How to Trade Bitcoin Futures | Recommended Futures Exchange Sites | Fees | Binance

Today, we will explore how to trade Bitcoin futures, recommended futures exchange sites, and fees. As the cryptocurrency market continues to evolve, more investors are attempting various investment strategies beyond simple spot trading. Among them, Bitcoin futures trading is an investment method that is attracting significant interest due to its ability to maximize profits through leverage and to hedge risks. However, futures trading can offer high returns, but it also carries considerable risks. Therefore, if you approach it without sufficient knowledge, you could incur significant losses.

Recommended Bitcoin Futures Exchange Sites

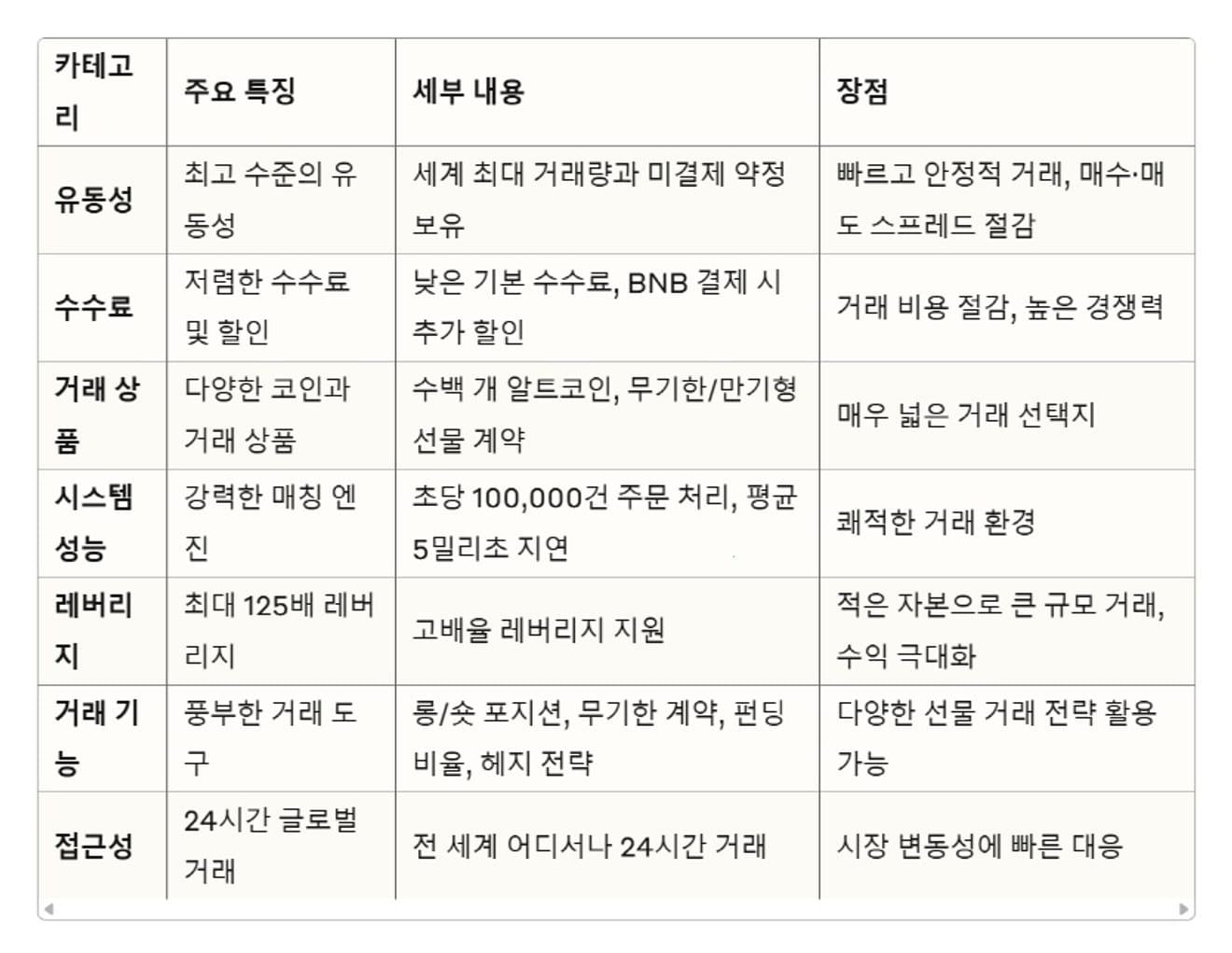

The main reasons for recommending Binance as a Bitcoin futures exchange are as follows:

1. Top Liquidity: Binance holds the largest trading volume and open interest in the world, enabling fast and stable trading at all times. High liquidity can narrow the bid-ask spread, reducing trading costs.

2. Low Fees and Additional Discounts: The basic trading fees are low, and you can receive additional discounts by paying fees with Binance Coin (BNB), making it competitive in terms of cost.

3. Support for Various Coins and Trading Products: Besides Bitcoin, you can trade hundreds of altcoins and various perpetual and futures contracts, providing a wide range of trading options.

4. Powerful Matching Engine and Fast Execution Speed: Provides a comfortable trading environment with a matching engine that can process up to 100,000 orders per second and an average latency of 5 milliseconds.

5. Leverage Support up to 125x: Enables large-scale trading with a small amount of capital through high leverage, which is advantageous for maximizing profits.

6. Various Trading Functions and Tools: You can utilize various futures trading functions such as long/short positions, perpetual contracts, funding rate settings, and hedging strategies.

7. 24-Hour Trading Availability and Global Accessibility: You can trade 24 hours a day from anywhere in the world, allowing for quick responses to market volatility.

For these reasons, Binance is a platform that is trusted and widely recommended by both domestic and international investors as a Bitcoin futures exchange.

How to Trade Bitcoin Futures

Now, let's learn how to trade Bitcoin futures on Binance. You can receive a 20% fee discount by accessing the website via the link below.

As trading can increase the burden of fees, it would be good to take advantage of the benefits in advance. Please note that if you signed up without a referral link or referral code, you will need to re-register after withdrawing to receive the fee benefits.

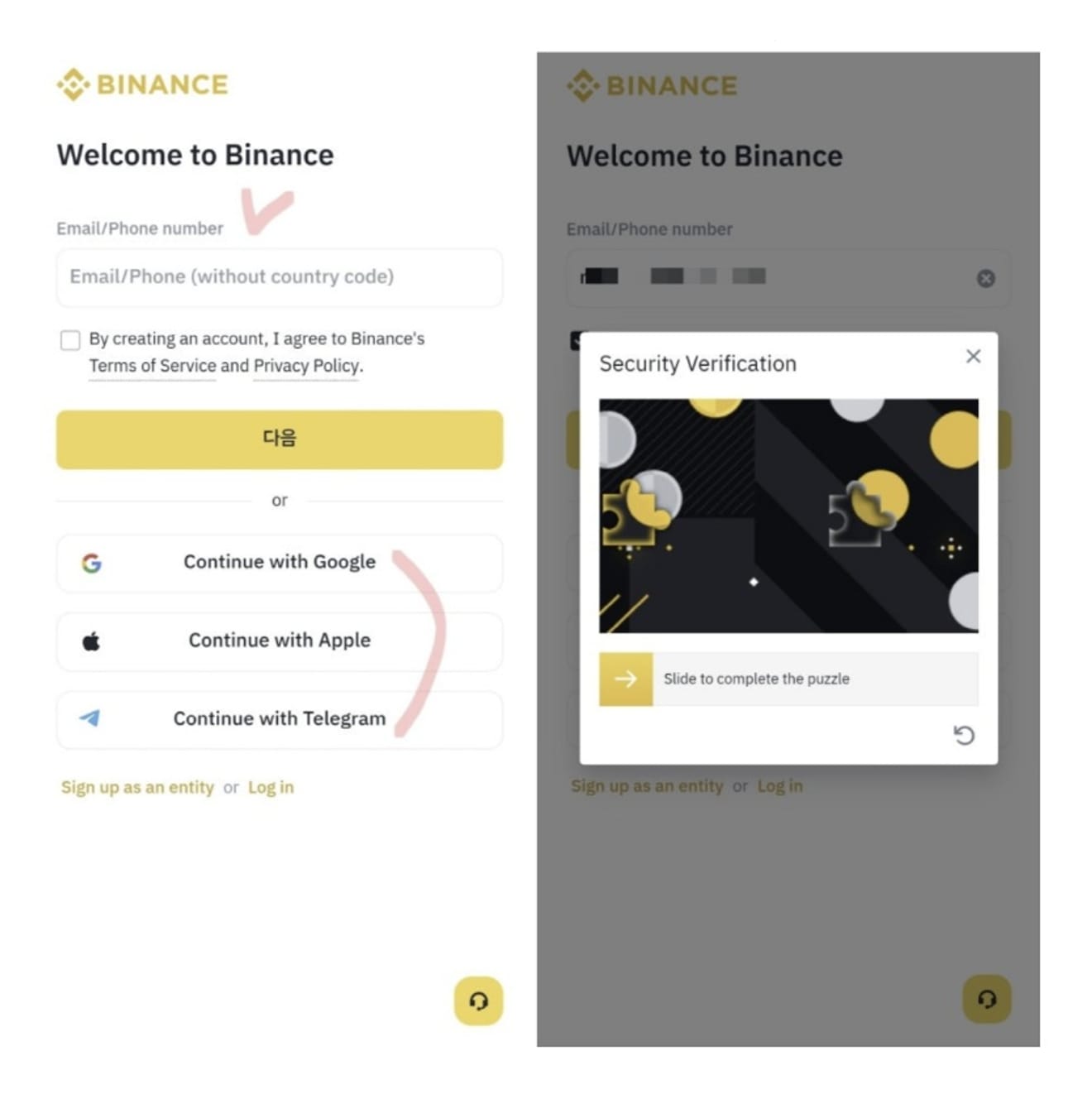

After accessing the Binance website through the sign-up link, start the registration process using your email or phone number. I proceeded with the new registration using an email address. After entering the email address, proceed with the security verification.

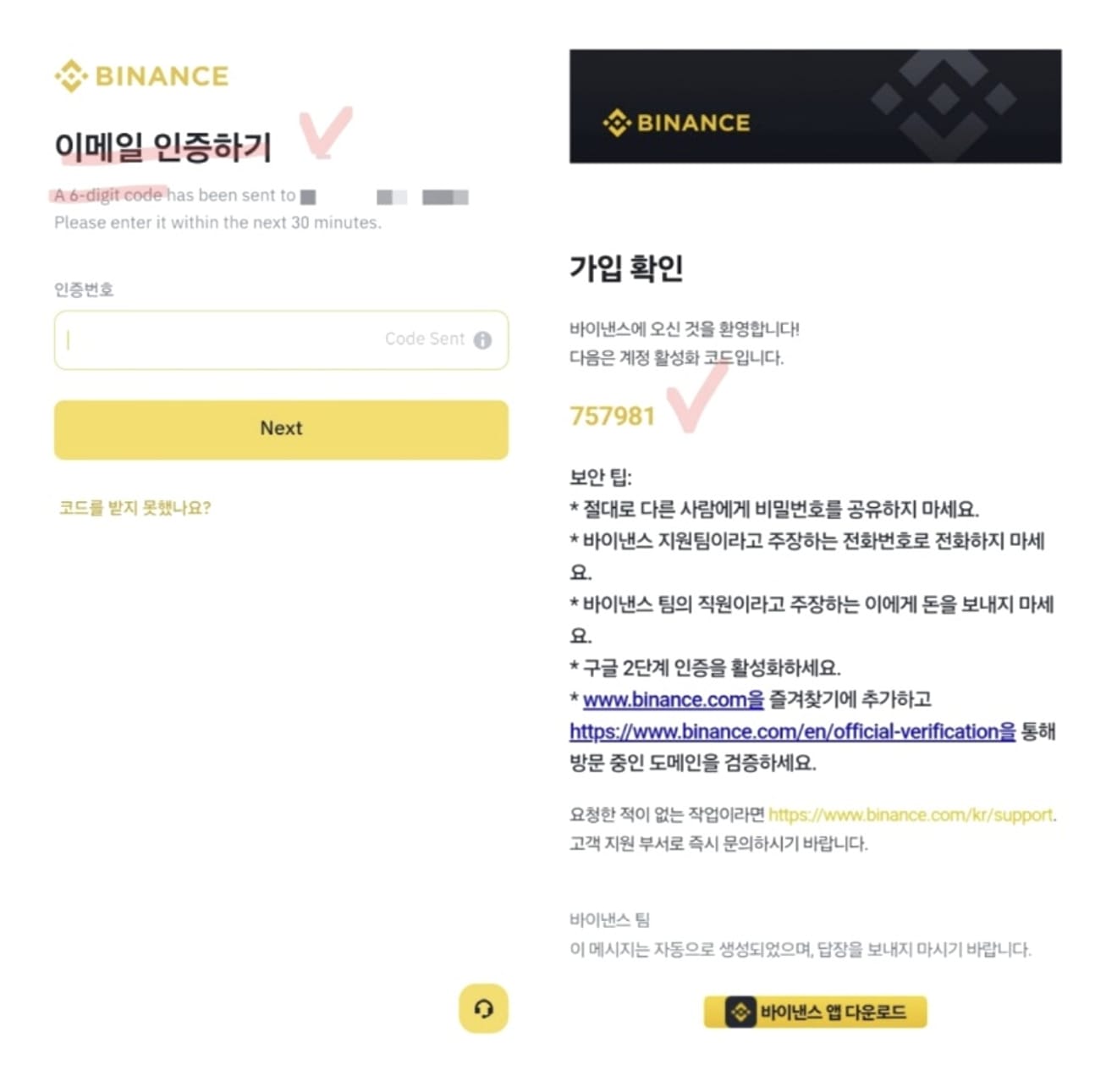

A 6-digit code will be sent to the email you entered for registration. Please check the account activation code received by mail and enter it.

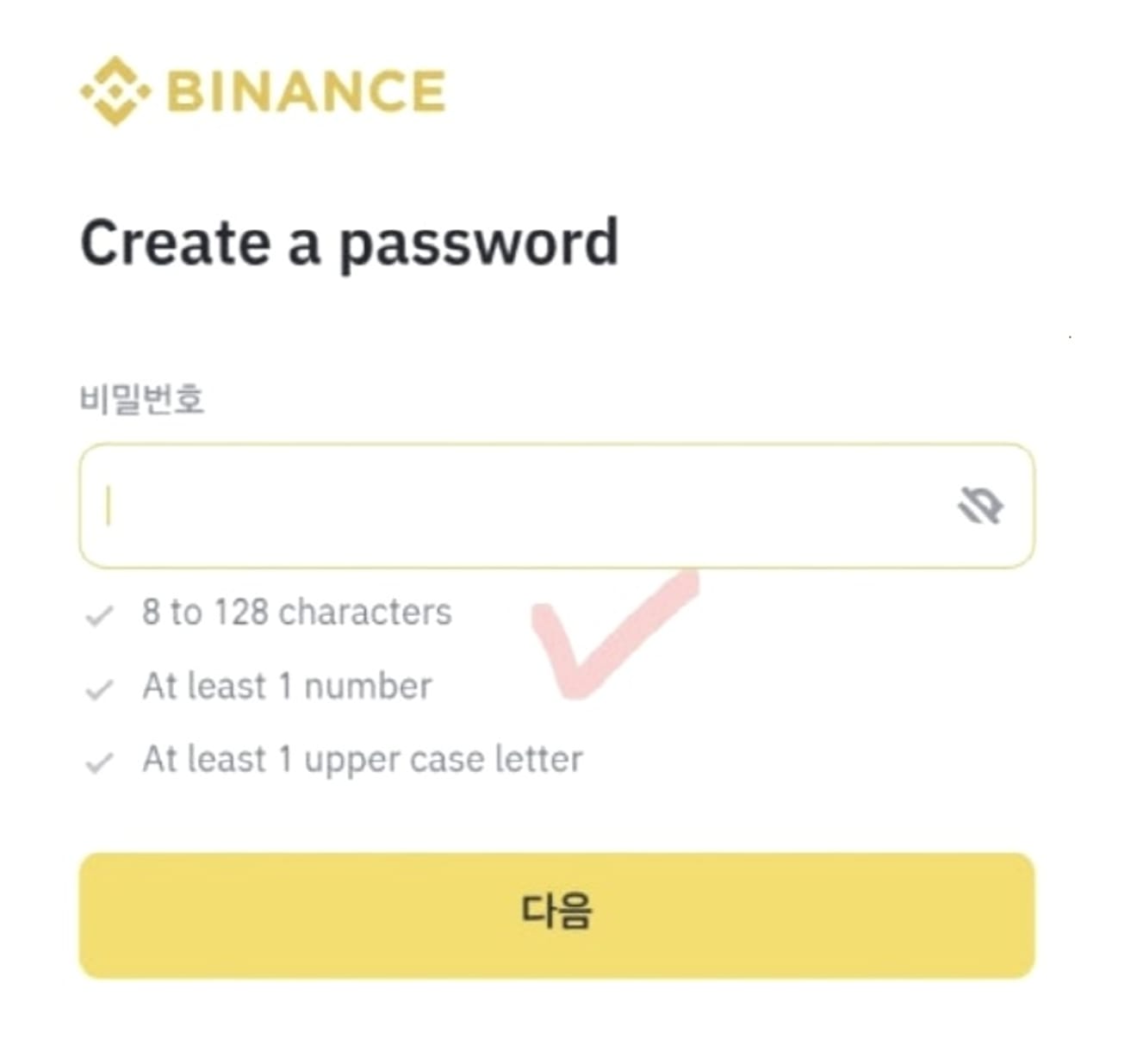

Once you set your password, the registration is complete.

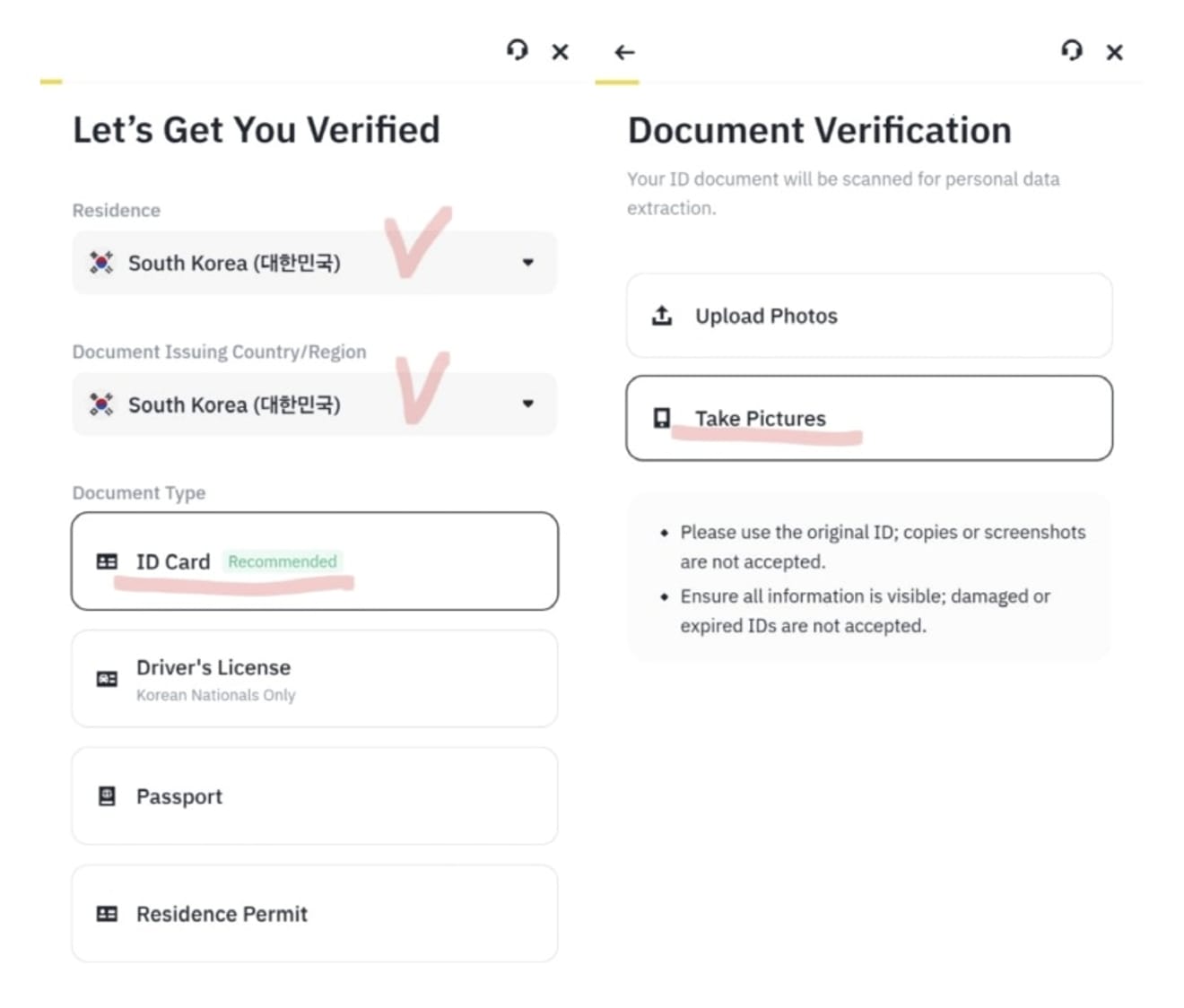

After registering, you need to go through the KYC (Know Your Customer) process. You can think of this as a personal identification process for cryptocurrency trading. I downloaded and proceeded with the Binance app considering taking photos of my ID, etc.

Set your residential area to South Korea and select an ID for personal verification. I proceeded with my driver's license. Upload photos of the selected ID and choose a photo shooting method. I selected photo shooting.

After taking photos of the front and back of your ID, check your personal face and finally proceed with the address verification process.

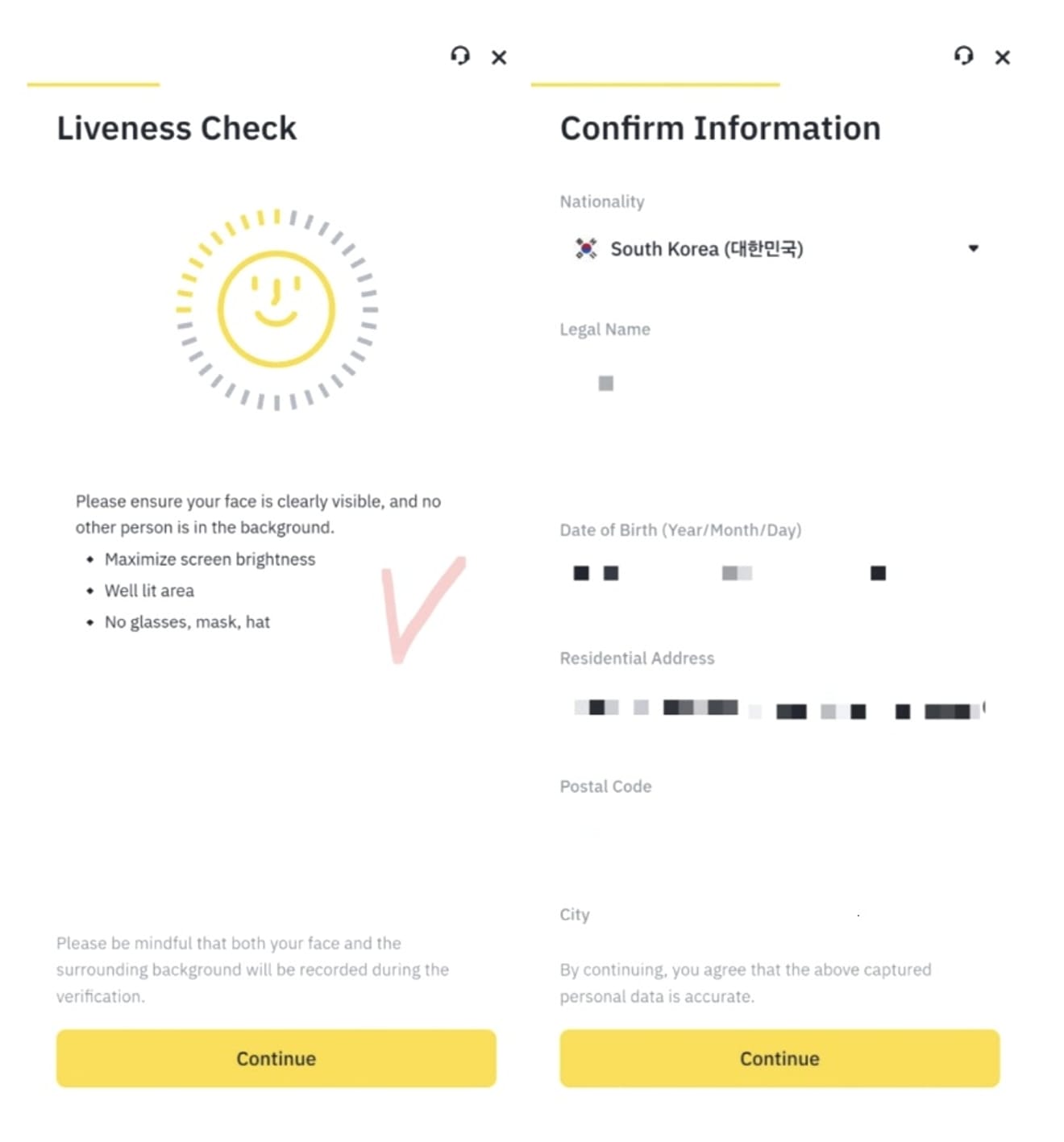

After this, you can verify the completion of the verification within 30 minutes through the review process.

Next, let's find out how to deposit from Upbit to Binance.

First, access the Upbit app and then buy USDT (Tether).

Then, you can select the USDT withdrawal function from the deposit/withdrawal menu. If you have followed along this far, you've already done half the work. Don't be discouraged.

Here, you must select the network and the amount. The network must be set to Tron, and you can enter the desired amount.

After that, you must select the deposit destination, and since we are dealing with how to deposit from Upbit to Binance, Binance is naturally the correct choice. And you must set the most important 'recipient address'.

This can be done by accessing the Binance app and touching Assets -> USDT -> Deposit in order.

After that, if you set the network to Tron, you can check the deposit address as shown above. Copy and paste this into Upbit, and the deposit will be completed. Now, let's find out how to trade Bitcoin futures on Binance in earnest.

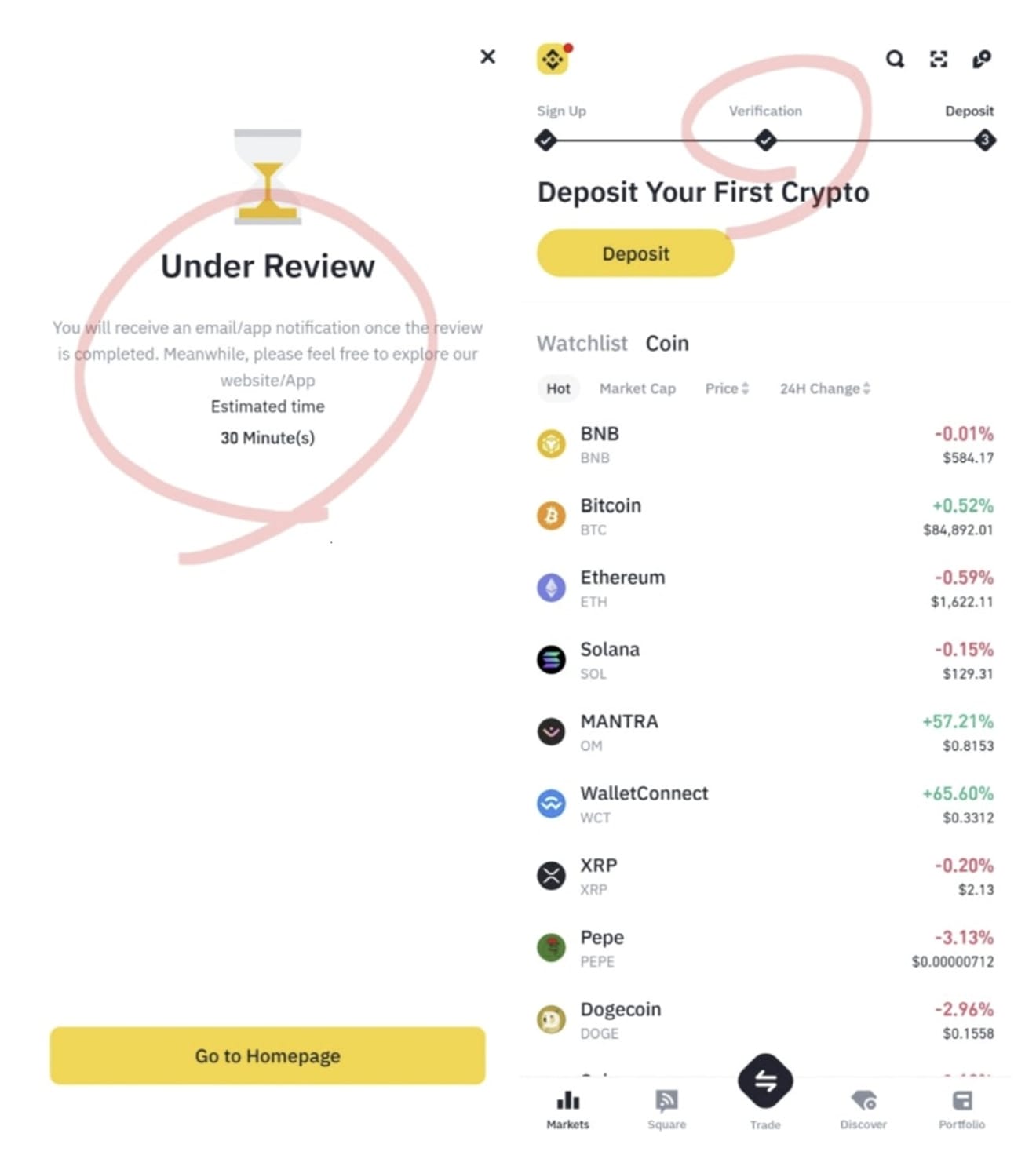

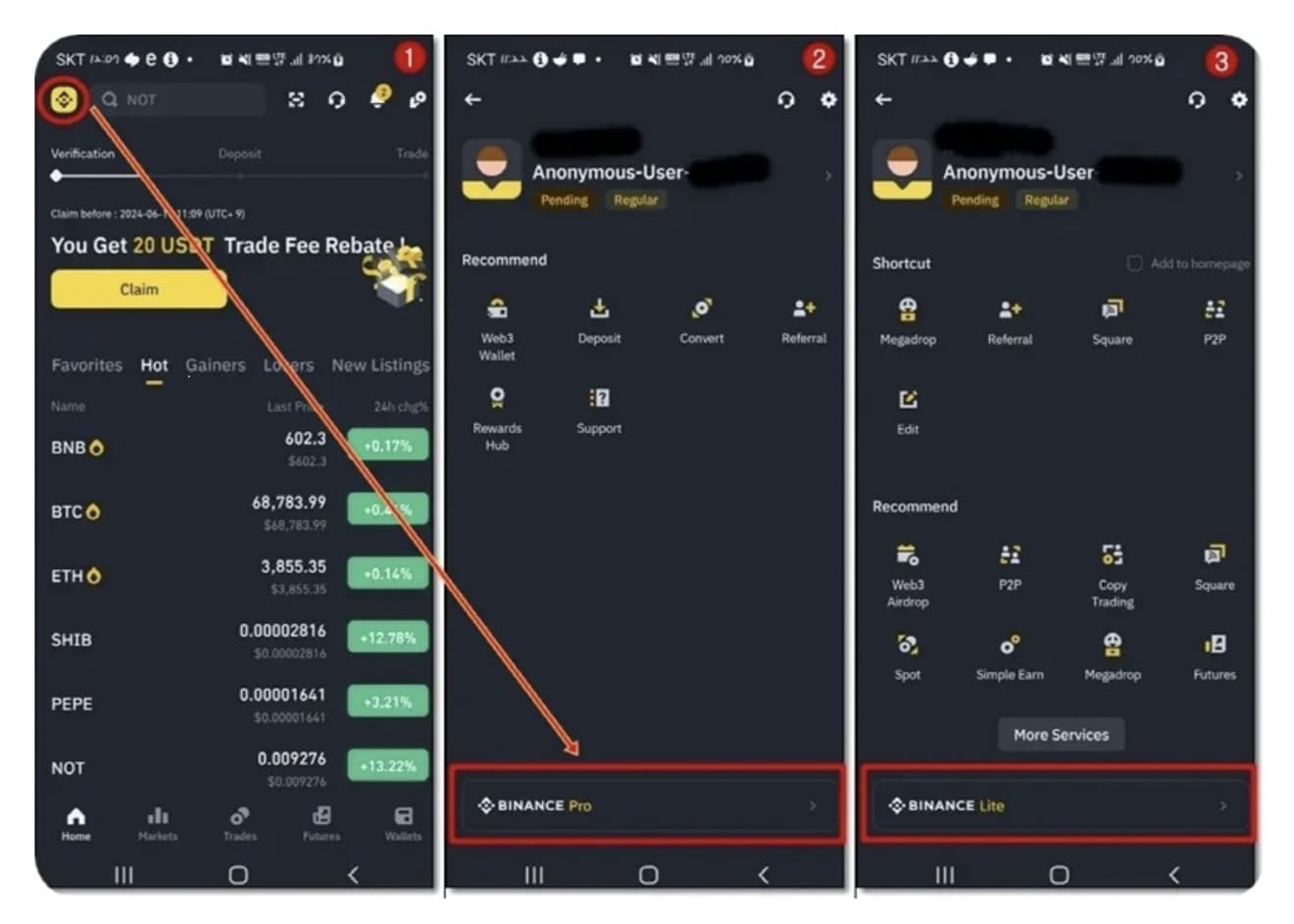

To start futures trading on Binance, you need to switch to Pro mode. Touch the Binance logo on the top left of the exchange to find BINANCE Pro below, then touch it to switch to Pro mode.

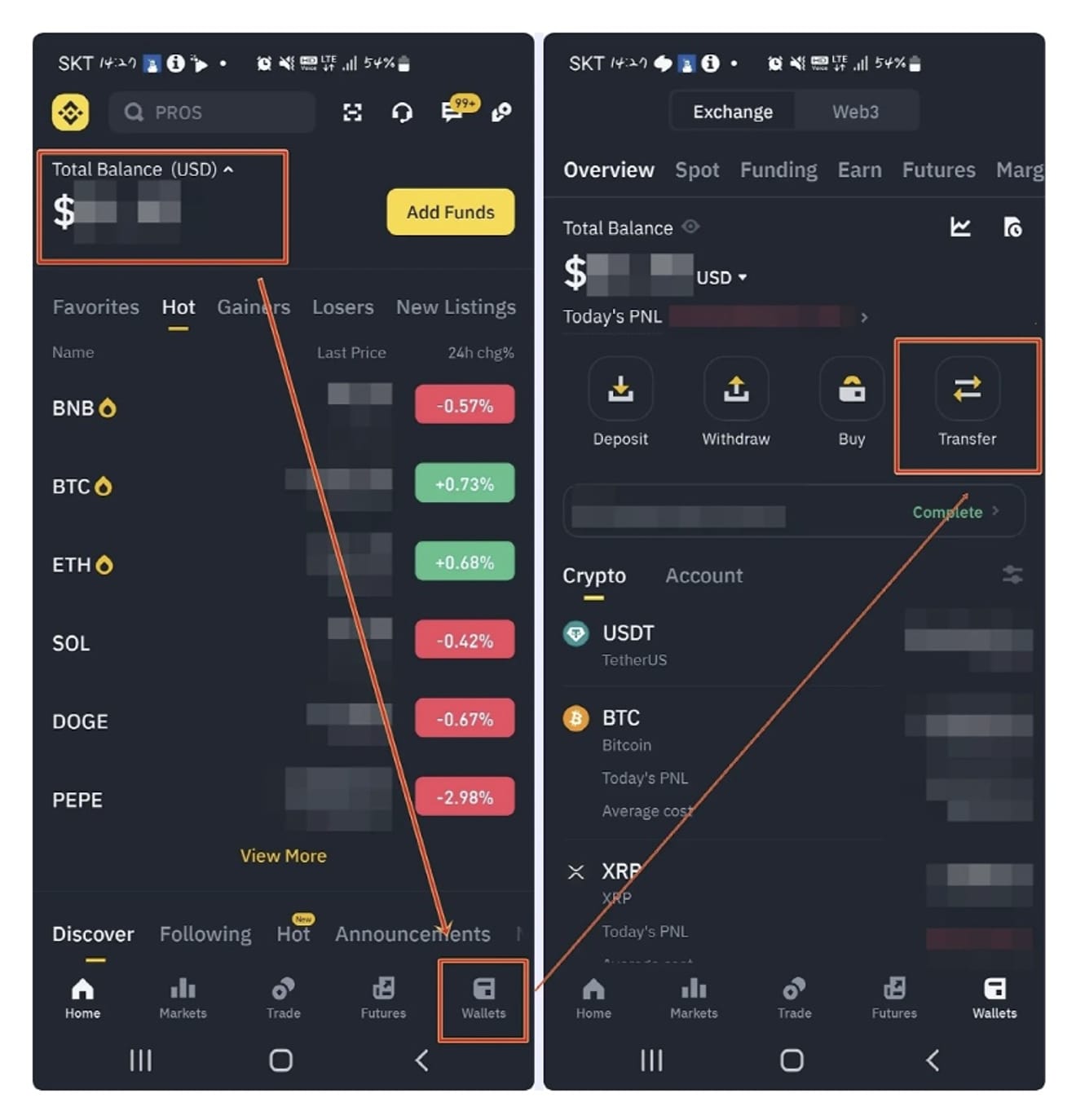

Access the Binance app and go to the main screen. If you have deposited funds into Binance and converted them to cash

Since the wallet you currently own is a spot wallet, you need to move the funds to a futures wallet to proceed with futures trading.

Touch Wallets, located on the right side of the menu at the bottom of the screen. Once you enter the Wallets screen, select Transfer, which is on the right side of the middle menu.

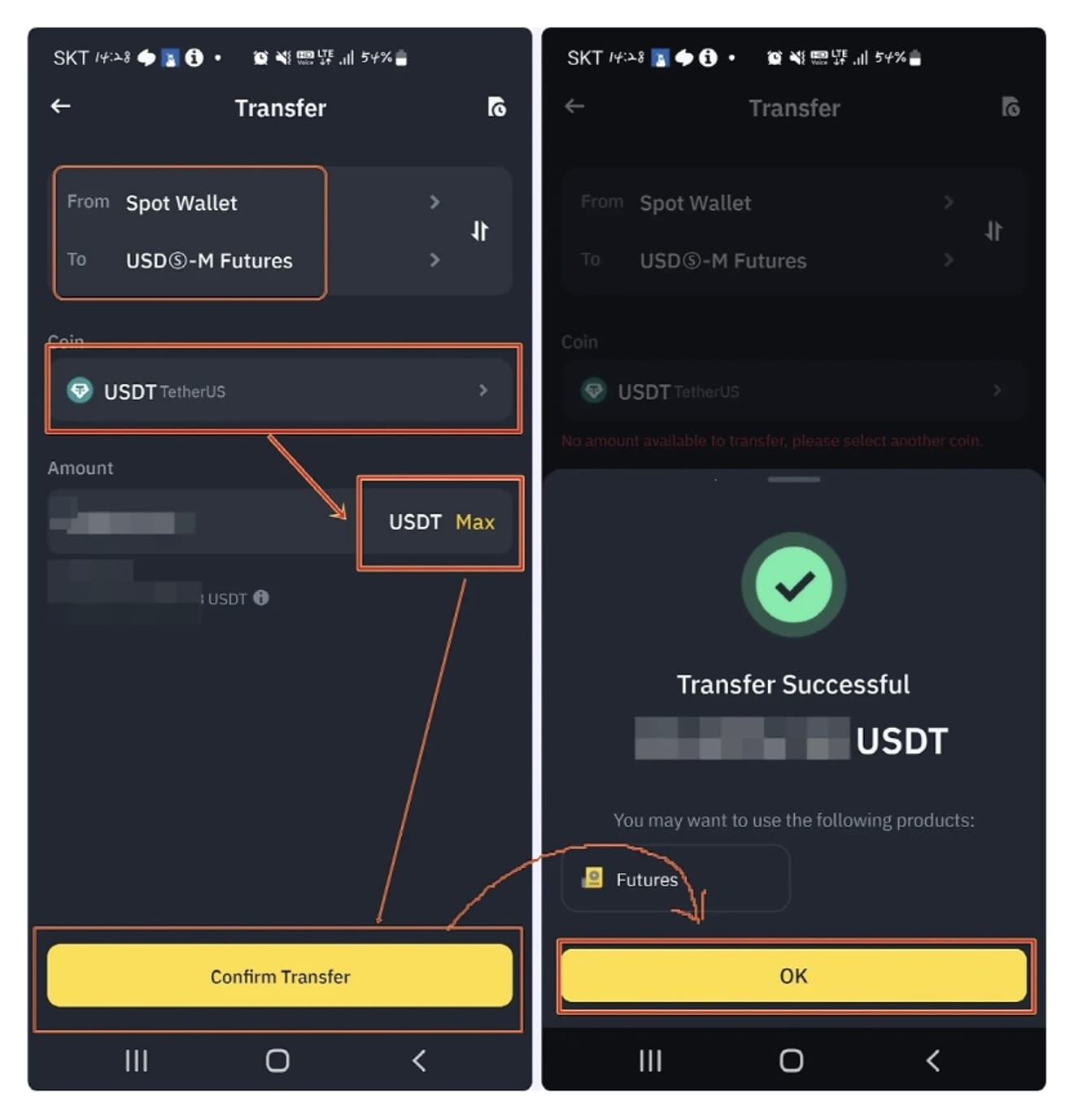

When you move to the Transfer screen, select USDT in Coin in the center of the screen. After entering the amount you want to transfer to the futures wallet, touch Confirm Transfer at the bottom. If a pop-up appears stating that the funds have been moved to the futures wallet, touch OK below, and the investment funds will be deposited into the futures wallet.

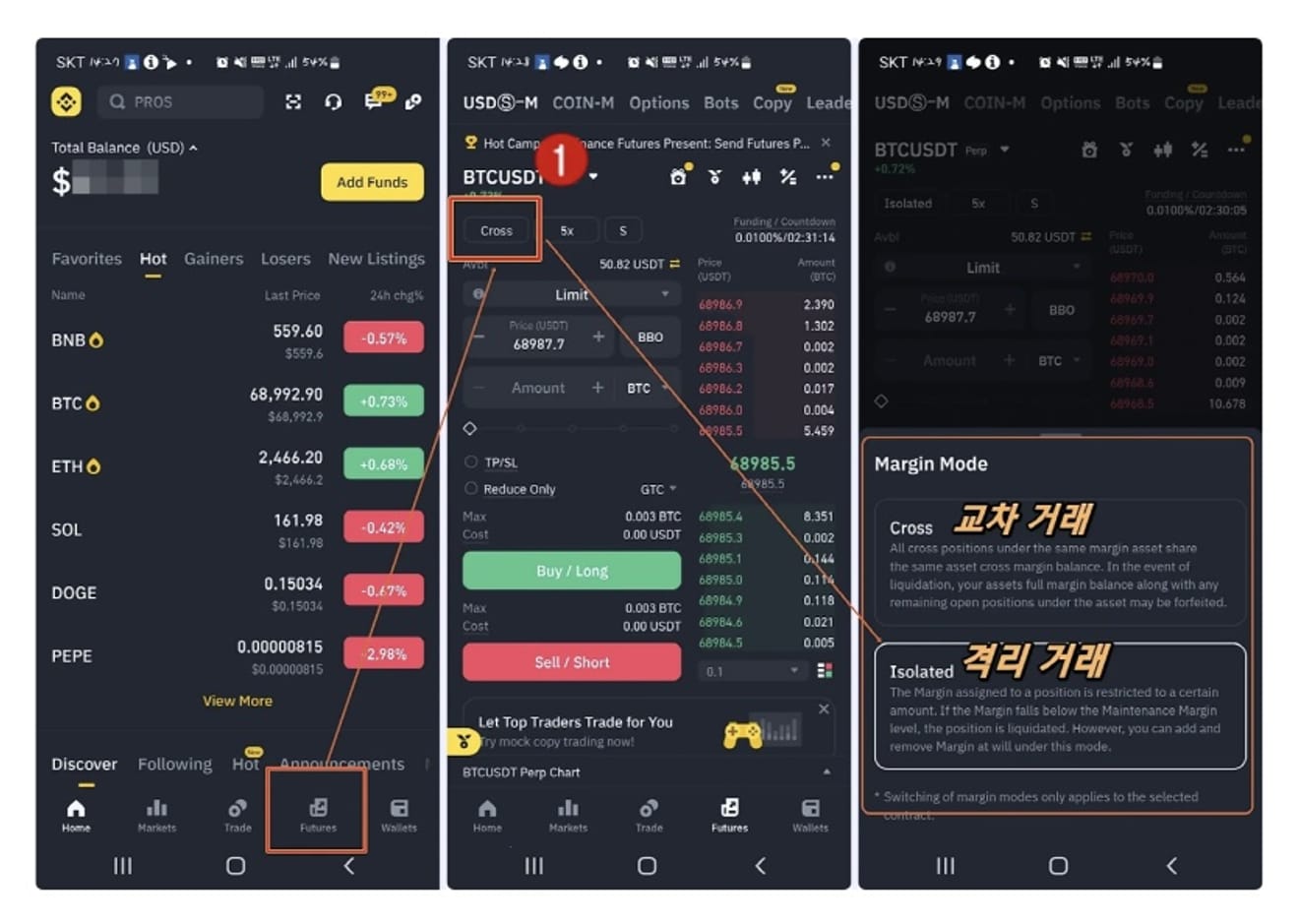

To start futures trading, you must select Futures from the bottom menu of the exchange. Before starting trading, you must set the margin mode. Touch the first Cross under the coin name and select the desired margin mode. There are two types of margin modes.

Cross margin mode utilizes the entire balance of the account for all positions, reducing the risk of liquidation. This reduces the risk of liquidation, but if forced liquidation occurs, you could lose all of your investment funds.

Isolated margin mode sets a margin limited to a specific position, and even if that position incurs a loss, it does not affect the entire account. Each position has an independent margin, so at the time of forced liquidation, only the amount of that position is liquidated.

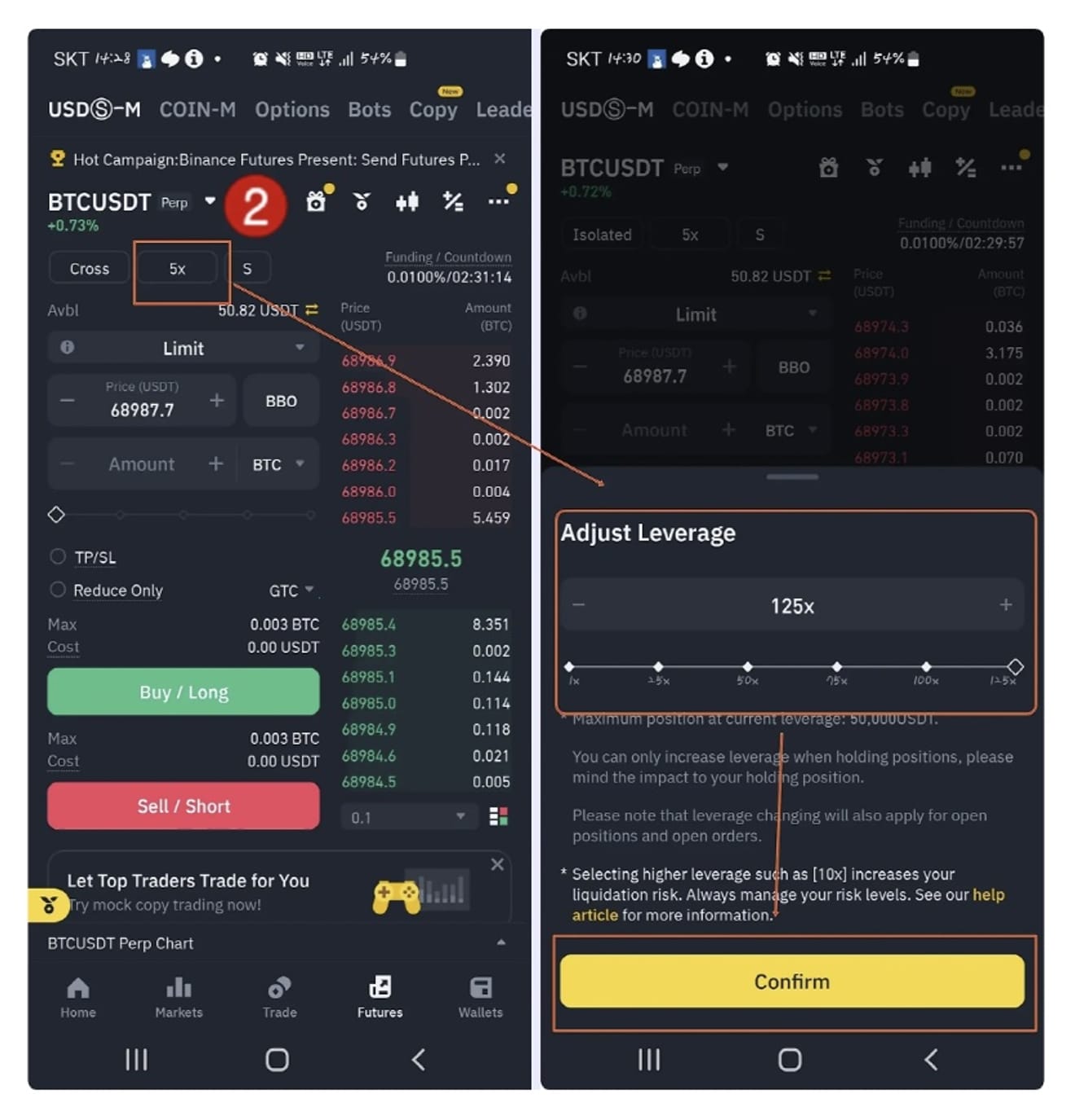

After selecting the margin mode, touch the leverage located next to it. Leverage can be set from a minimum of 1x to a maximum of 125x, but there may be restrictions depending on the popularity of the coin and the date of registration. After selecting the desired leverage, touch Confirm below.

Find and select the coin you want to trade.

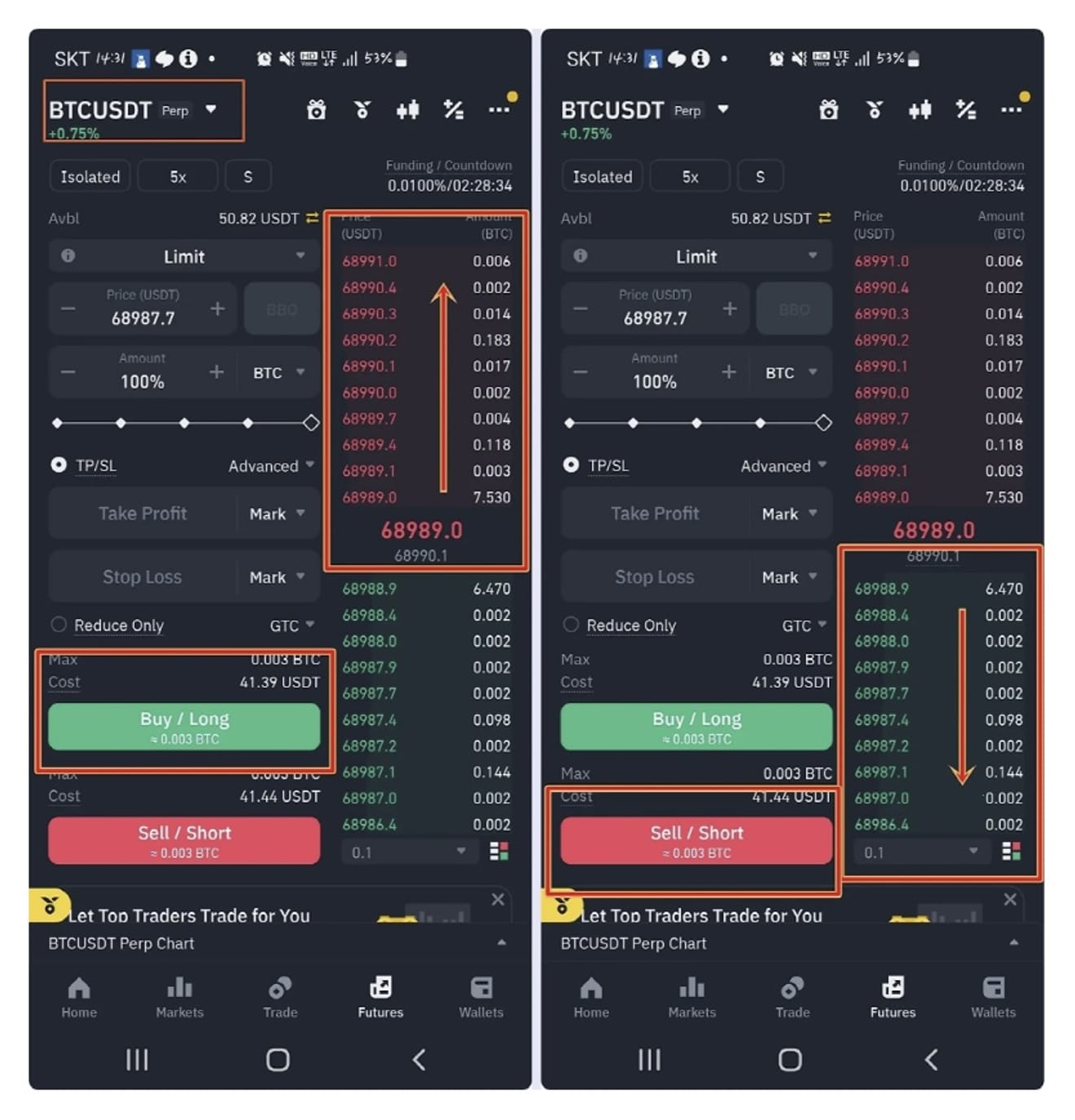

Depending on the trading volume of the coin, if you expect it to rise, select a long position; if you think it will fall, select a short position and start trading.

Bitcoin Futures Trading Fees

The futures trading fees on Binance are as follows:

1. Maker (Limit Order) Fee: 0.02%

2. Taker (Market Order) Fee: 0.04%

Binance's futures trading fees are competitive, and you can get an additional discount of about 10% if you pay the fees with Binance Coin (BNB). In addition, the fee rate may be even lower depending on the trading volume or VIP level.