How to Trade Bitcoin Futures | Recommended Futures Exchange Sites | Fees | Bybit

In today's post, we'll comprehensively examine how to trade Bitcoin futures, recommend reliable futures exchange sites, the important fee structure for trading, and the representative global exchange, Bybit.

The cryptocurrency market is growing rapidly and is now expanding beyond simple spot trading to various derivatives markets. Bitcoin futures trading, in particular, is attracting significant attention due to its leverage function, which allows for large trades with small amounts. Investors use this to expand profits or, conversely, use it as a hedging strategy to protect their assets.

However, futures trading involves high risks along with great opportunities. Because assets can be lost in a short period if the market fluctuates rapidly, selecting a stable exchange, understanding transparent fees, and systematic risk management are essential.

In this article, we've organized everything from the principles of Bitcoin futures trading, exchange comparison points, the pros and cons of Bybit, to the trading fee structure, making it easy for beginners to understand. Through this article, those who have no experience in futures trading can learn the basics, and those who already have experience can establish more efficient strategies.

Recommended Bitcoin Futures Exchange Sites

There are several Bitcoin futures exchanges, but there's a reason many investors recommend Bybit.

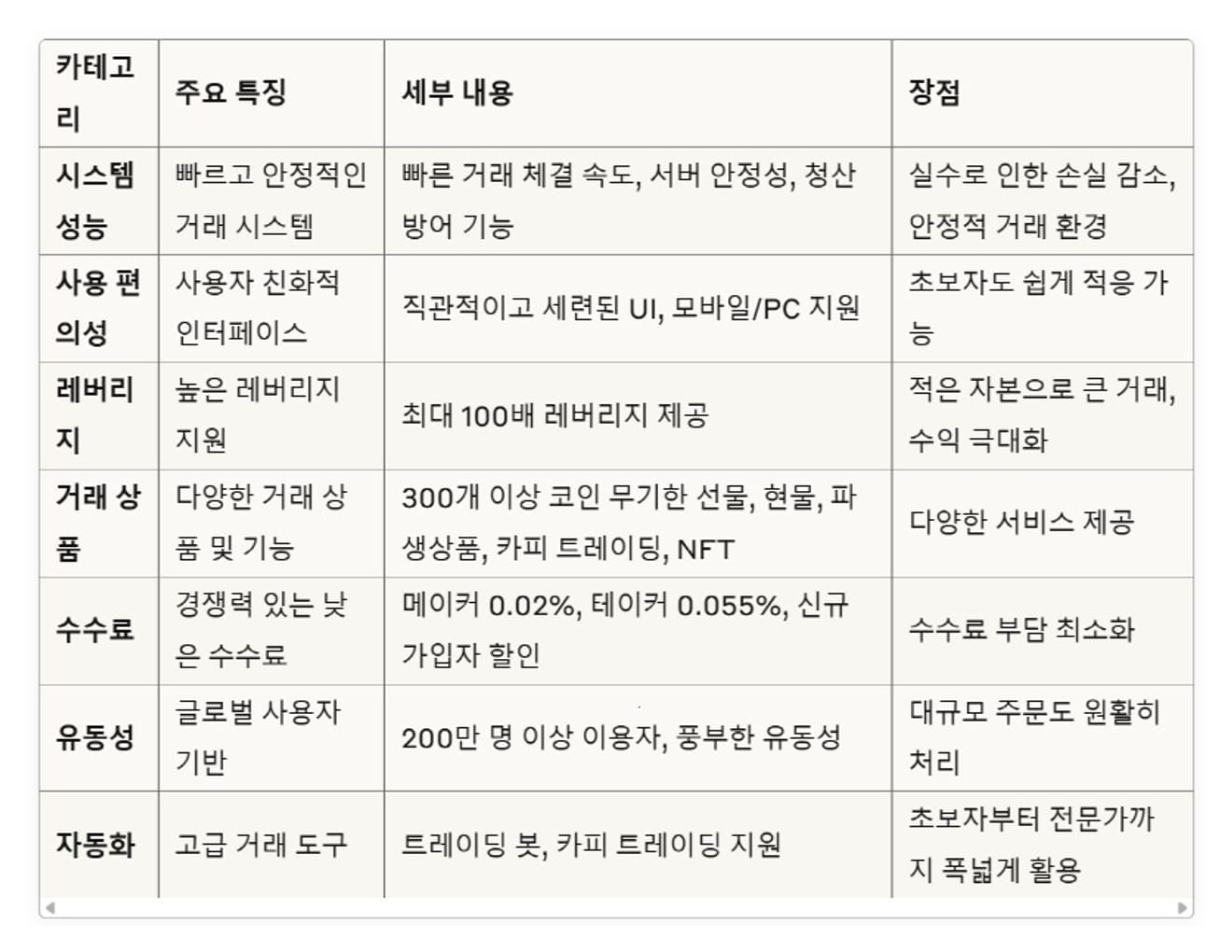

Stable Trading Environment

The transaction execution speed is fast and the server stability is excellent. The system doesn't stop even with rapid price fluctuations, so you can trust it.

Intuitive Interface

It provides a UI that beginners can easily adapt to. It supports both PC and mobile apps, and you can view charts and order windows at a glance.

High Leverage Support

Supports up to 100x. It is possible to make large transactions even with small capital, which can maximize profits. However, beginners are recommended to use a low ratio.

Various Products

In addition to Bitcoin, futures trading for more than 300 coins such as Ethereum and Ripple is available. Spot, derivatives, copy trading, and even NFT services are provided.

Low Fees

The basic maker fee is 0.02%, and the taker fee is 0.055%. Fee discount events are also frequently held for new subscribers.

Global Liquidity

There are millions of users worldwide, so the liquidity is abundant. Thanks to this, even large orders are processed quickly.

Automation Function

Supports trading bots and copy trading. Beginners can easily follow, and experts can also trade efficiently through strategy automation.

For these reasons, many users recommend Bybit as a futures exchange.

How to Trade Bitcoin Futures

The process of starting futures trading on Bybit can be roughly divided into four steps: signing up, security authentication, depositing, and executing transactions.

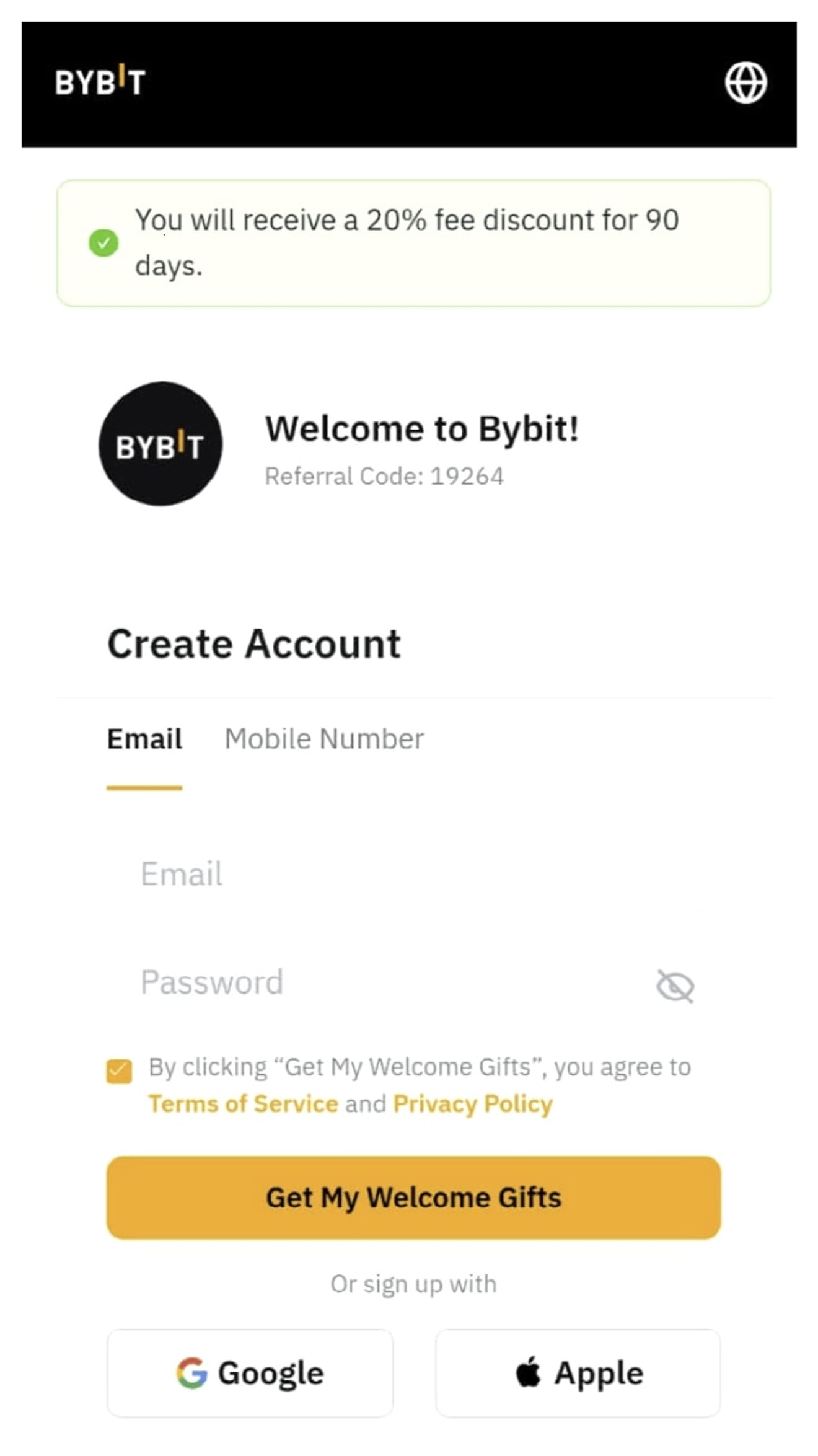

Sign Up and Authentication

Signing up is possible with only an email or mobile phone number. Afterwards, you must set up KYC authentication and 2-factor authentication (Google OTP). This allows you to securely protect your account.

If you use the partner link, a referral code is automatically applied. Through this, you can receive fee discounts or bonuses.

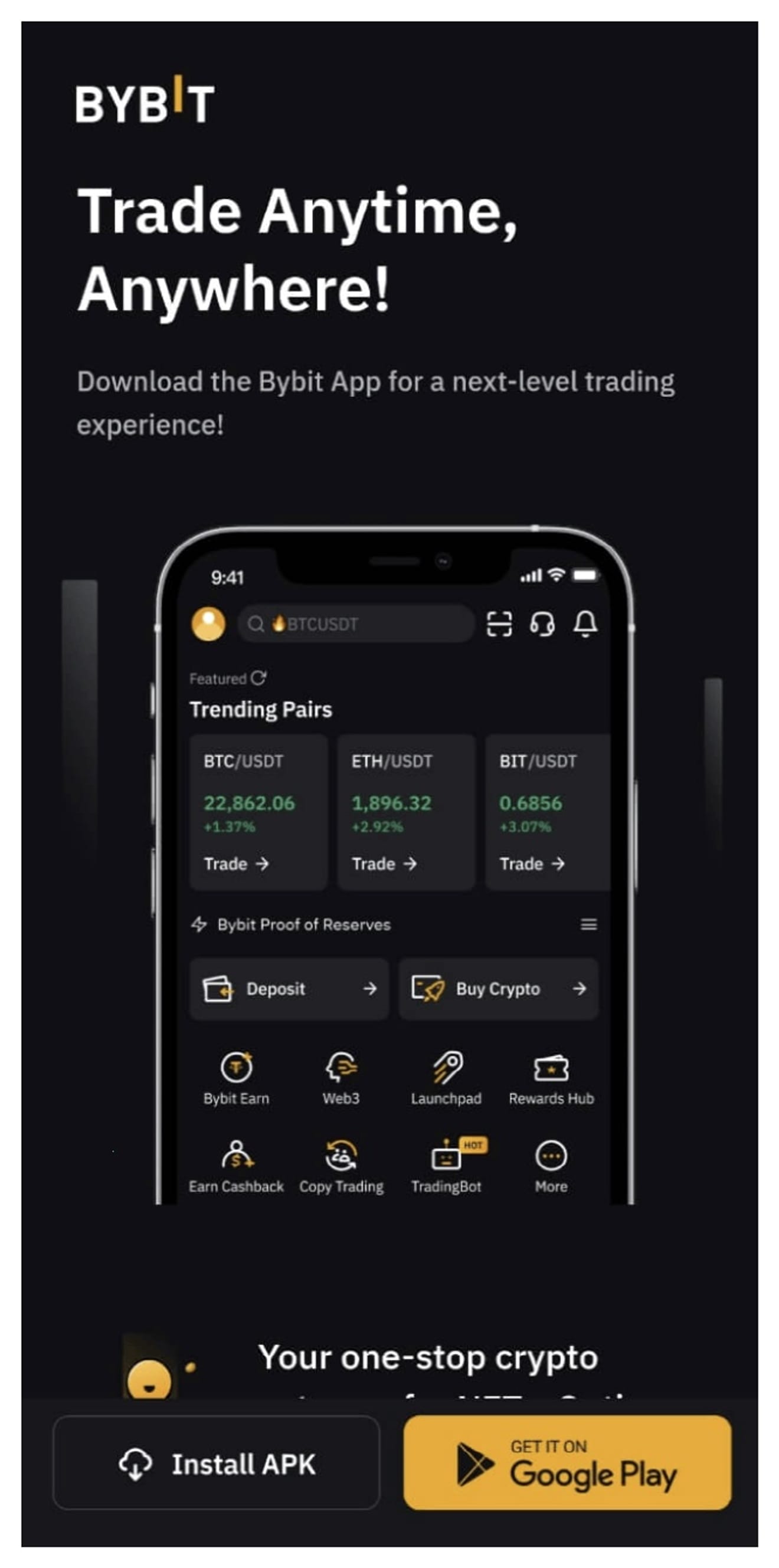

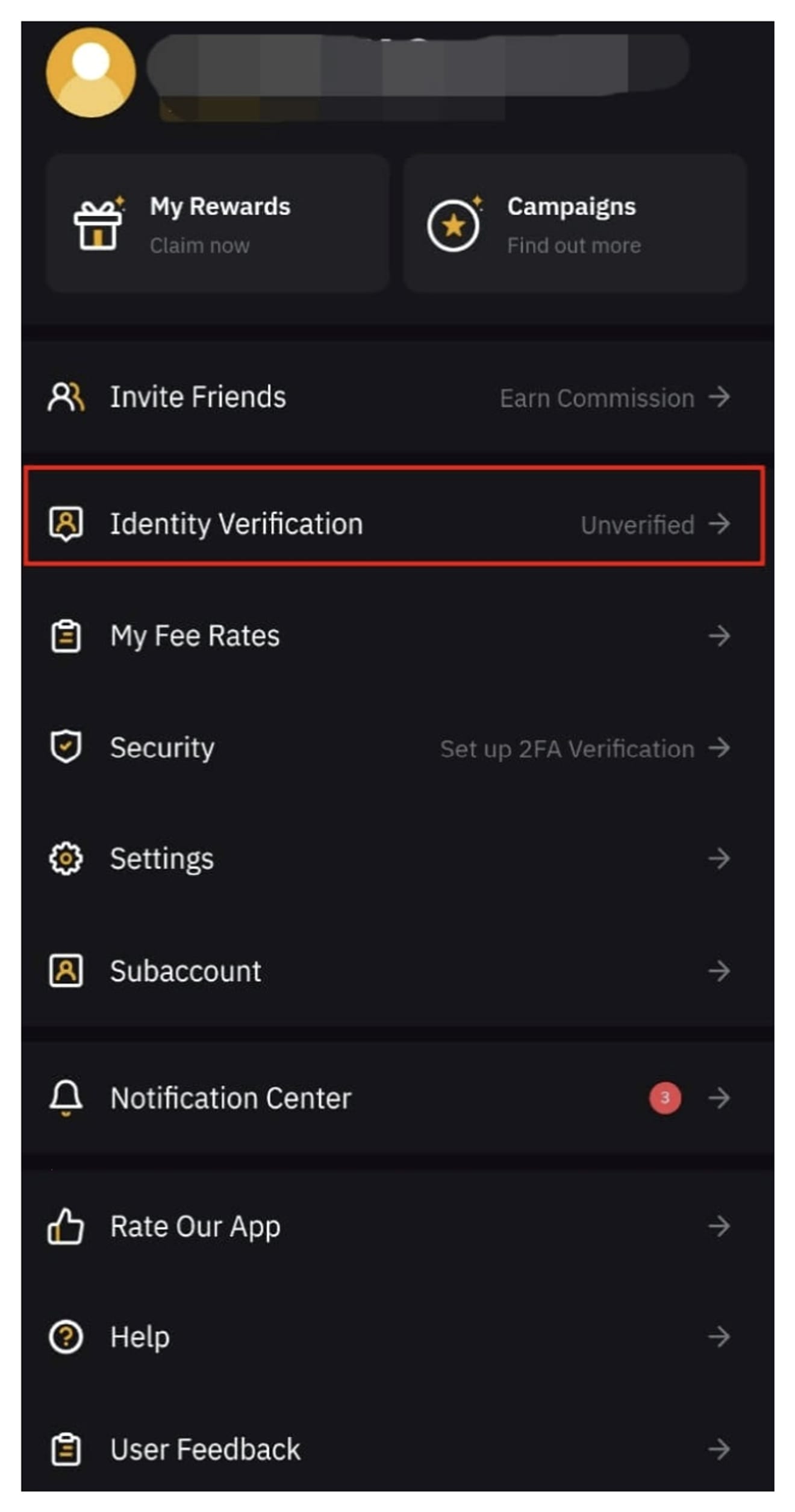

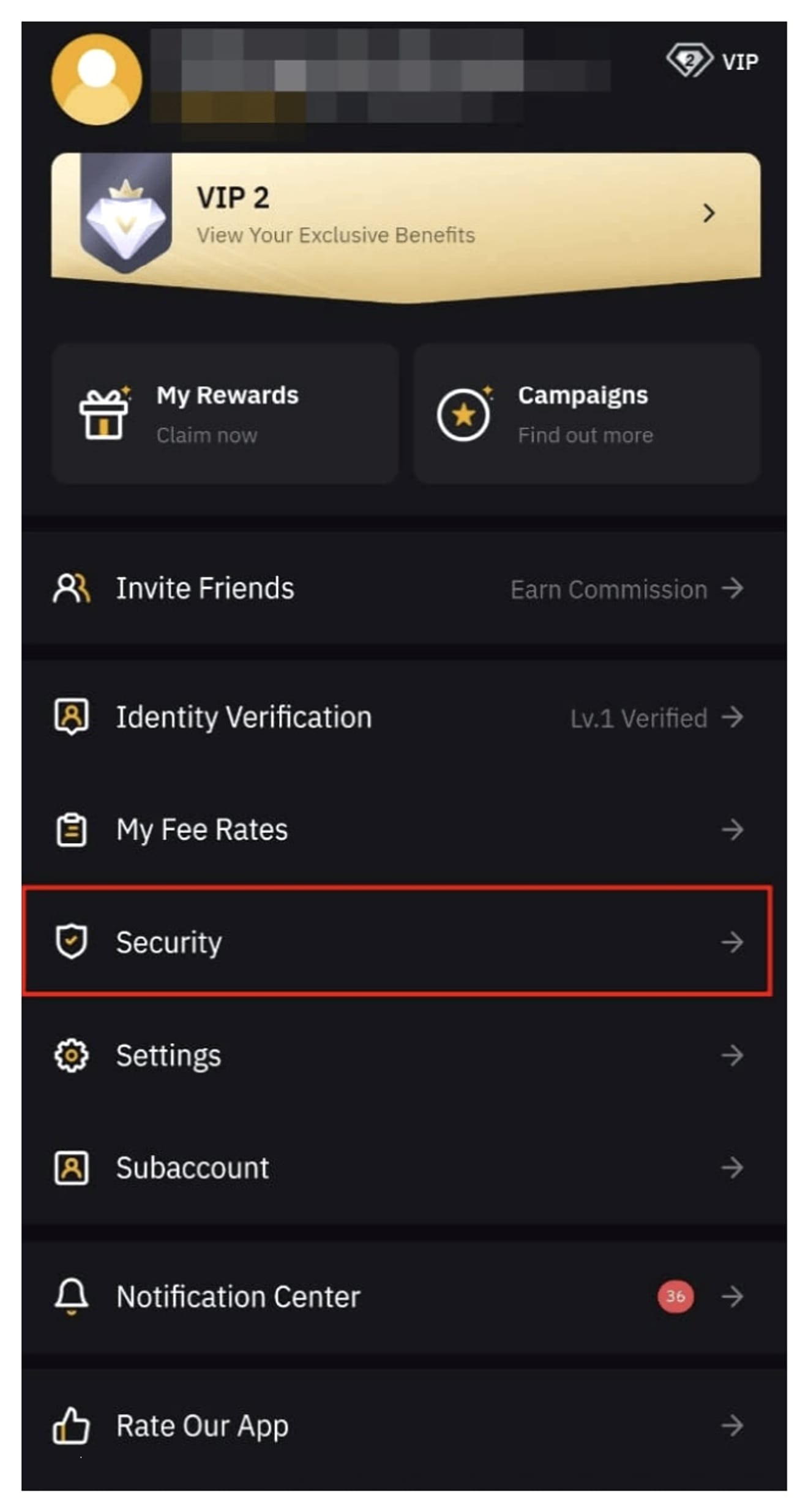

App Installation and Security Settings

After installing the mobile app and logging in, KYC authentication and OTP settings are available. KYC is often approved within minutes with an ID and selfie submission.

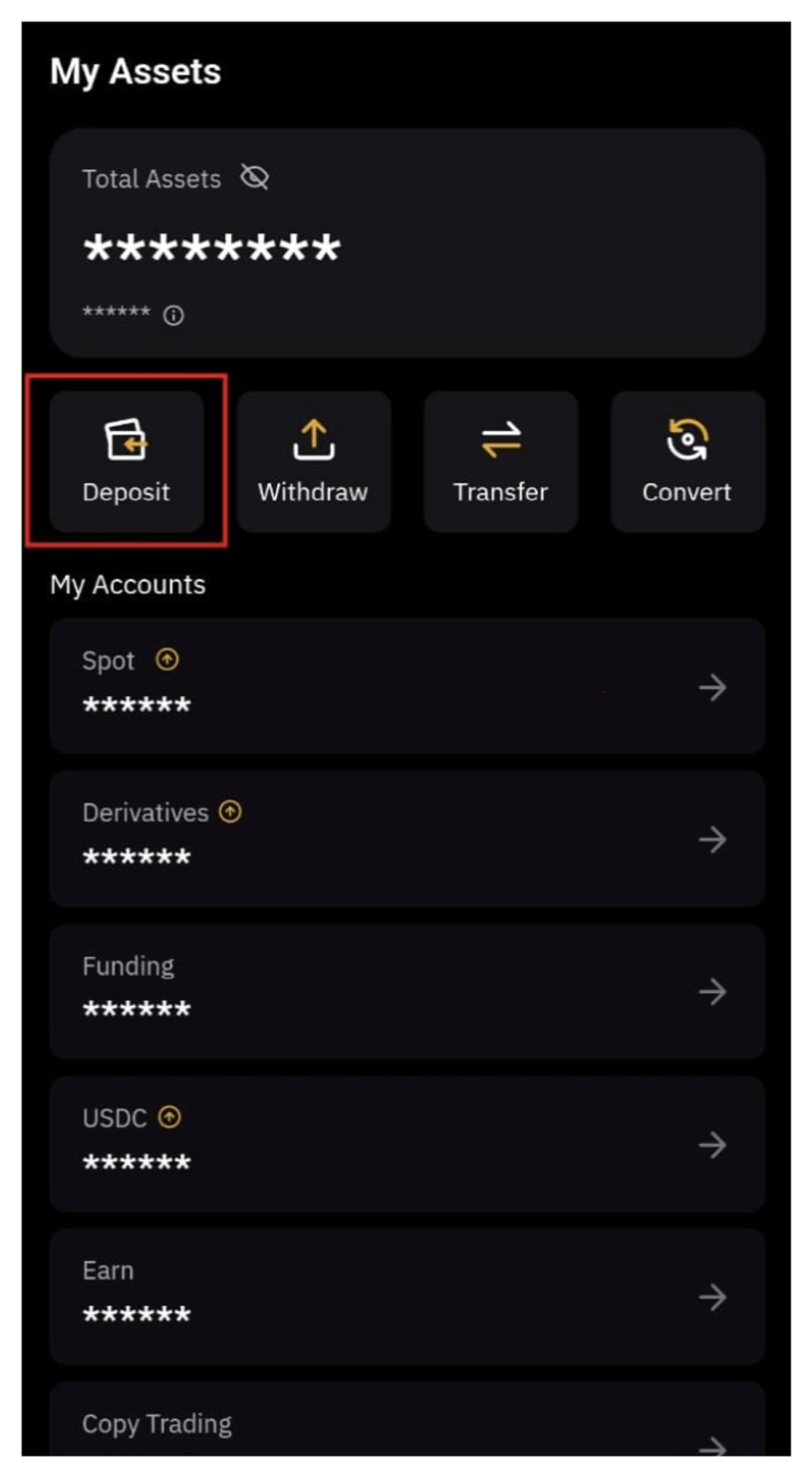

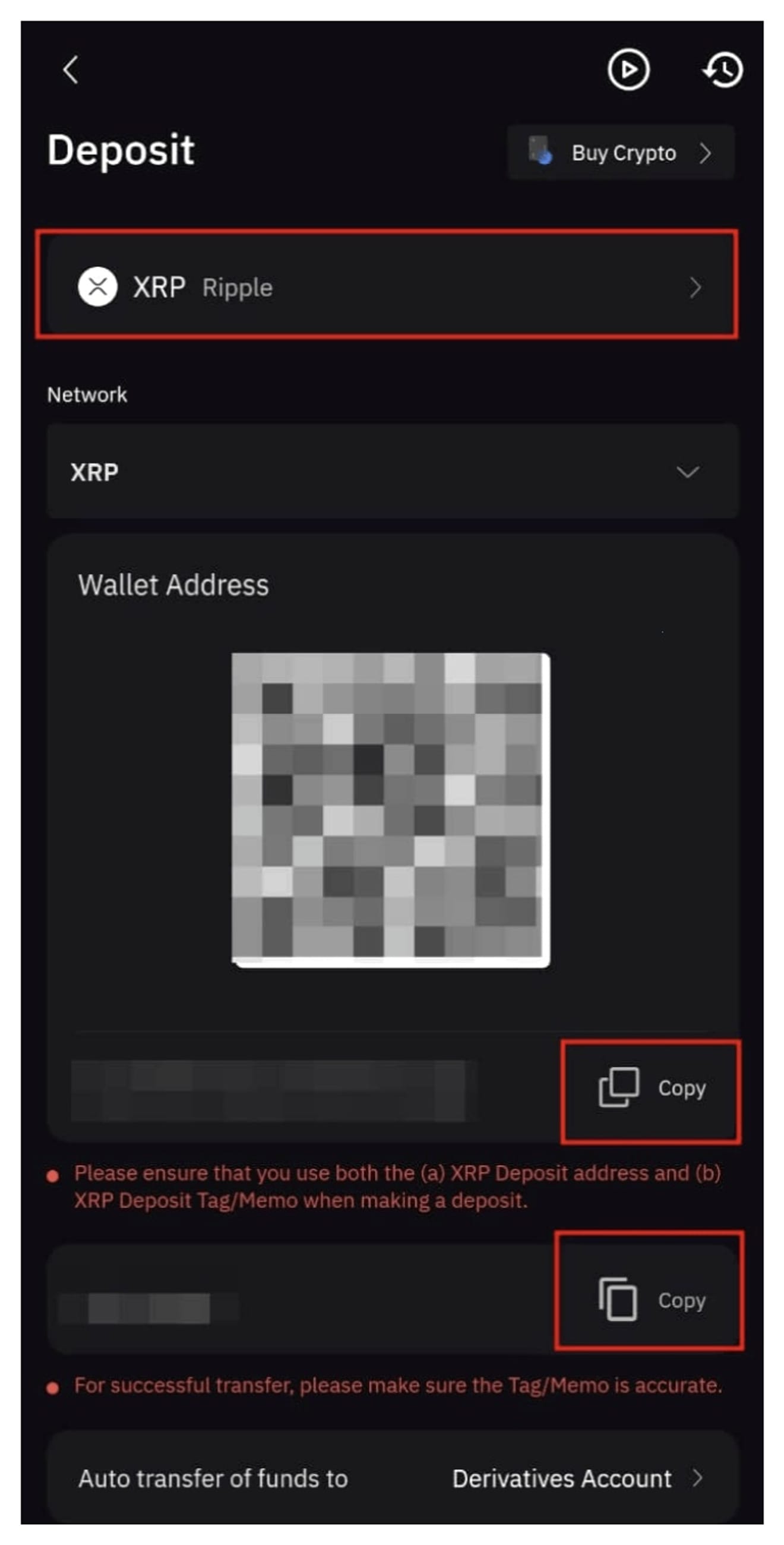

Deposit

Direct deposits in Korean won are not possible. Instead, you must purchase USDT, Ripple (XRP), etc. from domestic exchanges like Upbit and Bithumb and then transfer them to Bybit. When transferring, you must select a network (TRC20, ERC20, etc.) and confirm the address.

When the deposit is complete, the balance will be displayed in your asset wallet. Now you are ready to start futures trading.

Futures Trading Interface and Order Method

Select the "Derivatives" menu in the mobile app to move to the futures trading screen.

It consists of the basic chart, order book, order window, and position status tabs.

- Long: Buy position when price increase is expected

- Short: Sell position when price decrease is expected

There is also a funding fee system, so funds are exchanged between long and short positions every 8 hours.

Funding fees must be considered when maintaining a position.

Leverage is the ratio that determines how many times you will trade against the margin.

For example, if you use a 10x leverage with a 100,000 won margin, you can trade at a scale of 1 million won.

You can also make a large profit, but the risk of liquidation is also high, so beginners are recommended to use 5~10x or less.

There are Isolated and Cross modes in the margin mode.

- Isolated: Loss only from the margin of that position

- Cross: Loss compensation with the entire account balance

You can choose according to your trading strategy.

There are three order methods.

- Limit order: Order at the desired price

- Market order: Immediate execution

- Conditional order: Execution when a specific price is reached

Bitcoin Futures Trading Fees

Bybit's fee structure is relatively clear.

- Maker fee: 0.02%

- Taker fee: 0.055%

Fees are further discounted as the VIP level goes up. For example, VIP 1 is maker 0.018% and taker 0.04%.

Therefore, it is best to use limit orders to reduce fees.