Redotpay Review | Overseas Use | Apple Pay | USDT Payment | Physical Card

In this blog post, we will look at the review of Redotpay, overseas use, Apple Pay, USDT payment, and the physical card. Do you want to utilize digital assets in your daily life, but are you hesitant due to complex procedures or various restrictions? We will find a solution through the vivid experiences and reviews of actual users of Redotpay, which is gaining attention in the cryptocurrency payment card market. Before you start, you can get $5 by signing up for Redotpay through the link below.

After signing up through the official partner link above and issuing a card, if you enter 200FF2025 or Redot2025 in the promotion code section, you can use the card issuance fee at a 20% discount.

Redotpay Overseas Use Review

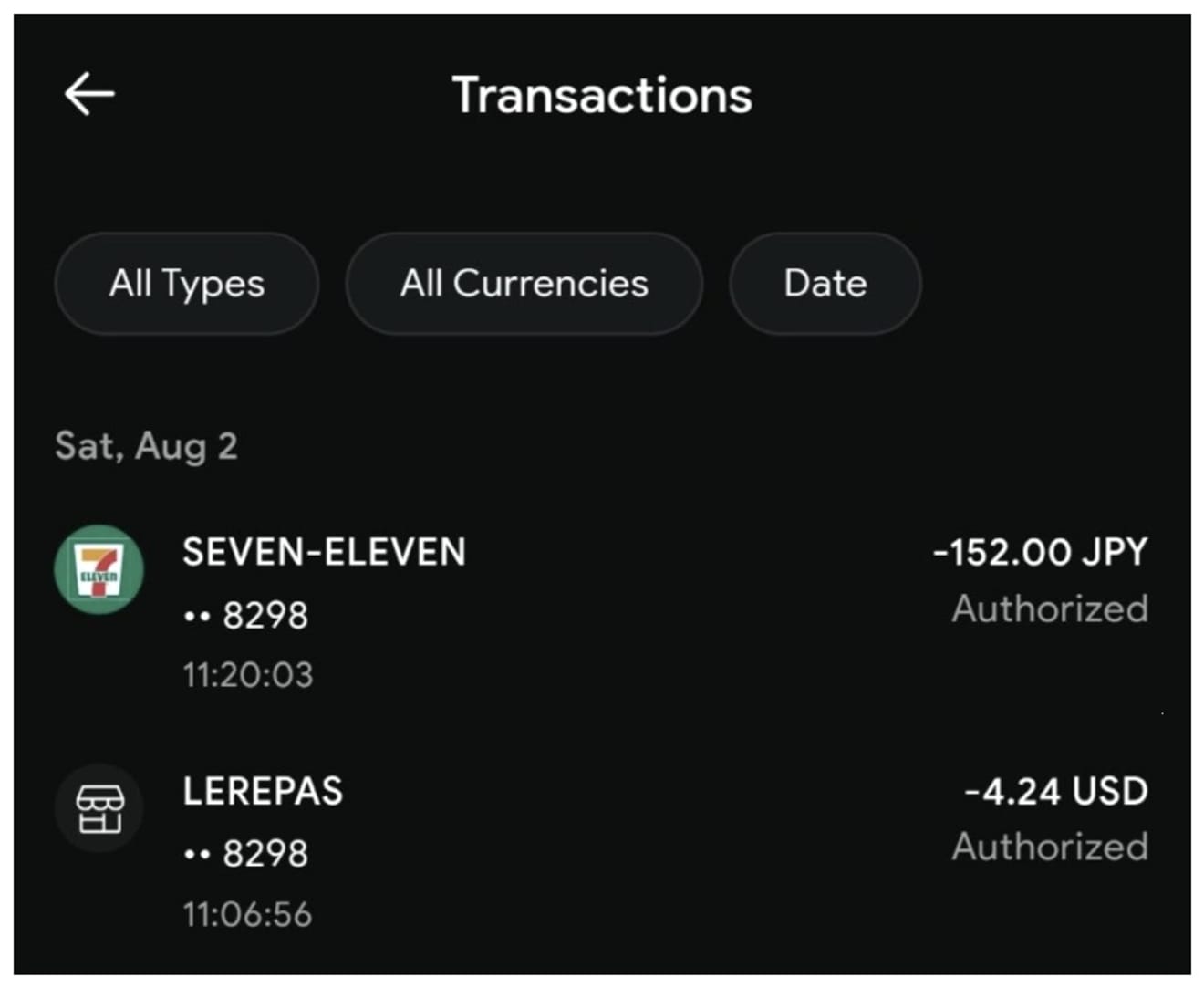

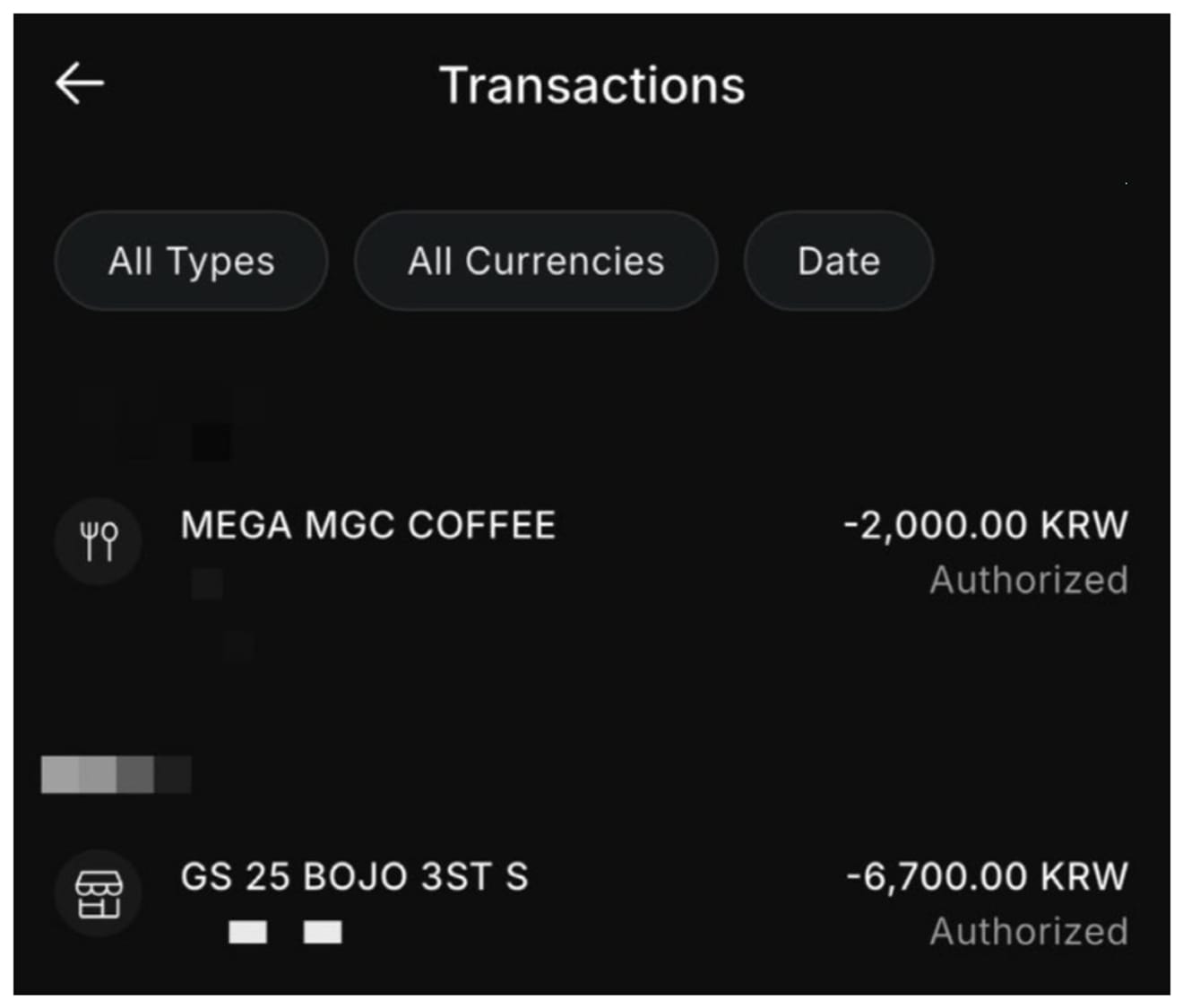

As a result of using the Redotpay card directly, the biggest advantage was that it can be easily paid like a check card without currency exchange even overseas. In Korea, 7,500 won was paid at Starbucks, and the payment was made with the exchange rate automatically calculated from the dollar balance held. It was used in the same way in Japan, and the utilization was high because you could choose between dollars and yen when paying. However, the fact that the physical card was delivered from Hong Kong, taking about a month, was a shame. Above all, I was convinced that the era without currency exchange will come in the future because I can freely pay overseas without going through an exchange office. However, since it has the nature of an exchange, it is safer to use it by charging only small amounts of money needed, such as living expenses or travel expenses, rather than storing all assets.

Redotpay Apple Pay Use Review

By registering Redotpay in Apple Pay and paying directly, Bitcoin felt like real money. Although it cost $10 to issue a virtual card, the process of transferring a small amount of BTC from a personal wallet to a Redotpay wallet and then paying at a convenience store and cafe was really simple. Payment was completed immediately by simply holding the iPhone to the terminal, and there was no need to worry about exchange rates or market fluctuations. In particular, it can be automatically converted to dollars and paid overseas, which was a great advantage because it avoids cumbersome currency exchange procedures and overseas card fees. At the moment of paying for a cup of coffee or a bottle of drink with Bitcoin, I could feel that digital assets are becoming a daily means of payment beyond a simple investment tool.

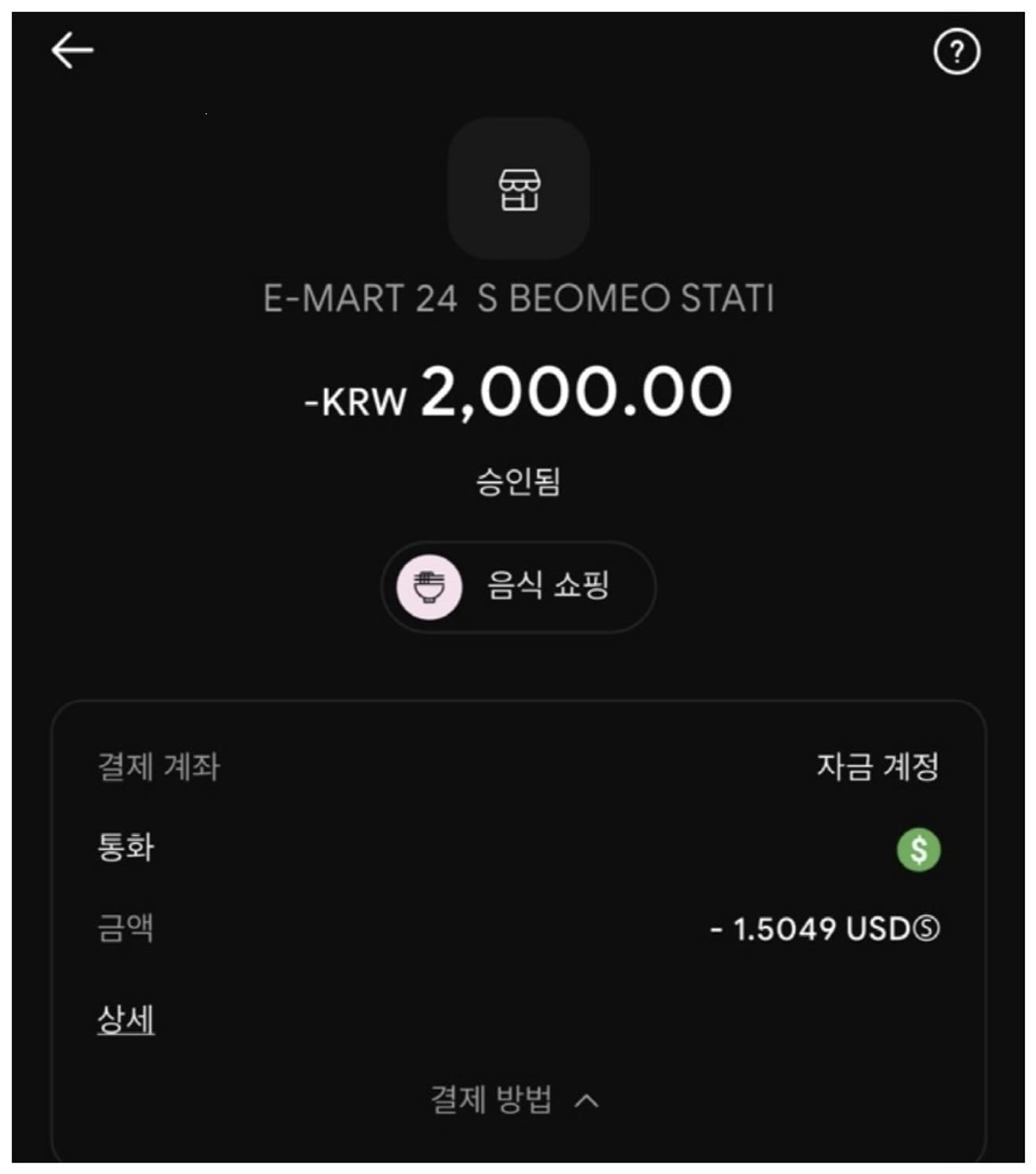

Redotpay USDT Payment Review

As a result of receiving Redotpay and registering it in Apple Pay, and then actually using it at a convenience store, the payment was made smoothly as with the existing check card. The registration process only requires email authentication and ID submission, and it was very simple to issue a virtual card and add it to Apple Pay immediately. I paid 2,000 won with USDT at E-MART24, and the payment history was immediately confirmed with an iPhone notification, which increased my confidence. In particular, it seemed useful for overseas payments because payments were made with dollar-based assets without currency exchange, and I was satisfied with the clean app UI and real-time notifications. However, the limitations that the virtual card is only available at Apple Pay stores and the issuance fee were disappointing, but it was of great significance just that Bitcoin and USDT can be used in real life.

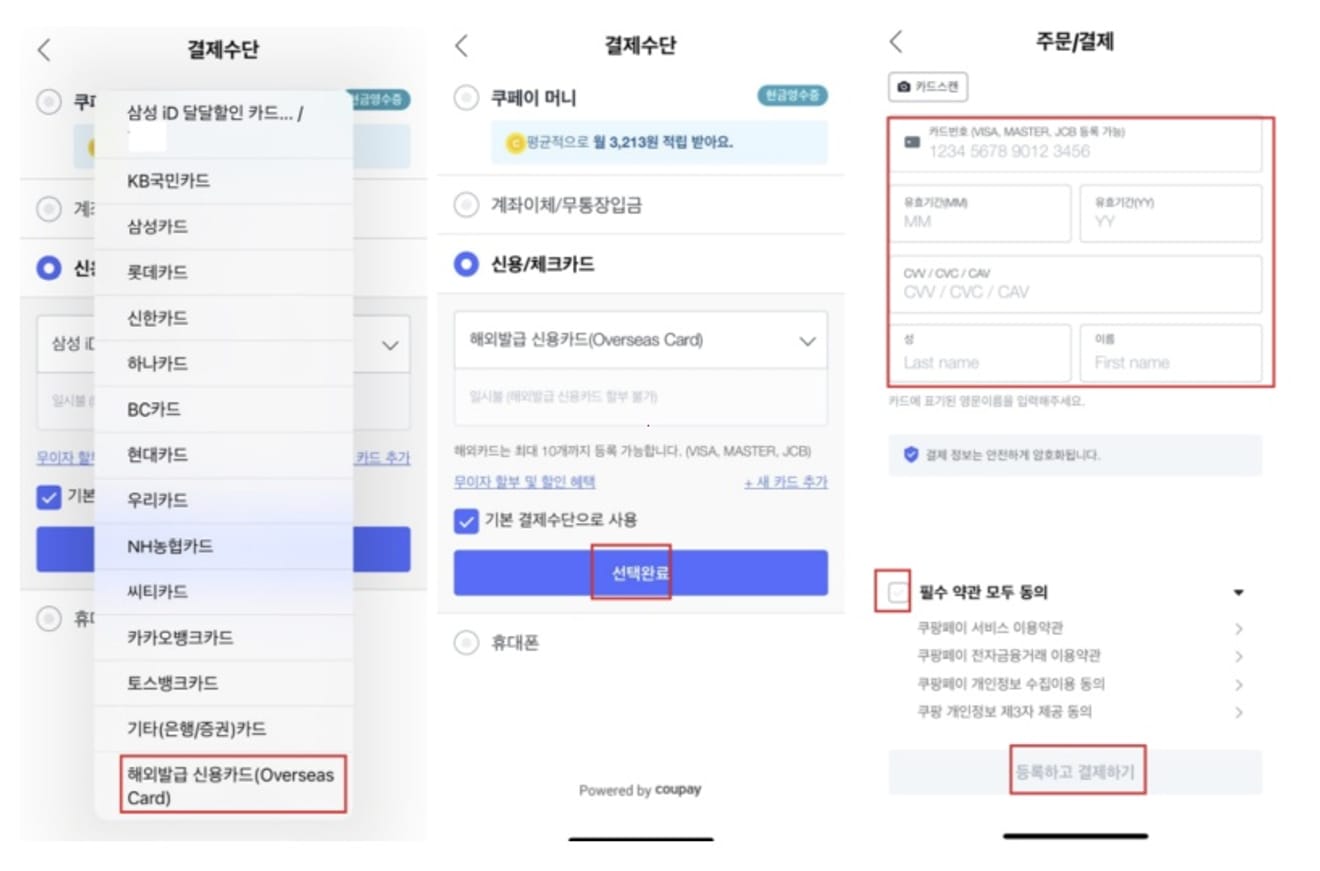

Redotpay Physical Card Use Review

As a result of issuing a Redotpay physical card and using it in various places such as cafes, hospitals, pharmacies, fruit shops, and coin karaoke, the payment was made without any problems like a general check card. If set to BTC or USDT, it is automatically deducted by that amount, and there was no case where the payment was rejected because it was recognized as an overseas VISA card at the time of payment. It can be used not only offline but also online, and I was actually able to complete the order and payment through the overseas issued card option at Coupang. The disadvantages were the FX fee of about 1.2% and the physical card issuance fee (100 USD), which was disappointing, but the fact that there is no annual fee acted as an advantage. In conclusion, Redotpay is a practical means of payment that allows you to directly consume Bitcoin and USDT in your daily life, and together with a cold wallet, it gave me the confidence that it can be fully utilized even in overseas life.