How to Check Bybit Fees | How to Get Discounts | Futures | Funding Fees

In this blog post, we will explore how to check fees on Bybit, how to get discount benefits, and learn about futures trading and funding fees. Before starting trading on Bybit, it is essential to check the fee structure. Transaction fees significantly impact profitability, making them even more important for traders who trade frequently. Bybit's fee system varies depending on the trading method, such as spot, futures, and funding fees, and there are also ways to receive fee discounts through VIP levels or referral codes. Effectively utilizing these can save a considerable amount of money. In this post, we will explain in detail how to check Bybit's fees, how to get discounts, futures trading fees, and funding fees, which many people are curious about.

How to Discount Bybit Fees

Ways to get a fee discount on Bybit include signing up through a discount link and achieving VIP status.

If you sign up through the link above, you can get a 20% discount on fees.

To achieve VIP 1 status on Bybit, you automatically level up if you meet one of the specific criteria. Reaching VIP status allows you to enjoy various benefits, such as transaction fee discounts, which is very advantageous for users who trade actively or hold a certain amount of assets.

There are four ways to achieve VIP 1 status: if your account has assets of 100,000 USDT or more, if you trade spot for 1,000,000 USDT or more in a month, if you take out a loan of 50,000 USDT or more in a month, or if you record a futures trading volume of 10,000,000 USDT or more in a month, you will automatically be upgraded to VIP status.

Bybit Spot Fees

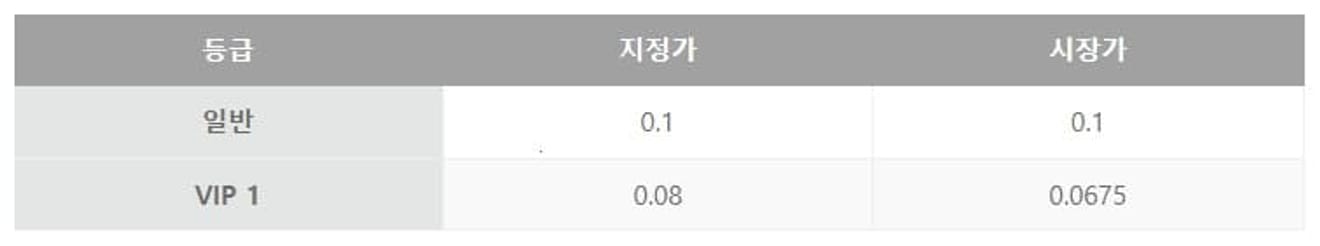

Bybit's spot trading fee is basically set at 0.1%. However, fees are discounted according to VIP status, and different fees apply depending on limit orders and market orders.

For general users, a fee of 0.1% is charged for both limit orders and market orders. However, from VIP 1 status, fee benefits are applied, and VIP 1 users pay 0.08% for limit orders and 0.0675% for market orders.

Bybit Futures Fees

When trading futures on Bybit, different fee rates apply depending on limit and market orders. Generally, general users must pay a fee of 0.02% for limit orders and 0.055% for market orders.

However, you can receive fee discounts if you obtain VIP status. VIP 1 users will pay 0.018% for limit orders and 0.04% for market orders.

Bybit Futures Leverage Fees

When trading futures on Bybit, using leverage increases the fee rate. Especially for USDT futures trading, if NON-VIP users receive a 20% fee discount, the limit and market order fee rates vary depending on the leverage ratio.

In general, if leverage is not used (1x leverage), a fee of 0.02% is applied for limit orders, and 0.044% for market orders. However, as leverage increases, the fee rate also increases proportionally.

For example, if 2x leverage is applied, the limit order fee increases to 0.04%, and the market order fee increases to 0.088%. If 5x leverage is used, the limit order fee increases to 0.1%, and the market order fee increases to 0.22%.

In particular, if 10x leverage is used, you must pay a fee of 0.2% for limit orders and 0.44% for market orders. If you apply 100x leverage, the limit order fee increases to 2%, and the market order fee increases to 4.4%.

As such, the higher the leverage ratio, the larger the trading volume, but the fee burden also increases. Therefore, when using high leverage, a careful trading strategy that considers fee costs is necessary.

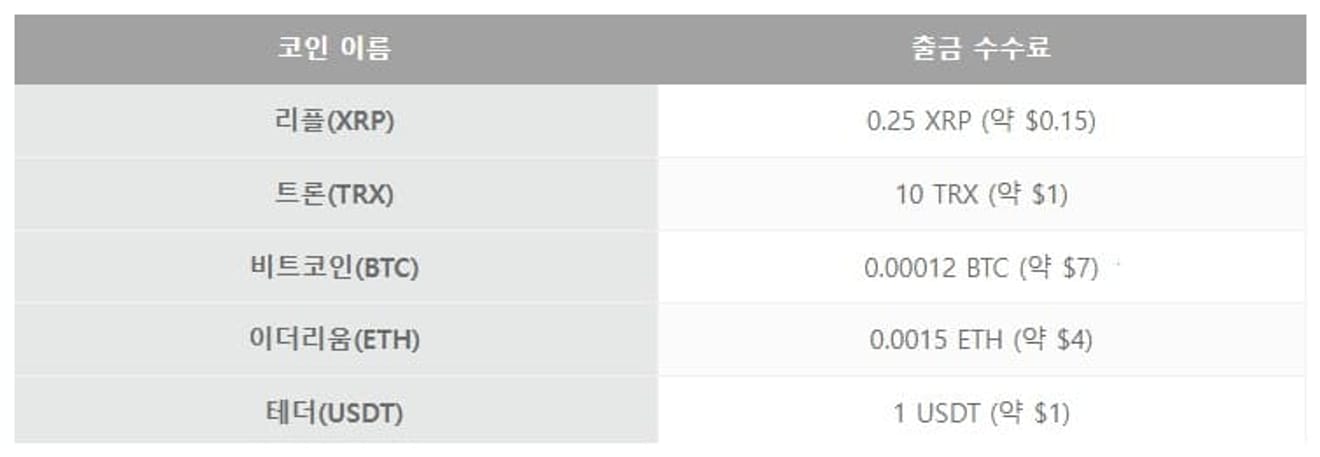

Bybit Withdrawal Fees

The fee for withdrawing from Bybit varies depending on the type of coin being withdrawn, and there may be slight daily fluctuations depending on network conditions. It is important to check the withdrawal fee for the relevant coin before withdrawing.

The withdrawal fees for the main coins that users frequently withdraw are as follows. First, for Ripple (XRP), a withdrawal fee of 0.25 XRP is charged, which is about $0.15. It is one of the coins preferred by many users because it can be withdrawn at a relatively low fee.

Next, Tron (TRX) is charged a withdrawal fee of 10 TRX, which costs about $1. The Tron network is often used for USDT (Tether) withdrawals due to its fast transfer speed and low fees.

On the other hand, Bitcoin (BTC) has relatively high network fees. Bybit charges a withdrawal fee of 0.00012 BTC, which is about $7. Bitcoin fees can fluctuate depending on network congestion, so you must check before withdrawing.

Ethereum (ETH) has a withdrawal fee of 0.0015 ETH, which is about $4. Ethereum gas fees can increase if the network usage is high, so the withdrawal time should be carefully considered.

Finally, for Tether (USDT), there may be fee differences depending on the network, but generally, a withdrawal fee of 1 USDT is charged, which is about $1. USDT is a method preferred by many traders because it can be withdrawn at a low fee when using the Tron (TRC-20) network.

Bybit Funding Fee

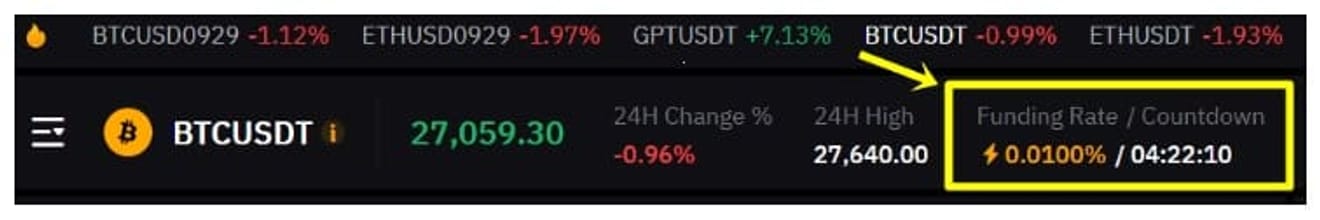

The funding fee refers to the amount paid from a majority of positions to a minority of positions to balance the futures market. In the example below, a positive value of +0.01% is shown. 'Countdown' written next to it

It means the time remaining until the funding fee settlement. Generally, settlements are made every 8 hours.

If the funding fee is positive, investors with long positions must pay a certain amount to investors holding short positions. The funding fee is calculated by multiplying the position's size by the funding rate. For example, if the funding rate is assumed to be 0.01% and you hold a long position worth $10,000, you will pay a funding fee of $1 to the short position holders, 10,000 × 0.01% = $1.

On the other hand, if the funding fee is negative, investors with short positions will pay to investors holding long positions. In this case, the amount is calculated by multiplying the position's size by the funding rate. If the funding rate is assumed to be -0.01% and you hold a short position worth $10,000, you will receive a funding fee of $1 from the long position holders, 10,000 × 0.01% = $1.

How to Check Bybit Fees

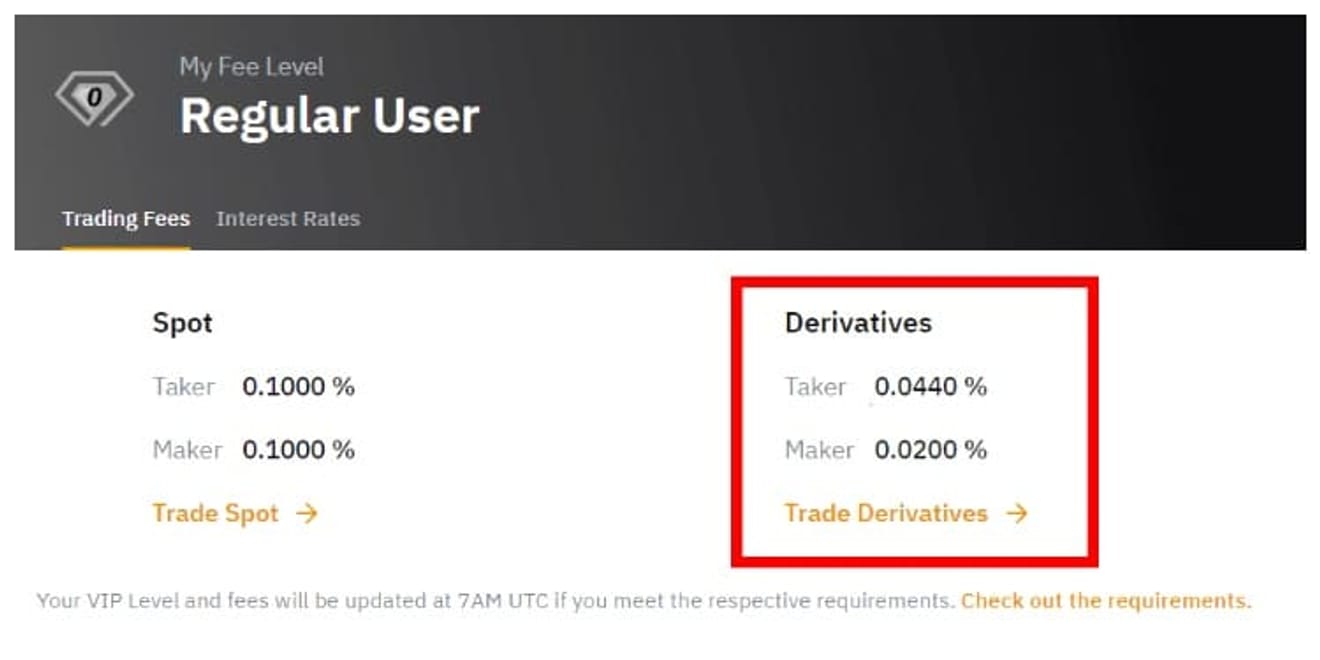

Click on the 'person-shaped icon' located in the upper right corner of Bybit, and then select 'My Fee Rates'.

Here you can check fee information. If the Taker fee is displayed as 0.044% in the Derivatives (futures) section, it means that the account is properly receiving fee discounts.