Redotpay ATM Withdrawal Methods | Fees | Withdrawal Limits

In this blog post, we will take a detailed look at the Redotpay ATM withdrawal methods, fees, and withdrawal limits. One of the most useful features of the Redotpay card is that you can directly withdraw cash from ATMs worldwide. You can convert cryptocurrency into local currency instantly and withdraw it, making it a very useful service when traveling abroad or when you need cash. However, before using ATM withdrawals, you need to check the withdrawal fee structure, daily and monthly withdrawal limits, and ATM compatibility by region in advance. Especially when using overseas ATMs, it is important to accurately calculate the total cost, as local ATM fees and Redotpay's own fees may overlap. In this article, we will explain in detail the entire process of Redotpay ATM withdrawals, the fee structure, and how to set withdrawal limits. We will also introduce useful ways to minimize withdrawal costs and efficiently withdraw cash.

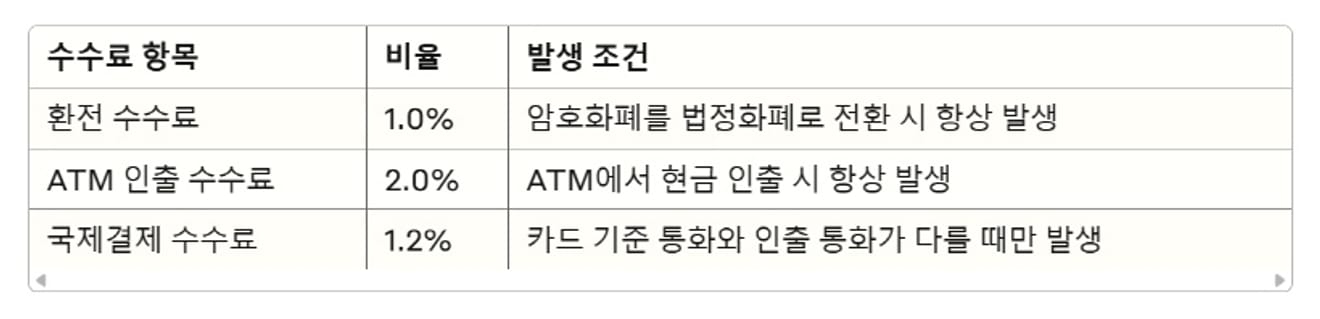

Redotpay ATM Fees

- Exchange fee: 1.0%

- ATM withdrawal fee: 2.0%

- International payment fee: 1.2%

The fees incurred when withdrawing from a Redotpay ATM can be broadly divided into three categories. For reference, you can receive a $5 bonus by signing up through the official partner link below.

In addition, if you apply for a card after signing up through the link above, you can receive a 20% discount on the issuance cost. (Physical card promotion code Redot2025, virtual card promotion code 200FF2025)

Redotpay ATM Withdrawal Method

The necessary items for Redotpay ATM withdrawals include a Redotpay physical card (Visa based), confirmation of ATMs that support foreign cards, and sufficient card balance.

1. Finding a suitable ATM

To use a Redotpay card in Korea, you must first find an ATM that supports foreign cards. ATMs from Kookmin Bank, Woori Bank, Shinhan Bank, and Hana Bank work most reliably. You must check if the ATM has a sign that says "Foreign card available." In particular, using a foreign currency-only ATM will make the transaction smoother, so it is best to look for a foreign currency-only ATM first, if possible.

2. Inserting the card and selecting a language

After inserting your Redotpay physical card into the ATM, select "English" from the language selection menu that appears. When using a foreign card, it usually switches to an English screen automatically, so you can proceed calmly without being flustered.

3. Selecting the withdrawal menu

Select the "Withdrawal" or "Cash Withdrawal" menu on the screen. Then, when a screen asking for the account type appears, select "Credit." You must select this because the Redotpay card works in credit card mode.

4. Entering the withdrawal amount

Enter the desired withdrawal amount in Korean Won (₩). To save on fees, it is best to withdraw a large amount at once. This is because fees are incurred each time you withdraw a small amount.

5. Completing the withdrawal

Once all inputs are complete, the transaction will be approved and cash will be dispensed. After receiving the cash, be sure to keep the receipt as well. It can be important evidence if you need to check the transaction history later or if a problem occurs.

Redotpay ATM Official Withdrawal Limits

- Withdrawal limit per transaction: USD 2,000

- Daily withdrawal limit: USD 10,000

- Monthly withdrawal limit: USD 20,00030,000

- Recommended number of withdrawals per day: 35 times

- Recommended number of withdrawals per month: within 70-80 times

The official withdrawal limits for Redotpay ATMs are as follows.