How to Trade Bitcoin Futures | Recommended Futures Exchange Site | Fees | OKX

In this article, we will look at how to trade Bitcoin futures, recommended futures exchanges, and fees. Are you interested in futures trading, a more advanced form of cryptocurrency investment? Bitcoin futures trading is an attractive investment method where you can expect significant profits with a small amount of capital by utilizing leverage, but it is a complex investment method that comes with high risks.

Recommended Bitcoin Futures Exchange Site

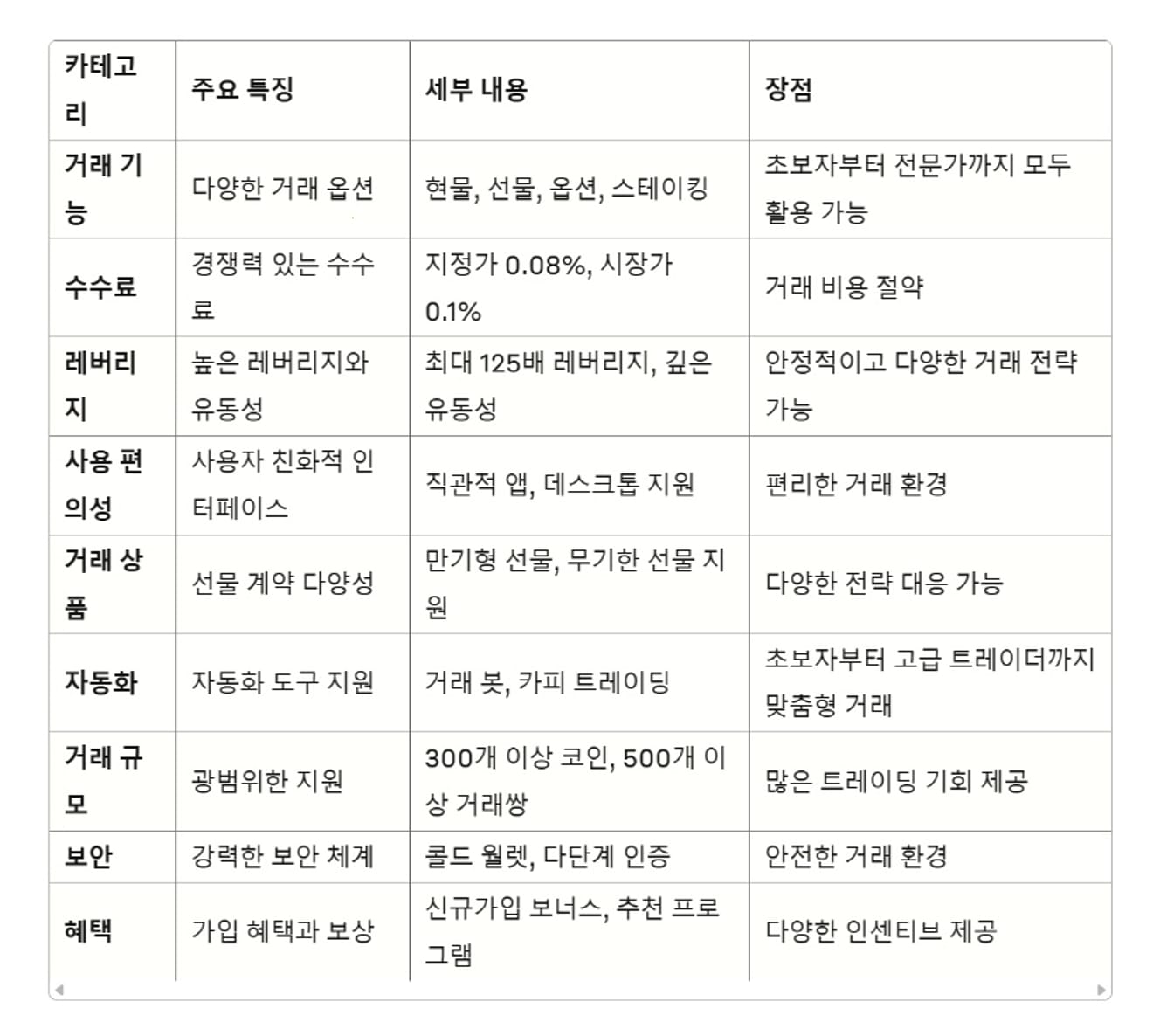

OKX is a global Bitcoin futures exchange that offers various trading options (spot, futures, options), low fees, up to 125x leverage, and high liquidity.

It is convenient with an intuitive interface and mobile/desktop support, and also supports various contract products such as perpetual and expiring futures. In addition, it is recommended as a platform that can be used by everyone from beginners to experts, providing automated trading tools, over 300 coins and over 500 trading pairs, strong security, and rewards for new sign-ups.

How to Trade Bitcoin Futures

Let's take a look at how to trade Bitcoin futures on OKX. Please access it through the fee discount link below.

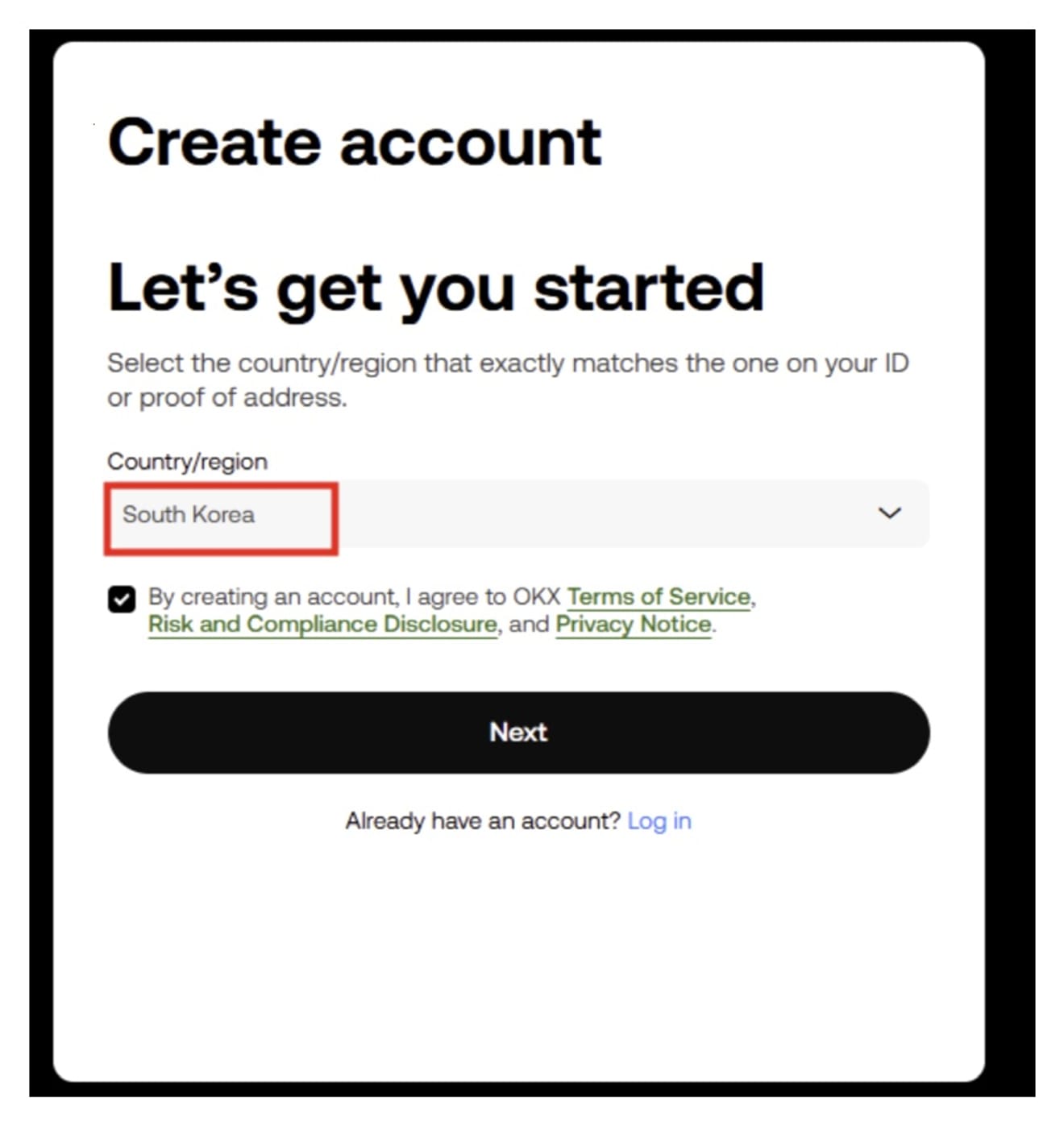

By signing up through the link above, you can enjoy fee discounts. Enter your country after accessing. In the case of Korea, you can select south korea. After selecting your country, agree to the terms and conditions and click the next button.

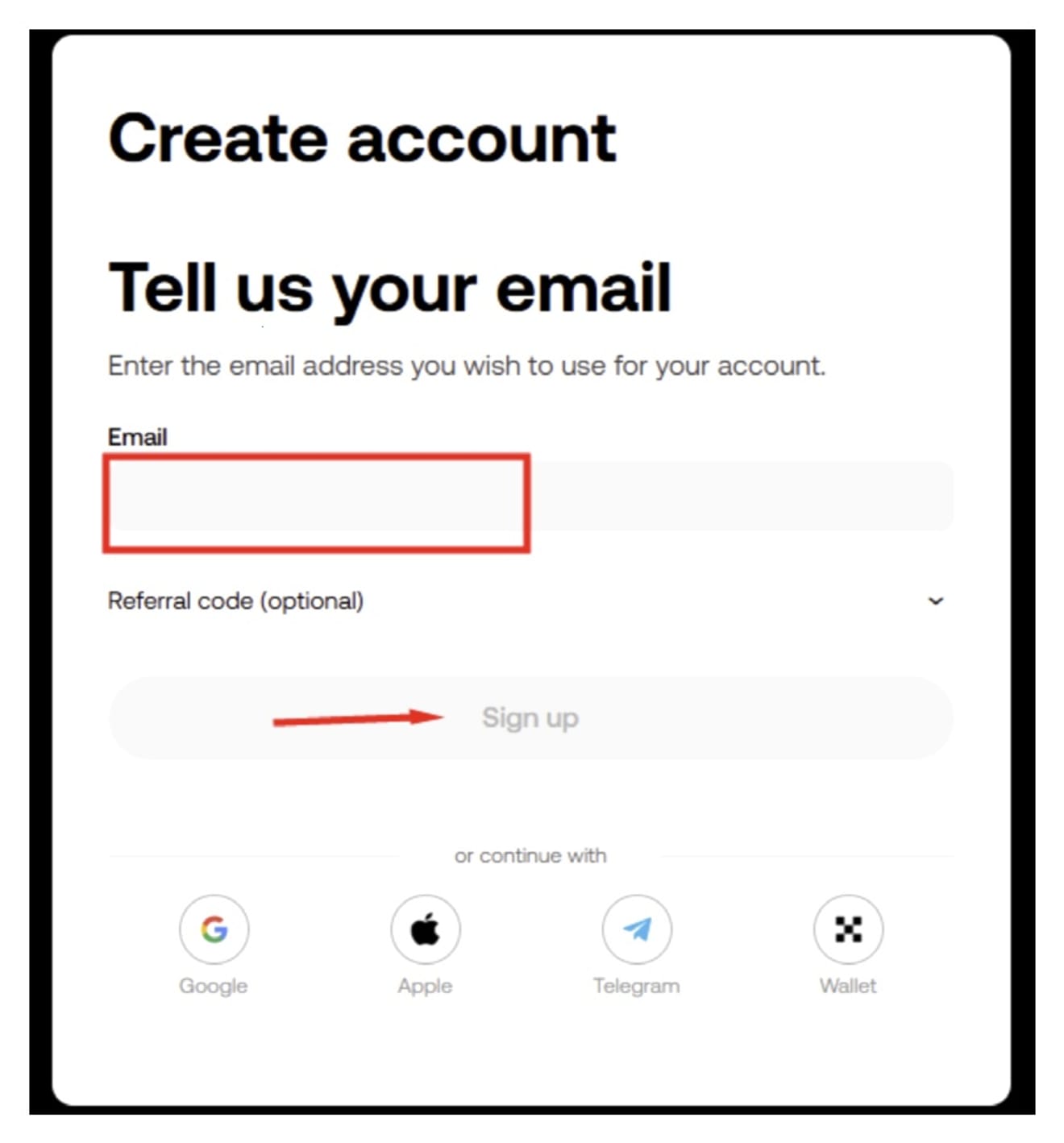

Enter the email address you will use to log in, and then click the Sign up button.

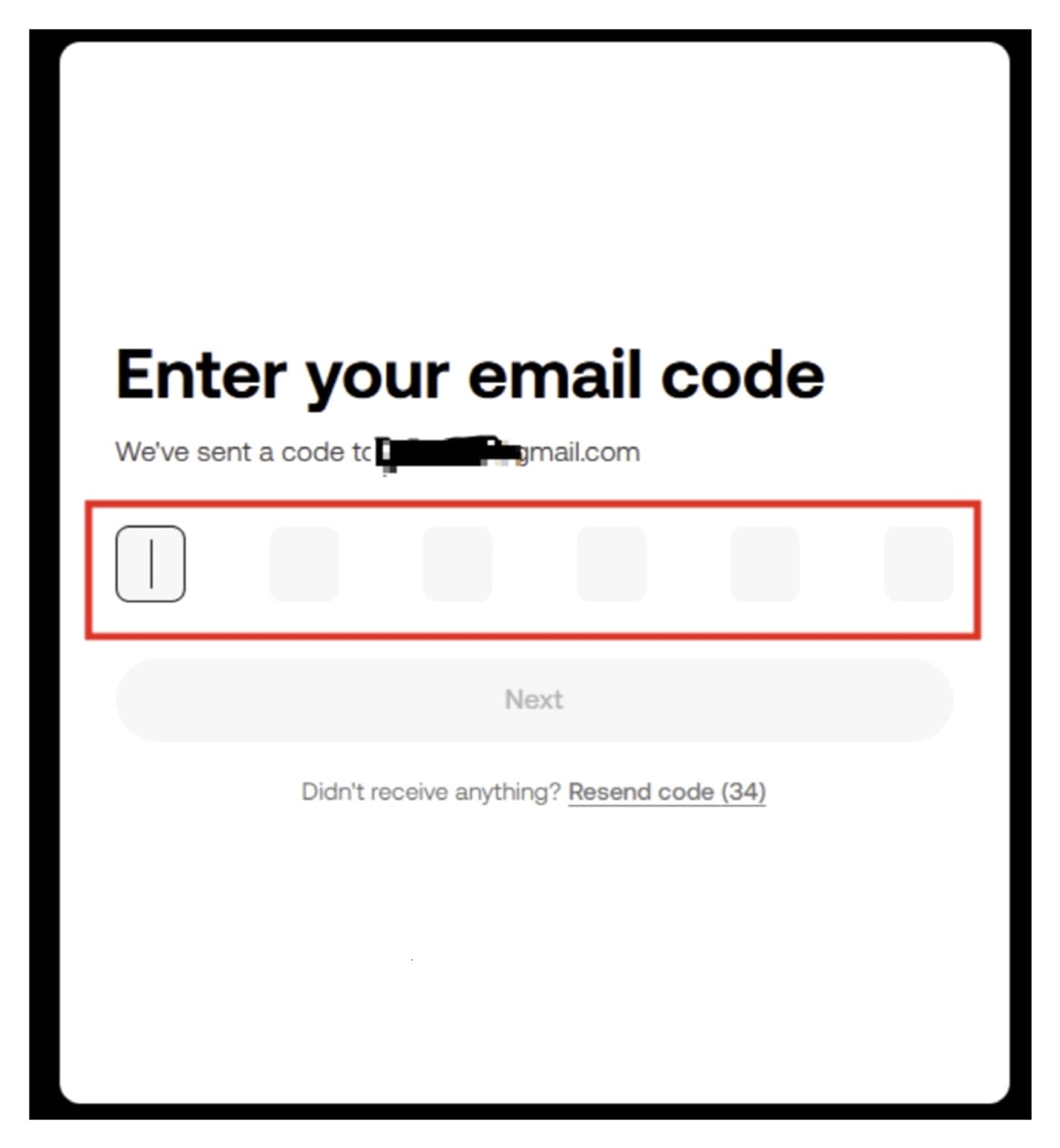

Enter the verification code sent to your email address.

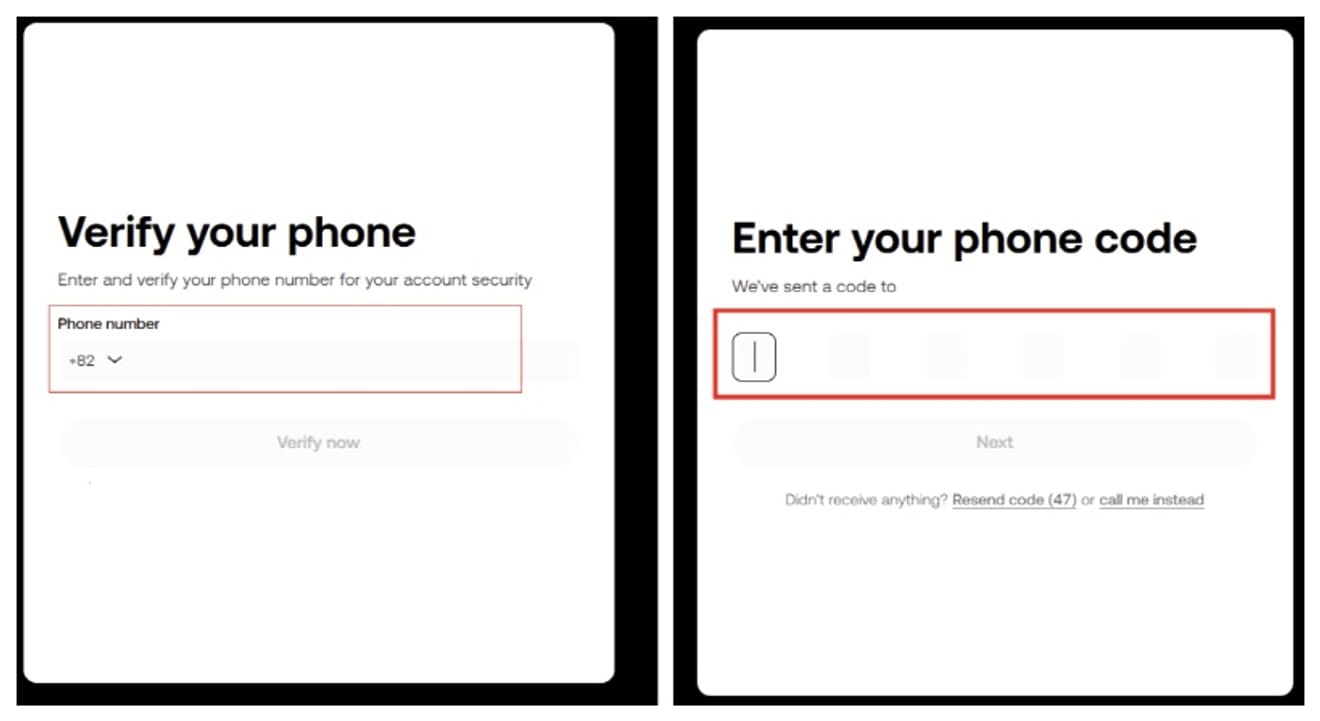

Enter your mobile phone number to proceed with number verification.

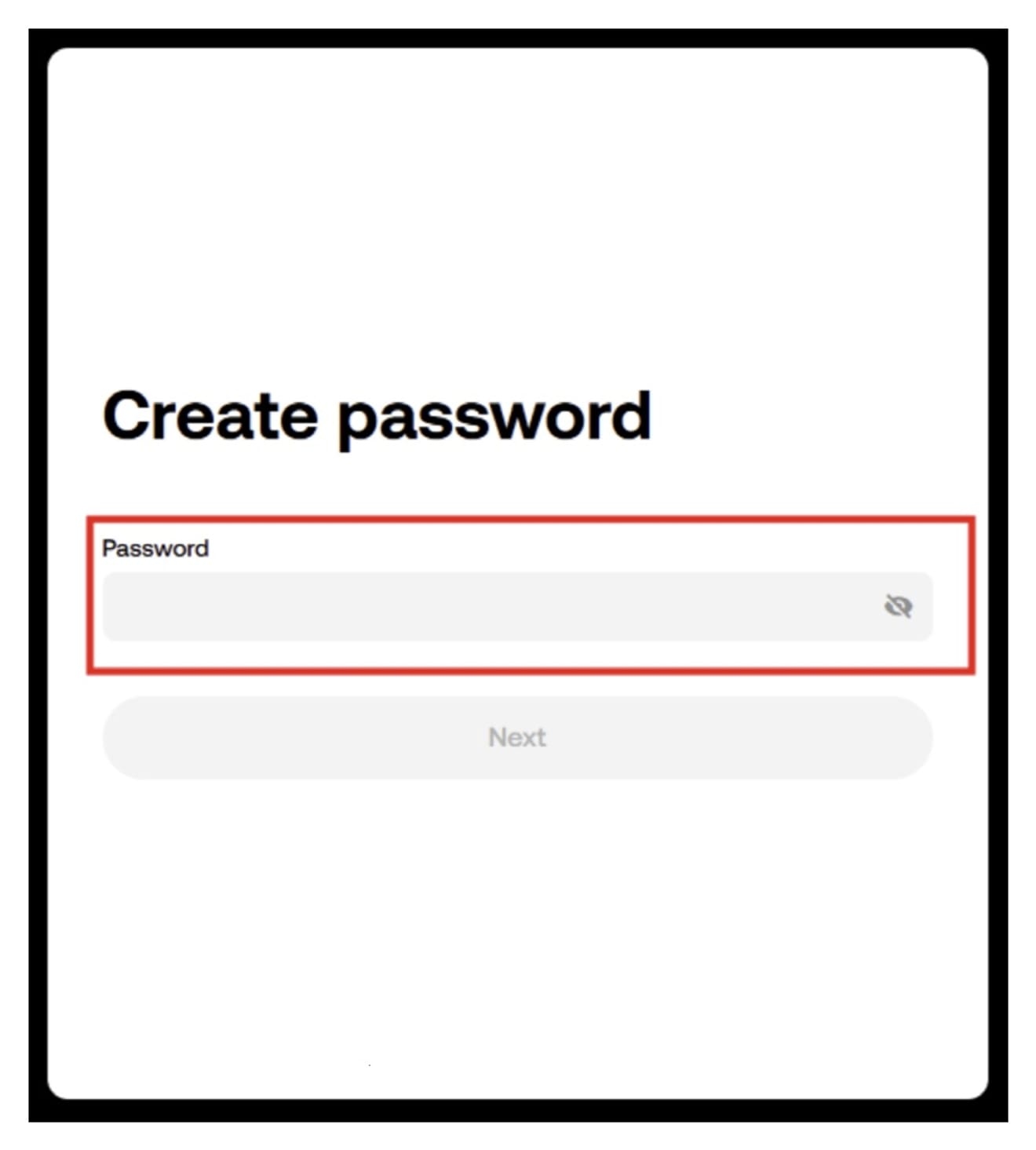

Set the password you will use to log in.

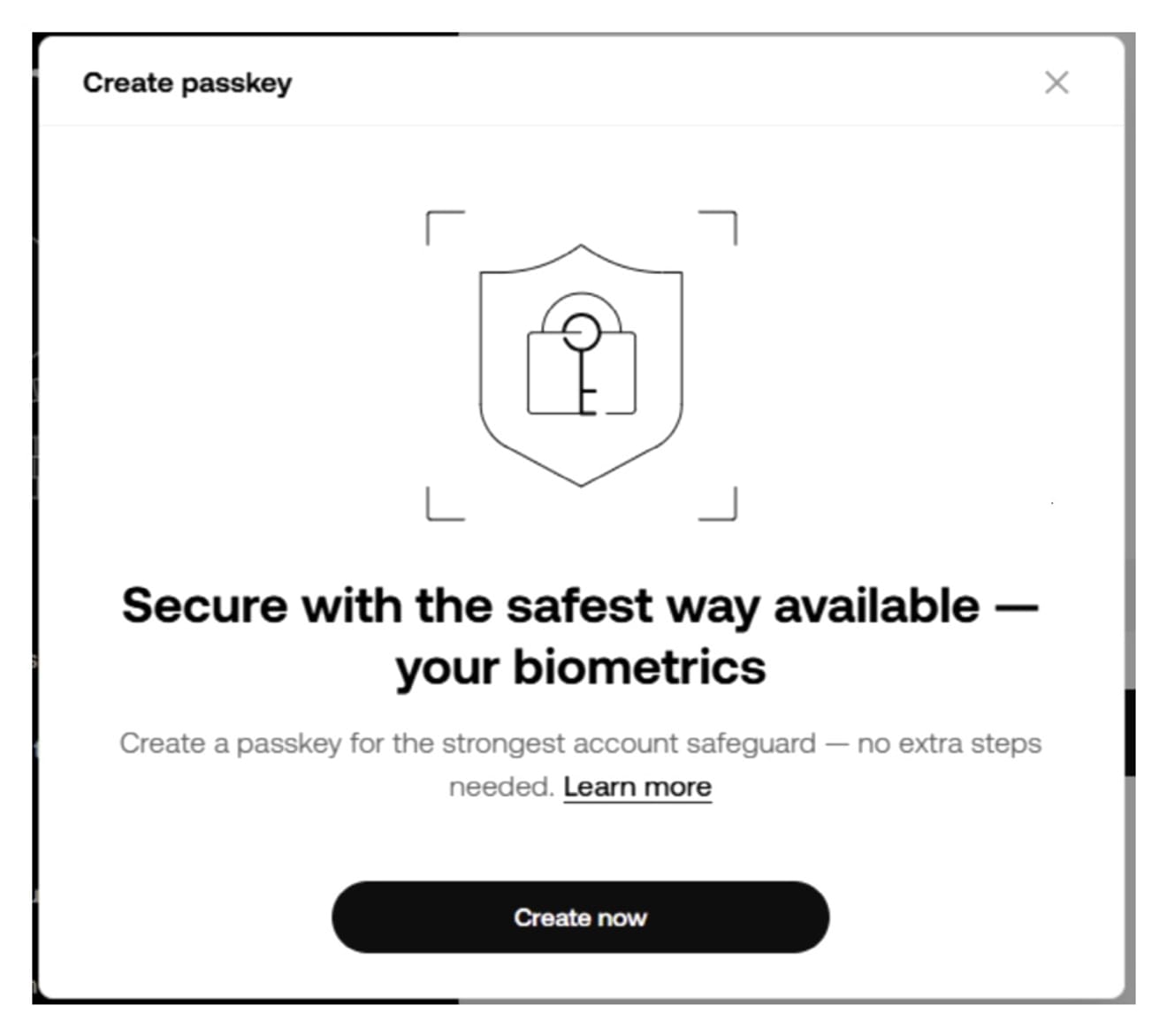

A message will appear asking you to set up biometric recognition, which is optional. You can set it up if you want, or you can close the window if you don't want to.

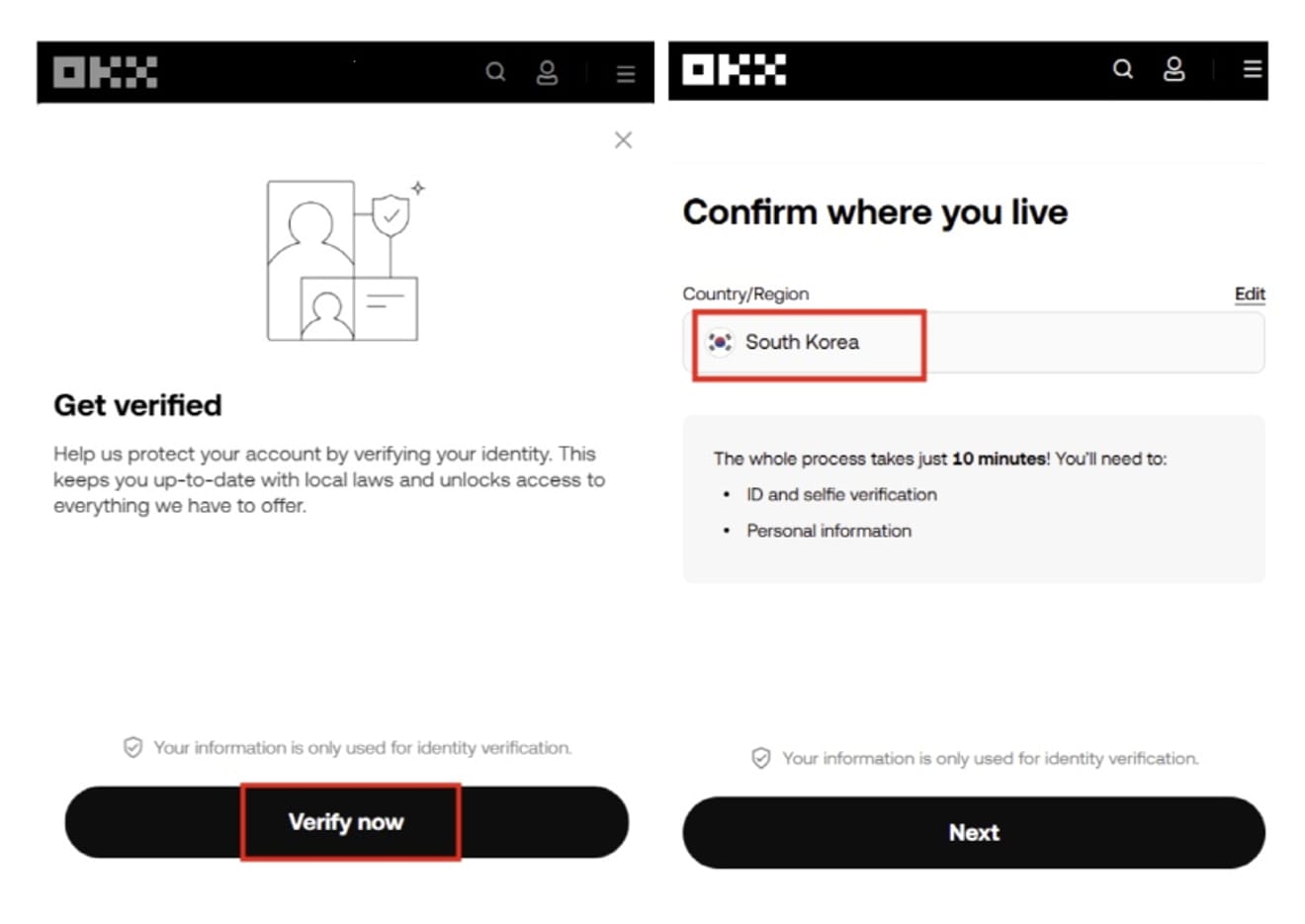

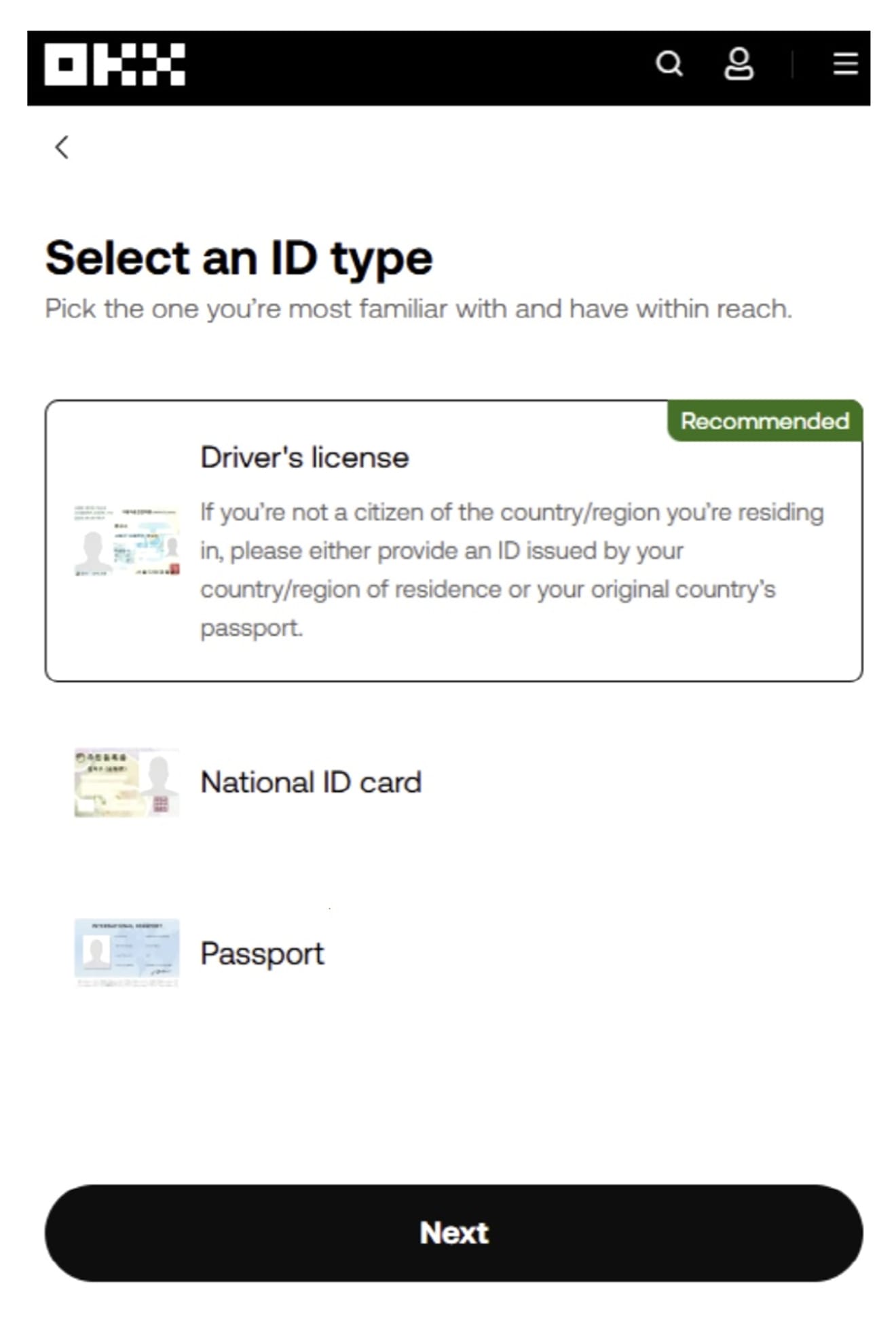

If you proceed to this step, your OKX registration is complete. Even if you have finished signing up, you need an additional verification process to deposit, withdraw, and trade. Click the verify Now button. The identity verification process requires taking a photo of your ID and a selfie, so it is much more convenient to proceed after installing the app.

Take a photo of your ID and upload it. Driver's licenses, resident registration cards, and passports are all acceptable as IDs.

If you have completed all these steps on a PC, a QR code will be displayed on the next screen. Scan the QR code to connect to your mobile device, then take a photo of your ID and upload it. Once you have uploaded your ID, take a selfie to verify your identity.

At this time, follow the instructions on the screen to move your face and recognize it, and the selfie verification will be completed. After entering your personal information, it will take a few minutes for your identity to be reviewed. Once the review is complete, your final identity verification (KYC verification) will also be completed.

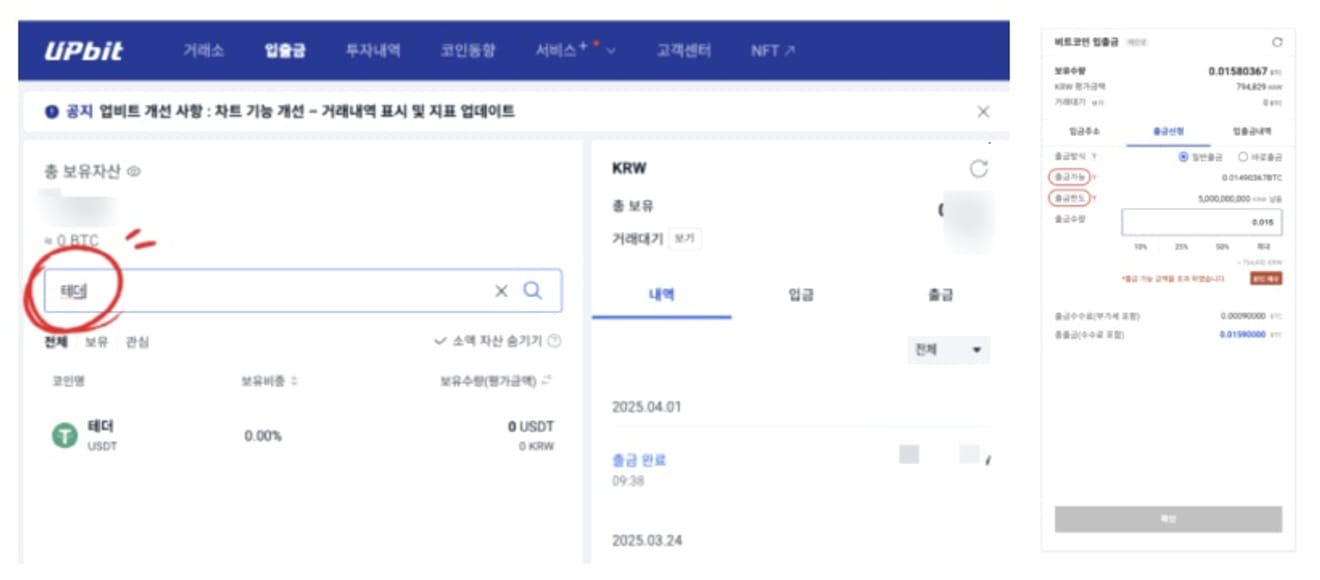

Next, let's take a look at how to deposit funds into OKX, a Bitcoin futures exchange. Since OKX is an overseas platform, you deposit Korean won into Upbit and then transfer it to OKX. Connect your account to Upbit via K bank and then transfer Korean won.

Purchase Tether USDT from the exchange menu. Tether (USDT) is a stablecoin that is 1:1 linked to the dollar and is widely used as a means of transfer.

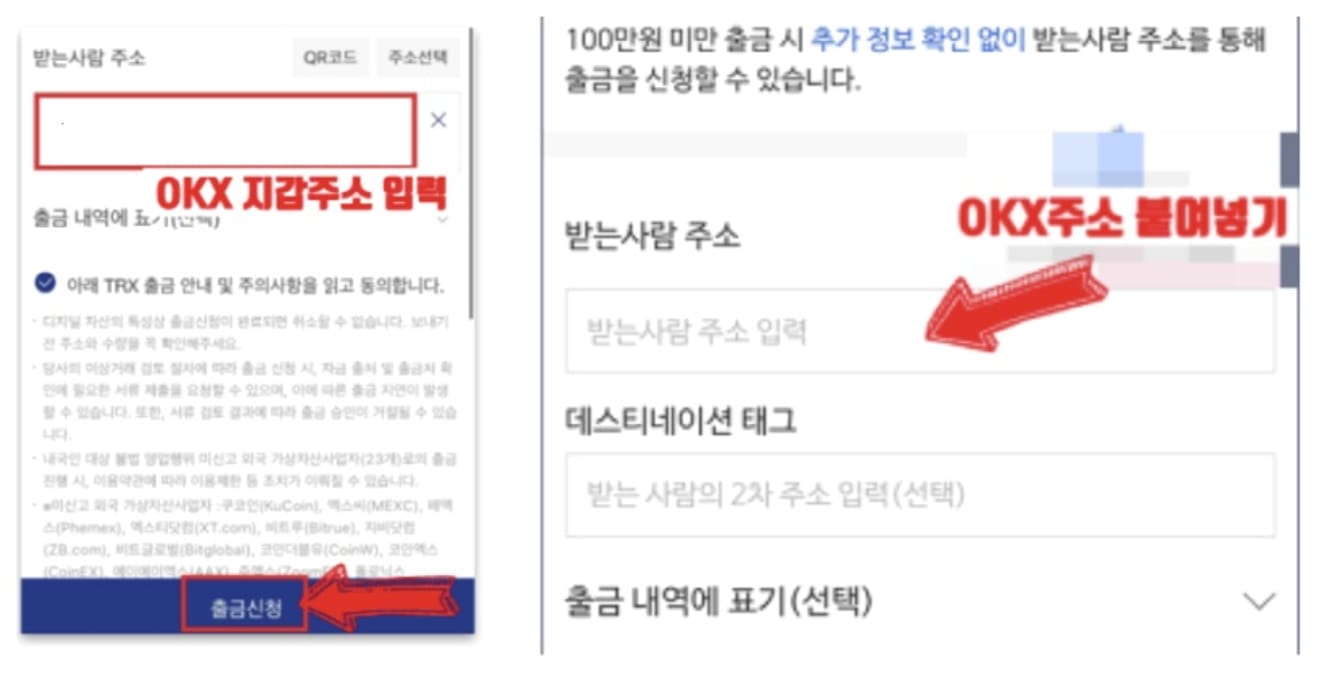

Search for 'Tether' in the deposit/withdrawal menu and select it. Click [Withdrawal]. You can select a general withdrawal. Instant withdrawal is a transfer between accounts within Upbit. You can choose between Ethereum and Tron for the withdrawal network, and select TRON, which has lower fees. Enter the amount.

When you proceed to this point, the address input window will appear. You can copy and paste the deposit address from the OKX exchange. You should be careful because it's difficult to find if even one lowercase alphabet is incorrect.

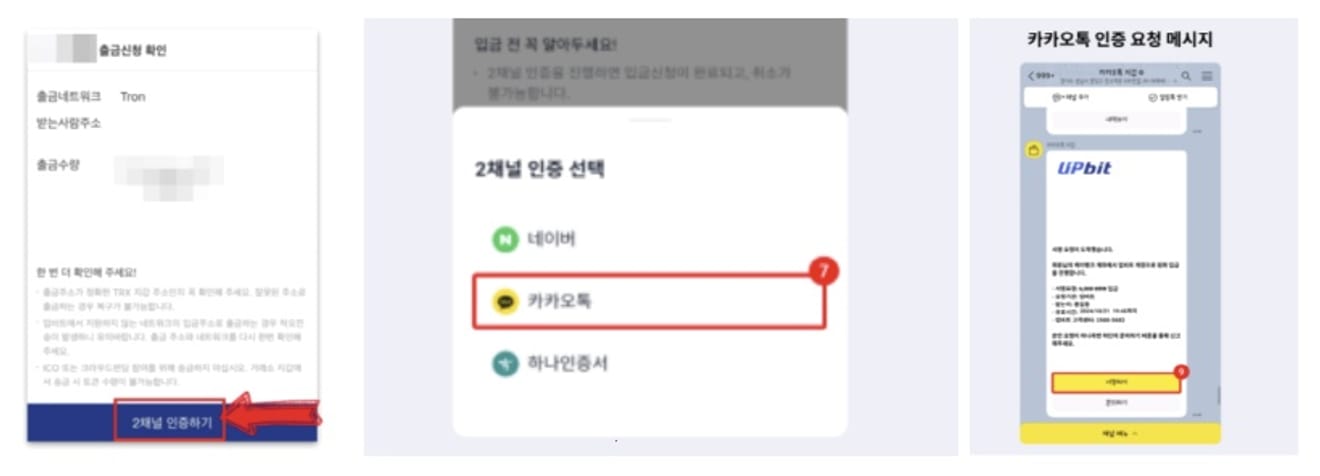

Since authentication is done through two channels, Naver and KakaoTalk, please enter your password. If it's your first transfer, we recommend starting with a small amount for a test.

Let's create an OKX deposit address. Please note that you must complete KYC identity verification before sending Tether to OKX.

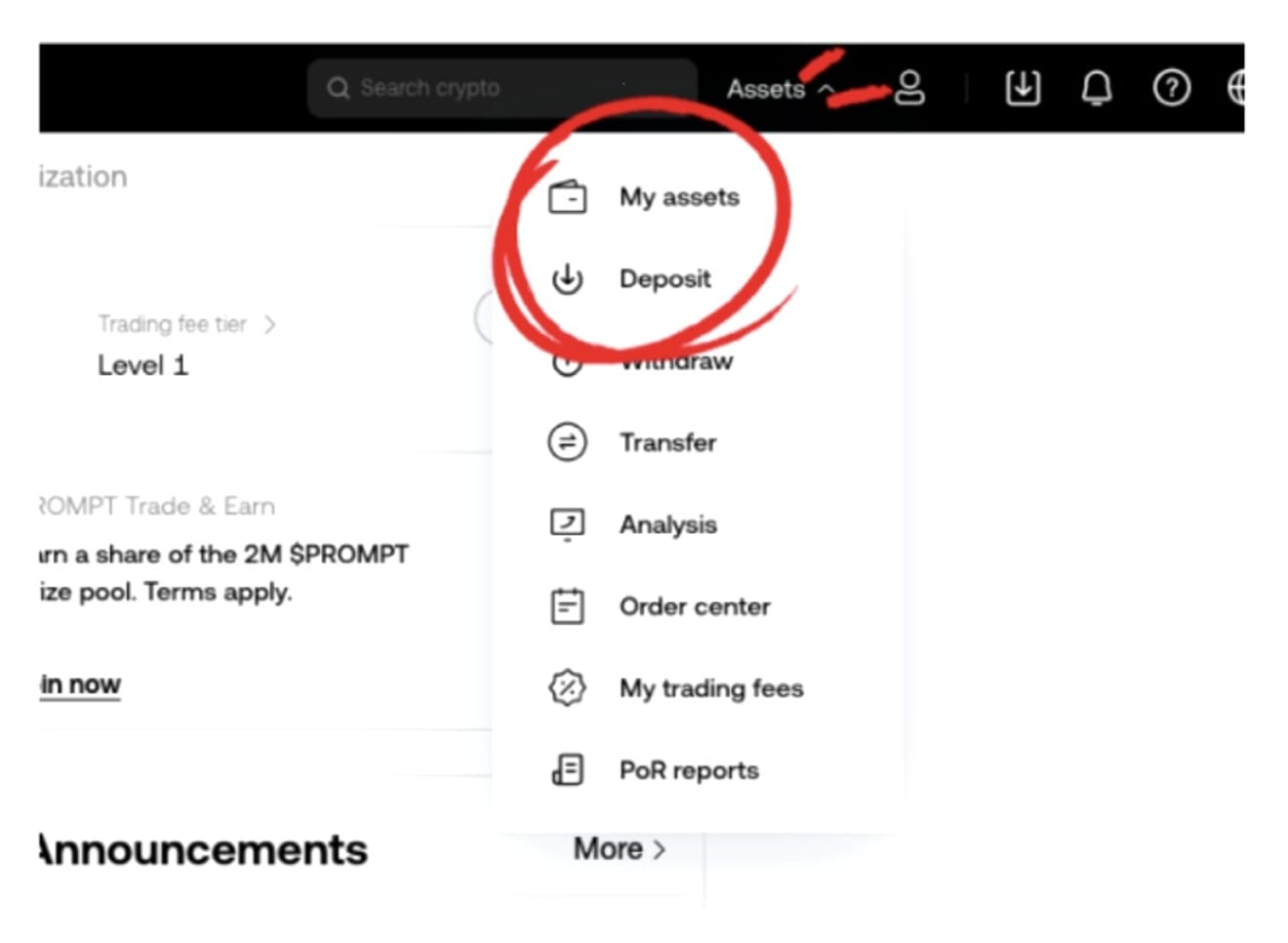

Click the Deposit button in My Assets.

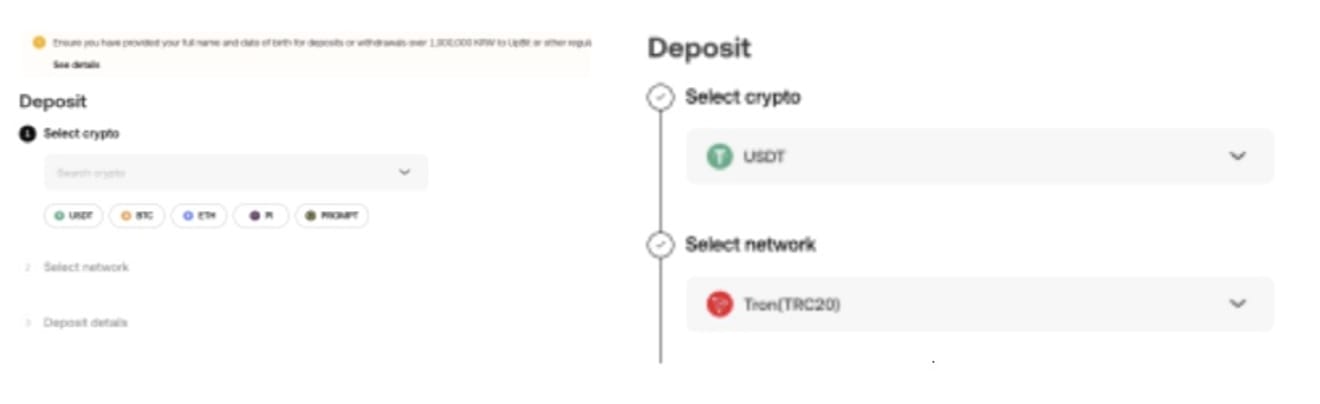

Select Tether USDT and the withdrawal network Tron (TRC20).

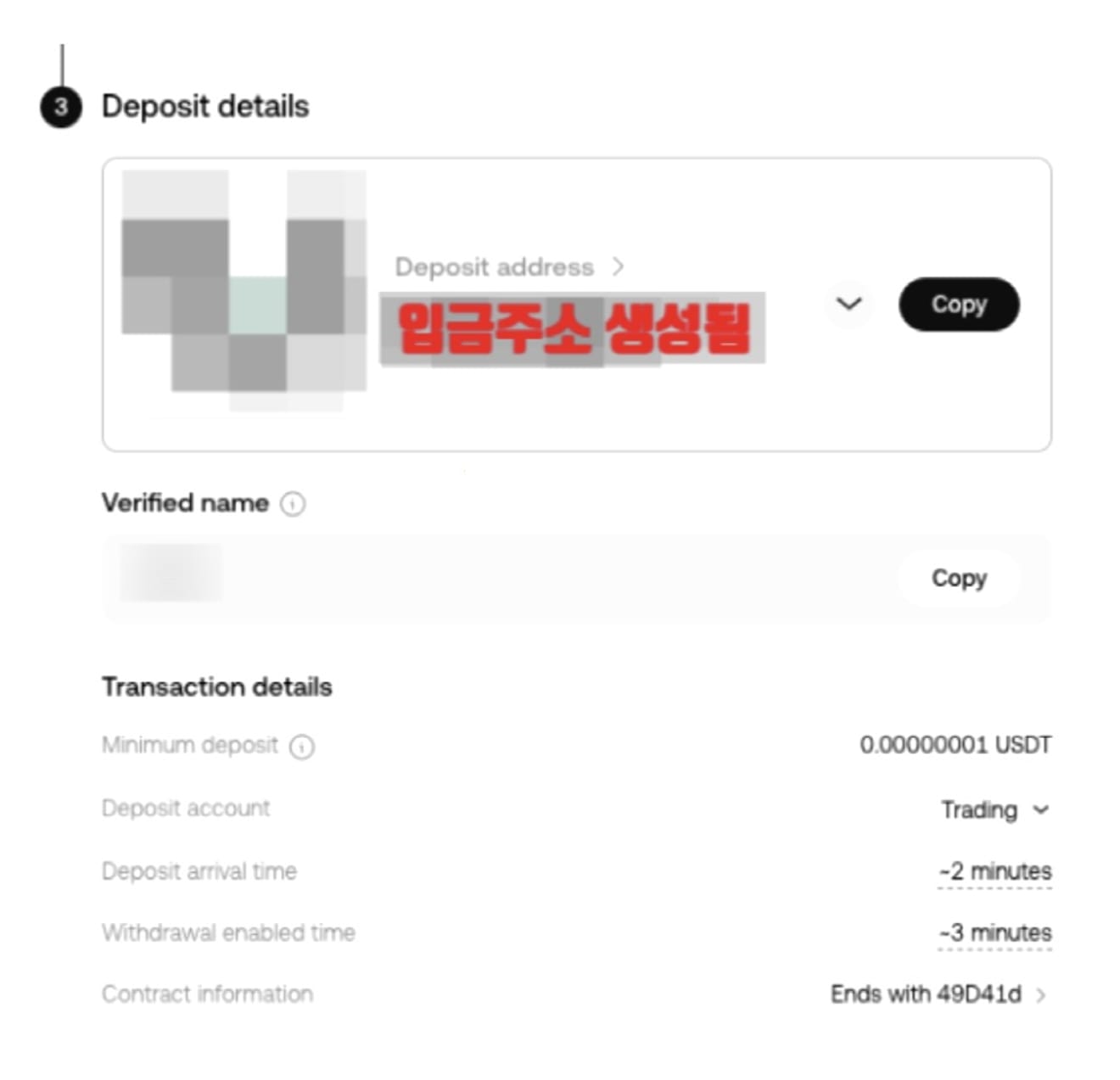

As shown above, a 'deposit address' is generated and copied. This address will be pasted into the Upbit withdrawal screen.

You can check the deposit details within 10 minutes. A process notification usually appears.

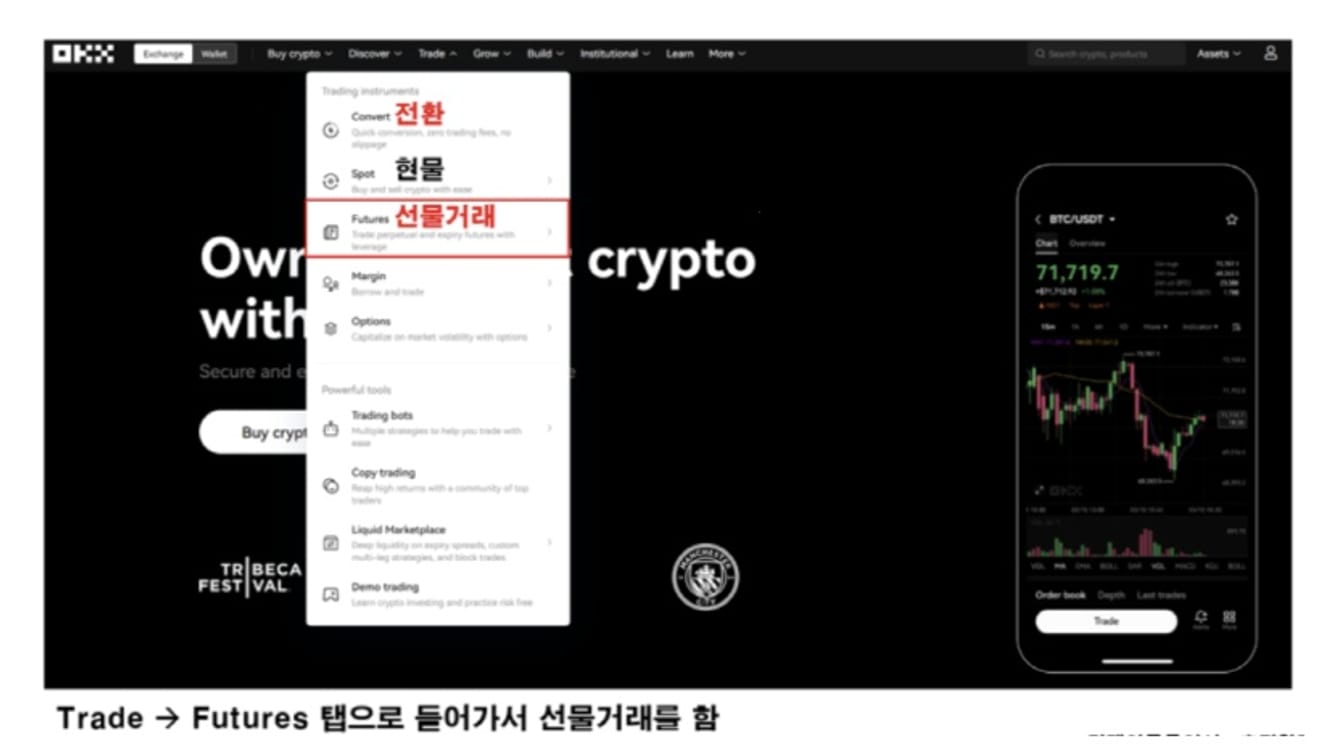

Now it's time to start futures trading in earnest.

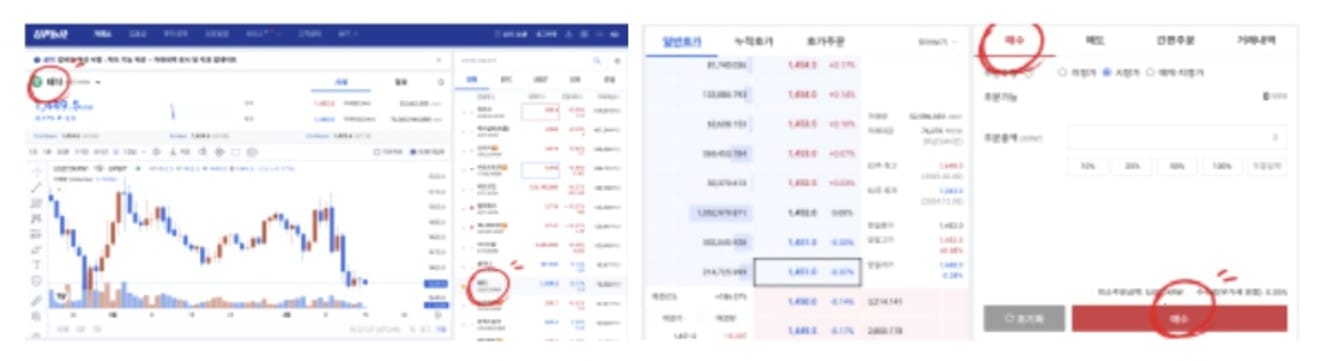

Go to the Trade → Futures tab on the homepage. For reference, spot trading is Spot.

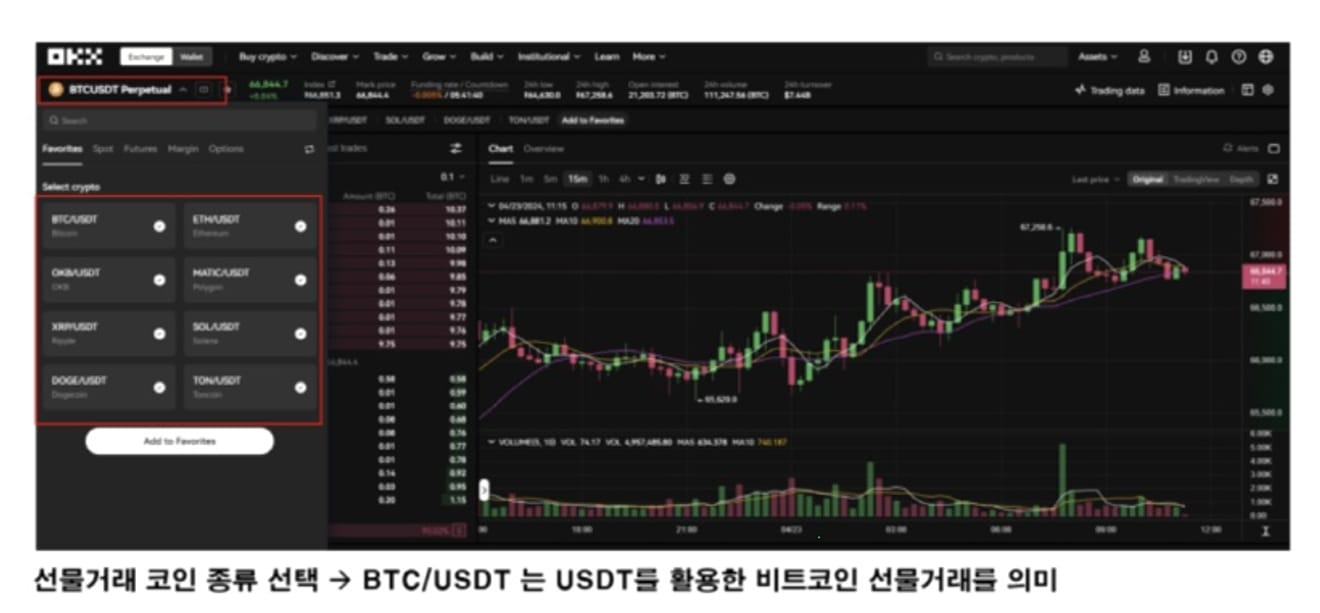

The first thing to check is the type of coin to trade. It is basically set to BTCUSDT, which means that USDT is used for Bitcoin futures trading. You can change it at any time if you want to trade other items.

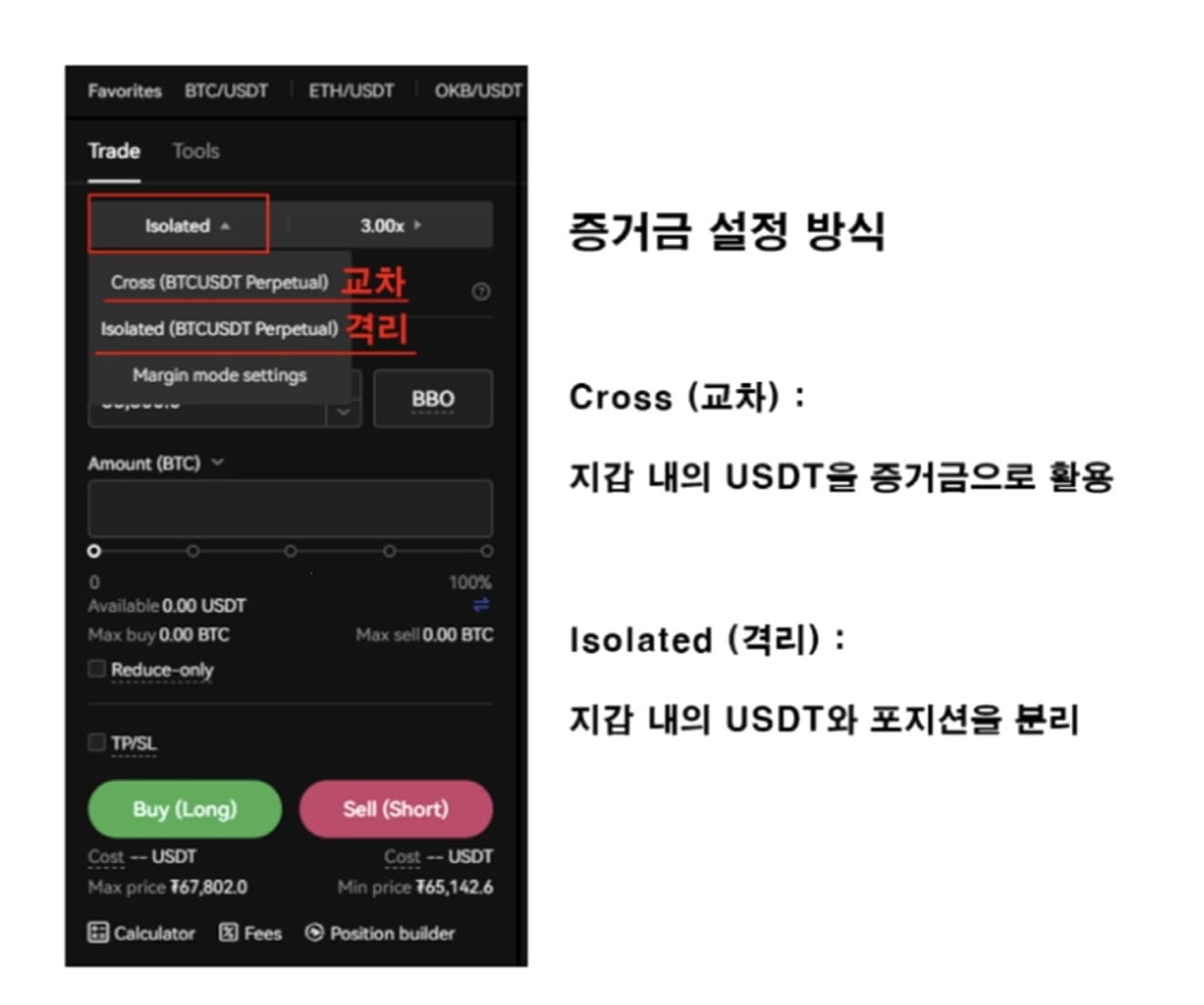

Let's summarize the parts that can be confusing in the order window. The first thing to consider is the margin setting on the upper left. You have to choose one of the two.

Cross means cross in Korean, and it is a method of using USDT in the futures wallet together as margin for the position.

For example, if you have enough USDT in your wallet and only enter a portion into the position, the liquidation line will be shared with the funds in the wallet, and the liquidation range will become very wide. However, if you are liquidated even once, all of your funds may disappear, which may be disadvantageous in terms of risk management.

Isolated means isolation in Korean, and it is a method of separating funds in the wallet from the position.

Unlike Cross, there is a disadvantage that the liquidation line can be shortened, but even if liquidation occurs, you will only lose the USDT entered into the position, which can be advantageous for risk management.

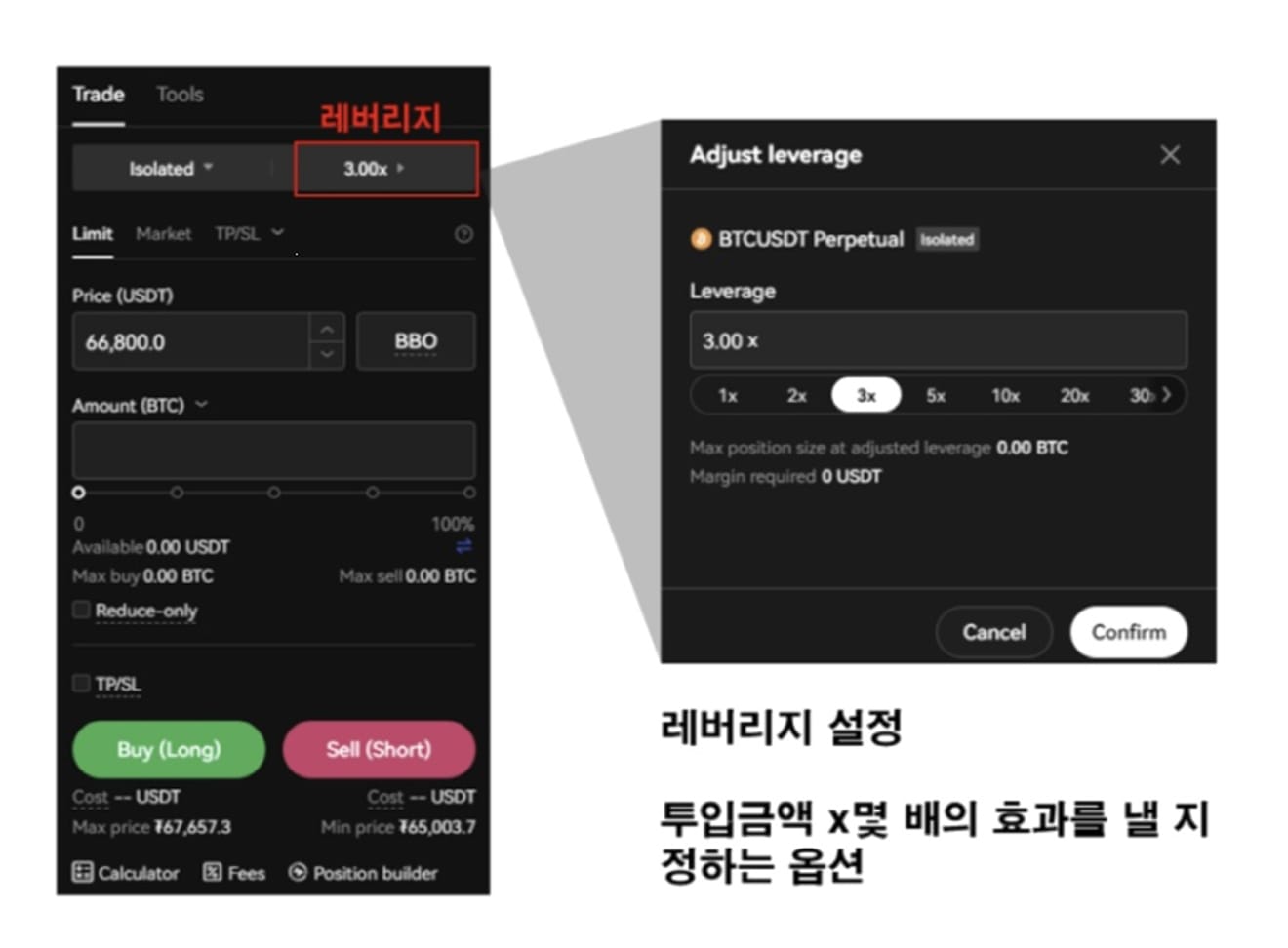

Next, click the leverage setting tab at the top right of the order window. Leverage is the process of setting how many times the funds invested in the position will be efficient. For example, if you invest only 100,000 won in the position and use a leverage of 20 times, you will get the effect of investing 2 million won.

In this case, if a 1% profit occurs and you earn 20,000 won, you will get the effect of earning a 20% return on the principal. In summary, leverage 20 times can be understood as a 20-fold profit or a 20-fold loss.

Of course, losses can also be large, so if you are new to futures trading, it is recommended to set the leverage low. Also, we recommend that you enter in a sure place.

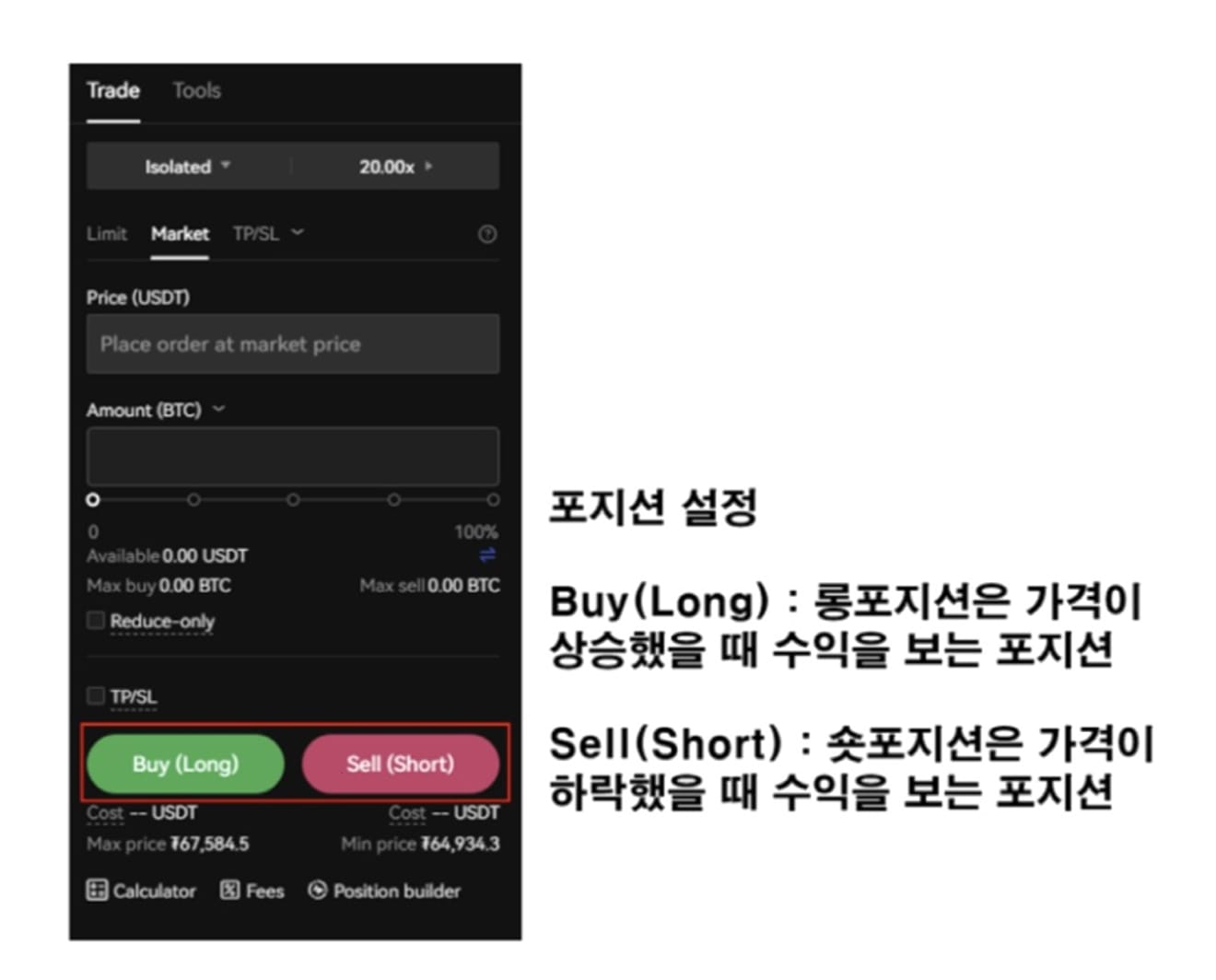

Finally, it is the process of setting the position. Since it is a two-way trade, you will enter by selecting one of the two positions.

A long position is a position that enters assuming that the price of the coin will rise, and you will profit when the price rises.

A short position enters assuming that the price of the coin will fall, and you profit when the price falls.

Bitcoin Futures Trading Fees

OKX Bitcoin futures trading fees are as follows:

- Taker order fee: 0.08%

- Maker order fee: 0.1%

These fees apply to most futures trading, including Bitcoin futures trading, and are considered competitive. In addition, OKX also provides fee discounts according to the VIP level, so users with a large trading volume can trade at lower fees.