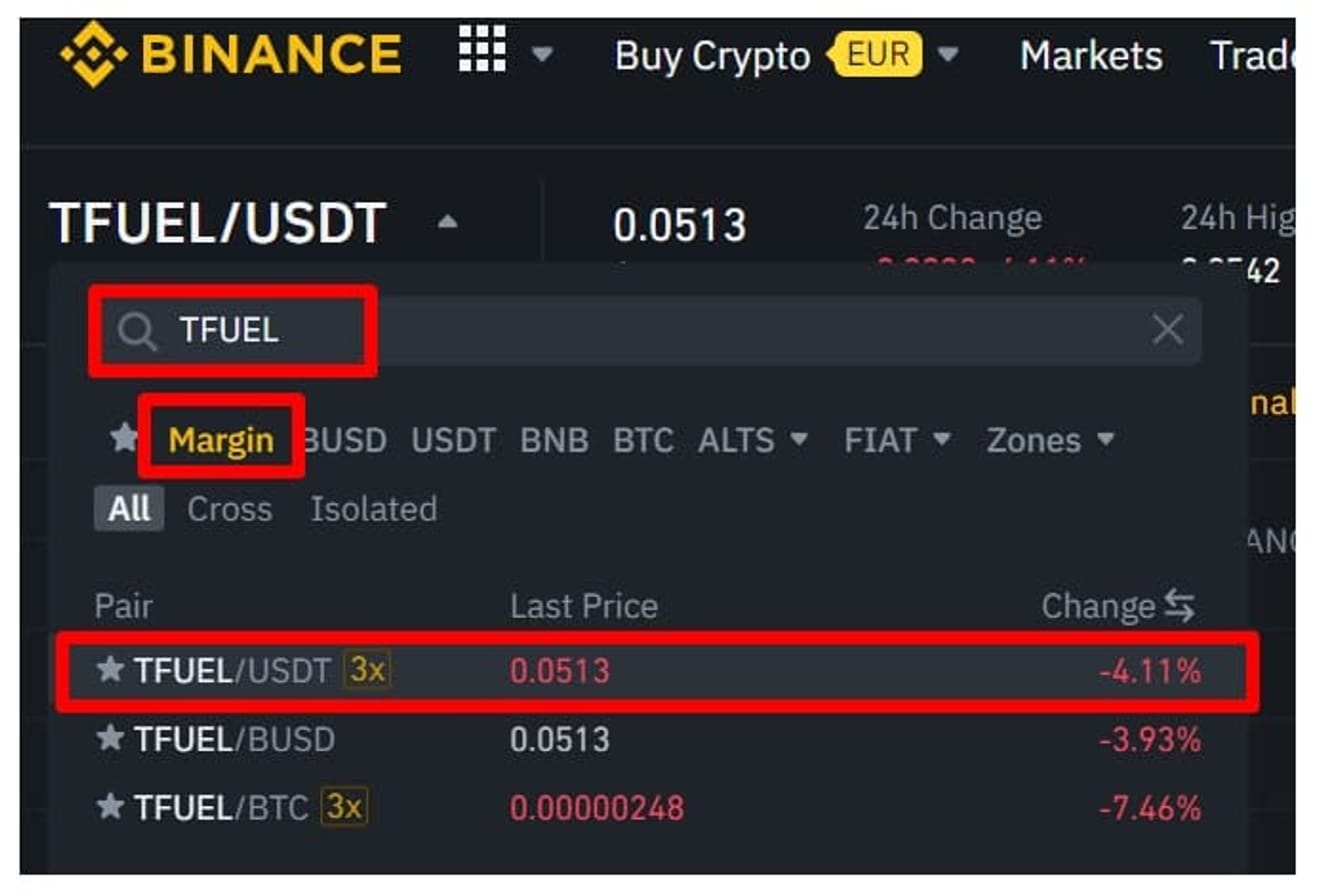

Once you enter the market, enter TFUEL in the search bar, check the Margin tab, and click the 'TFUEL/USDT' row. '3x' displayed on the right means that you can borrow up to 3 times the collateral.

Click the 'Borrow' button in the bottom right to borrow the coins.

The amount of TFUEL that can be borrowed according to the current fund situation is displayed. Let's borrow '7000' coins. Click the 'Confirm Borrow' button.

- Hourly Interest Rate: You must pay 0.00083333% interest on the amount borrowed per hour. This varies depending on the coin and is generally very small.

- Maximum Borrow Amount: The maximum limit that can be borrowed is determined according to the amount of Tether deposited, the Binance account grade, and the maximum amount for each coin.

Now, we will sell the borrowed 7000 coins in the market. Isolated 5x → SELL → Market → Normal → Enter the quantity → Click the Sell TFUEL button. If you click the 'Borrow' tab and press the 'Sell' button, the process of borrowing and selling is automatically carried out. Since we borrowed manually, we will use the Normal method, and when you become proficient later, try using the Borrow tab.

If a strange window appears on the left, press the 'Skip' button to skip, or if you want to read the help, press 'Next' to look at it step by step.

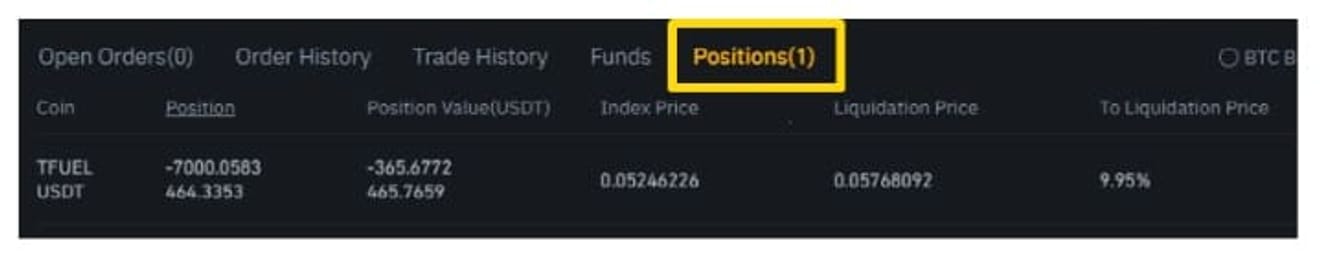

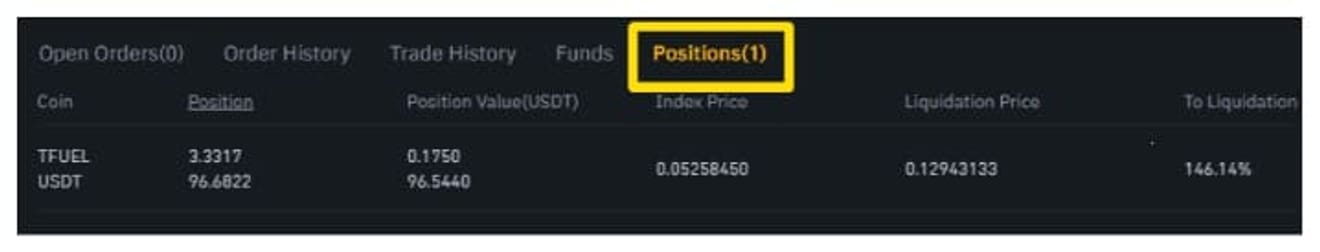

You can check the position status by clicking the Positions (1) tab at the bottom. Let's check them one by one.

5. Closing the position

There are several ways to close a position, but today, we will close the position by buying TFUEL in the margin market and repaying it in the orthodox way. First, let's buy back 2000 Theta Fuel in installments and pay it back. Isolated 5x tab → BUY tab → Market (Market Price) → Normal → Enter 2000 in Amount and click the 'Buy TFUEL' button.

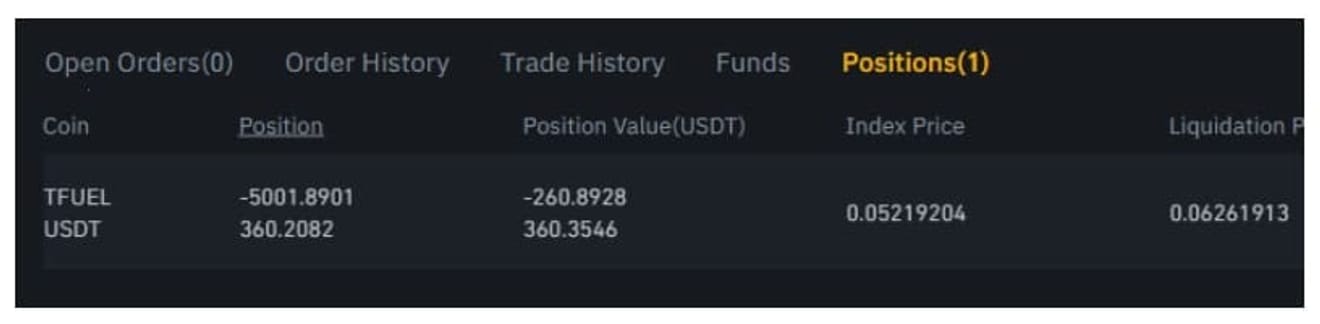

After the purchase, you can see that the short position has decreased to about '-5000' in the position on the left. Although we haven't paid back the coins yet, the position decreases by that amount because we hold 2000 in spot. In other words, if you buy 7000, you are almost in a neutral position. You can pay it back in this state, or you can continue to hold it.

Now, let's repay 2000 Theta Fuel. Click the 'Repay' button located at the bottom right of the screen.

Let's repay all the holdings. We purchased 2000, but only 1998 are left because the fees are automatically deducted in the trading process. Click 'Confirm Repayment'.

Now, let's purchase approximately 5000 coins remaining additionally. Considering the fees incurred in the middle, we decided to purchase 5010.

Looking at the left screen, the position is displayed as 3.3317. This means that because we bought generously, we hold 3.3317 more. Now, let's repay all of the remaining amount. Press the 'Repay' button located at the bottom right of the screen, which you used before.

We will repay all the amounts including interest. Click 'Max' and then click 'Confirm Repayment'.

Now, we have repaid all the loans. The reason the position still remains is because the remaining Theta Fuel is considered a long position. In the case of a small amount, you can move it to the spot market and convert it to BNB or sell it in the market and exchange it for Tether.

6. Transfer the balance to the spot market

Now, let's move Tether and the remaining TFUEL to the spot market. Click the 'Transfer' button located at the bottom right.

You can set From (Isolated Margin) and To (Fiat and Spot) as shown below, and then move both TFUEL and USDT.

Binance Margin Fees

The fees incurred when margin trading on Binance are mainly divided into two types: trading fees and loan fees.

1. Trading Fees

Since margin trading is conducted in the spot market, spot trading fees apply. Basically, a fee of 0.1% is charged to both the Maker and Taker. However, you can receive additional discounts if you pay the fees using BNB.

2. Loan Fees

In margin trading, since you borrow funds to trade, interest is also generated on the loan. The interest rate on the loan varies for each coin, and generally, the daily interest rate is between 0.01% and 0.08%. Interest is charged at every hour on the hour, and the interest rate may vary depending on the borrowed coin, so it is recommended to check it directly.