How to Trade Bybit Futures | Fees | How to Short

This article covers how to start futures trading on Bybit, its fee structure, and how to set up short positions. Recently, investors seeking high profits in the cryptocurrency market are increasing. There are many cases where people look for futures trading because they are limited to spot trading alone. Among them, Bybit is a representative platform favored by global traders. Many users flock to it thanks to its intuitive UI, fast execution, and various features. However, futures trading involves both the possibility of high profits and significant risk. Especially when using leverage, it can be a burden for beginners. Therefore, it is important to understand the basic principles, actual usage, fee structure, and short position strategy. In this article, we will explain step by step from the basics of futures trading to how to short.

How to Trade Bybit Futures

Here's how to trade futures on Bybit. We'll open a Bitcoin short position as an example and organize related terms.

1. Sign up for Bybit

First, you need to create an account. Click the link below.

By signing up through this link, you can receive a 20% discount on fees for life and various other benefits.

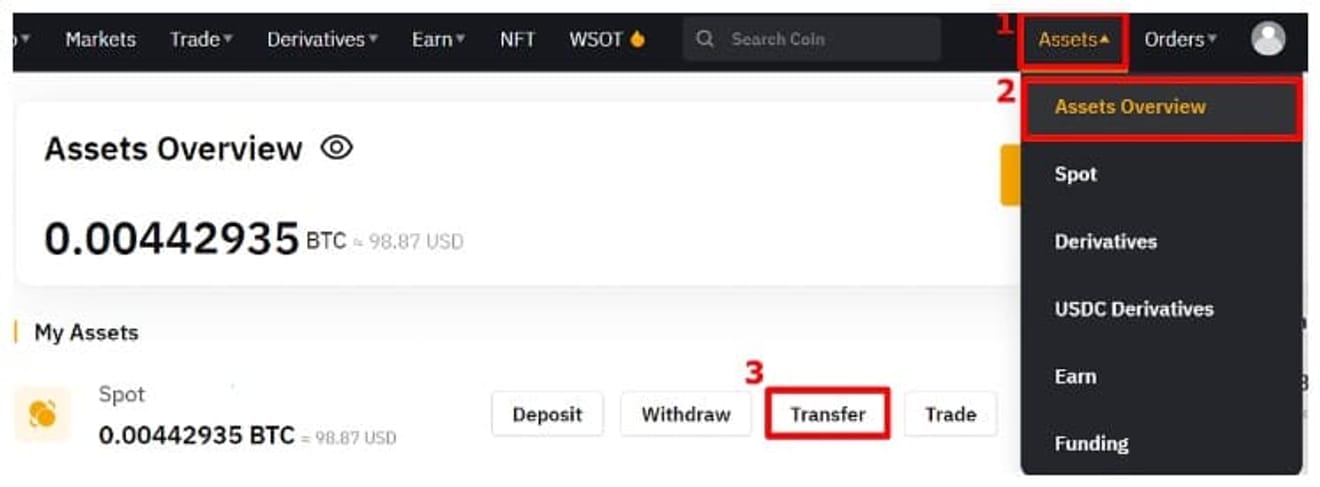

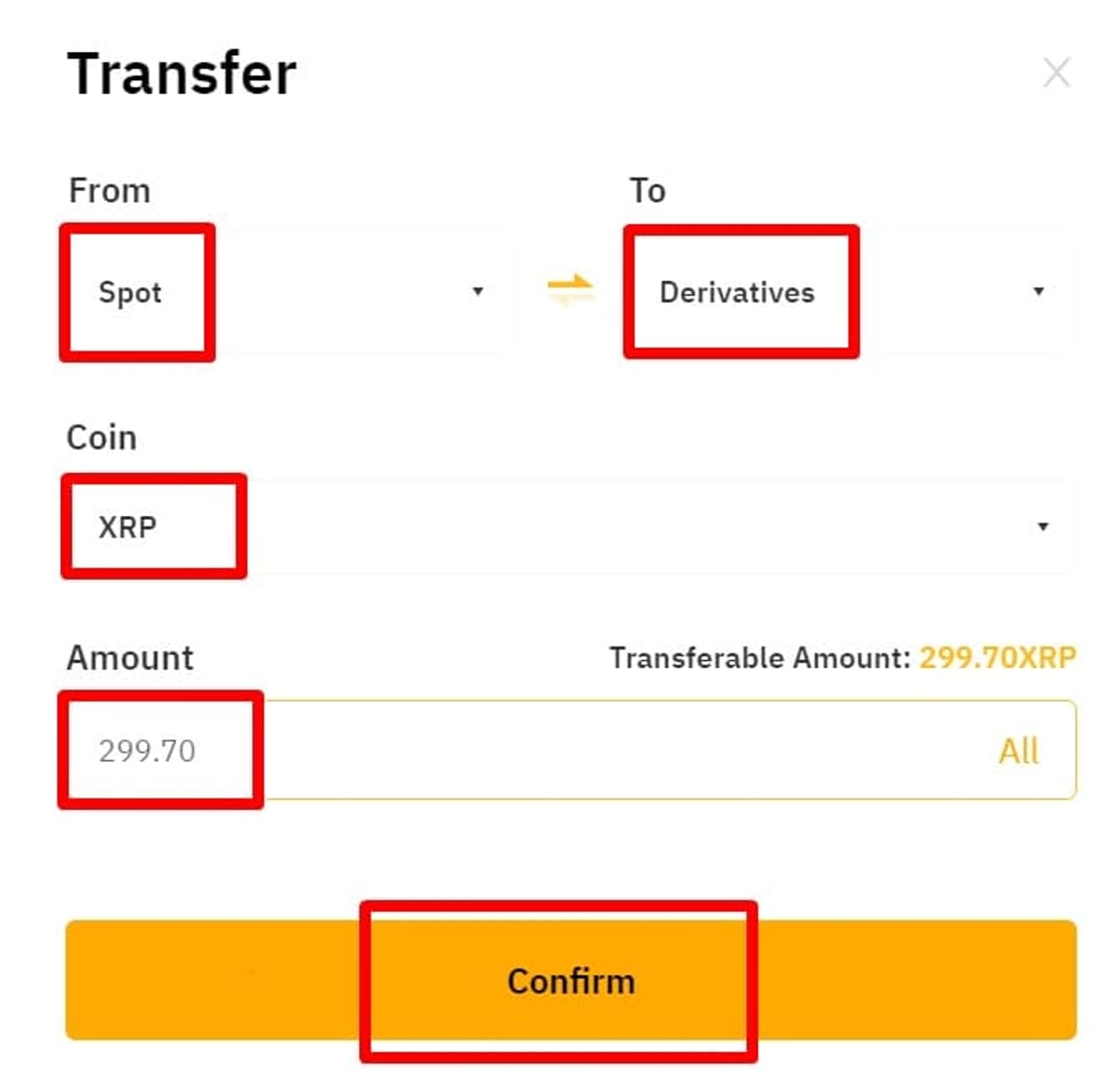

2. Transfer Funds

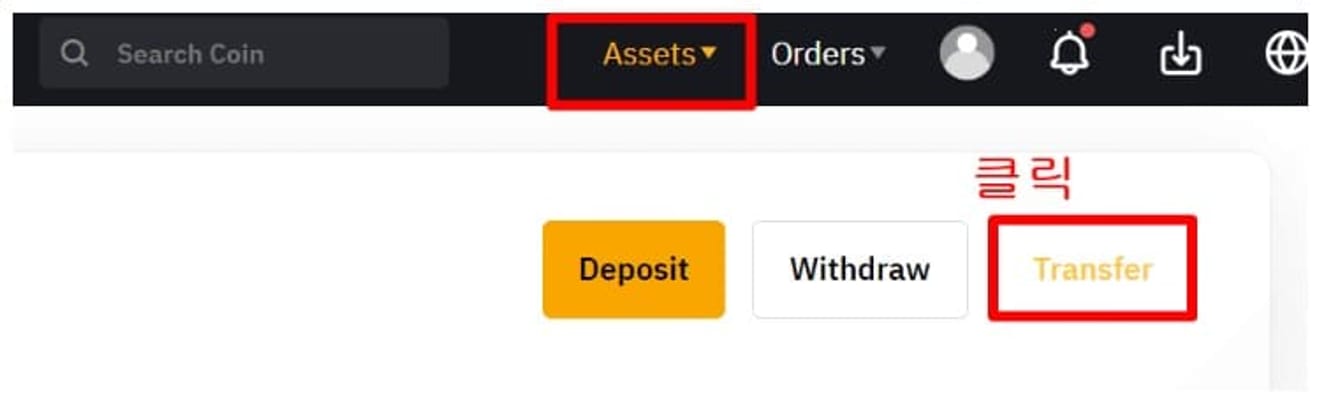

Go to Assets → Assets Overview from the top menu.

Click the 'Transfer' button.

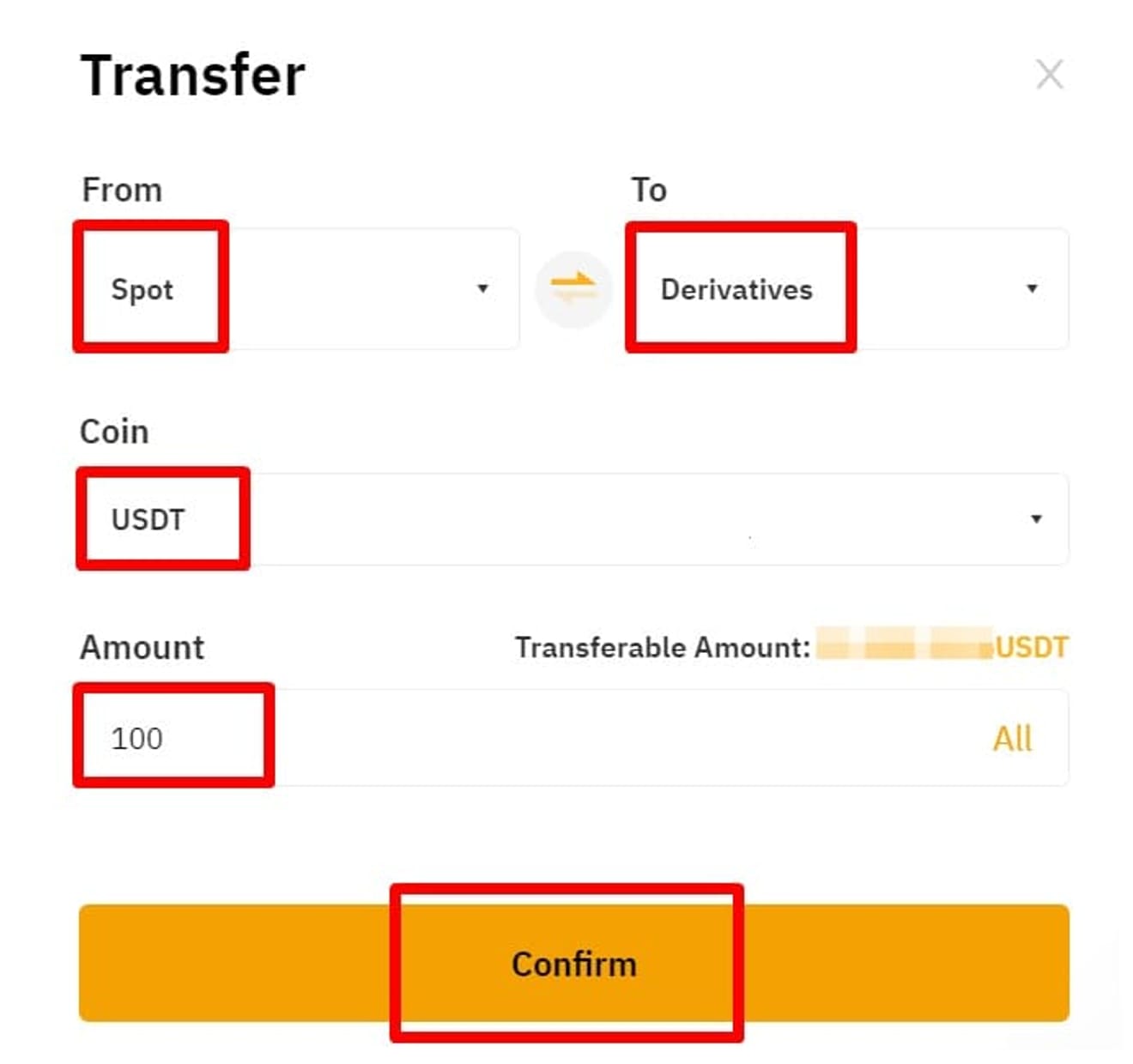

Transfer USDT from your Spot account to your Derivatives account. Example: 100 USDT.

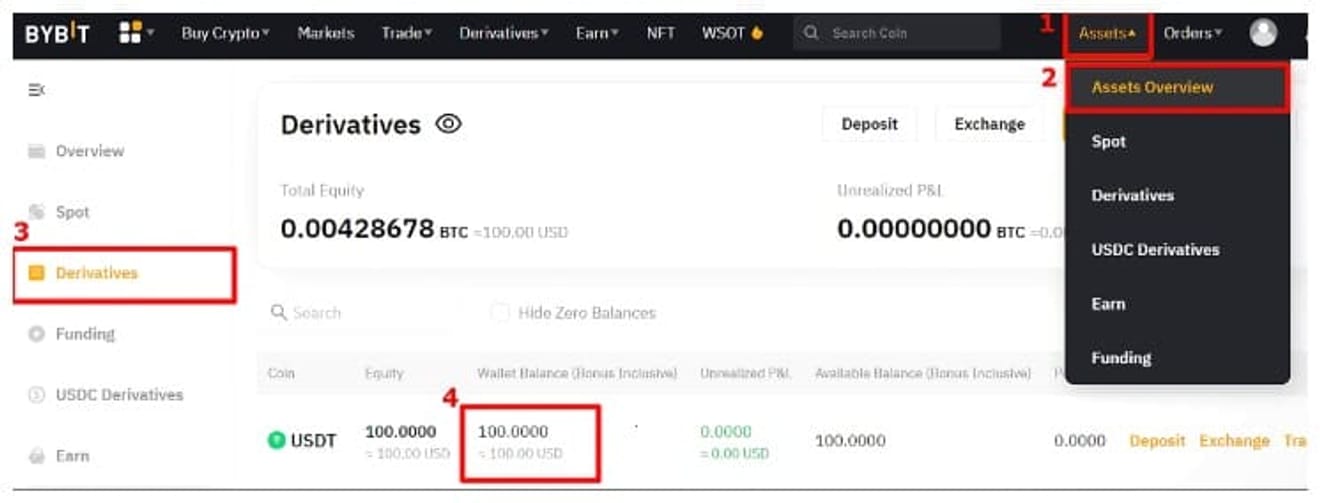

Check the transferred USDT in your Derivatives wallet.

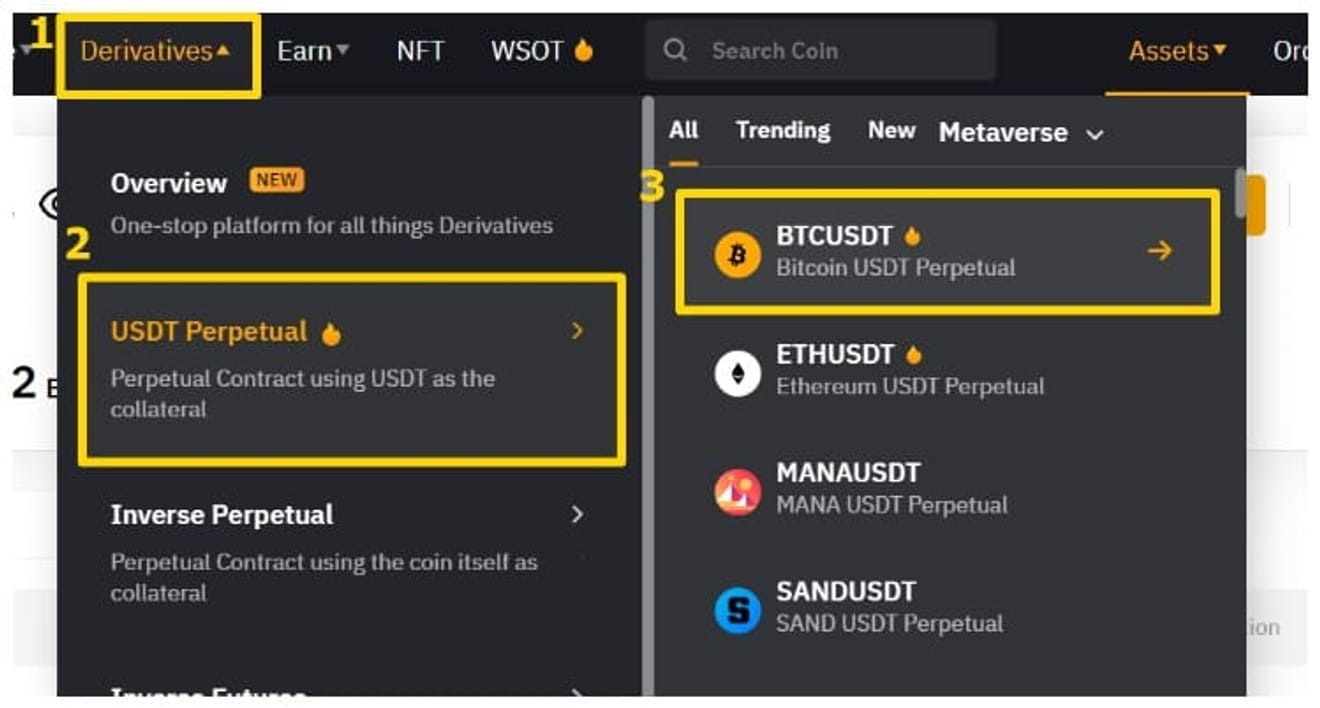

3. Entering the USDT Futures Trading Market

Enter the BTCUSDT perpetual contract.

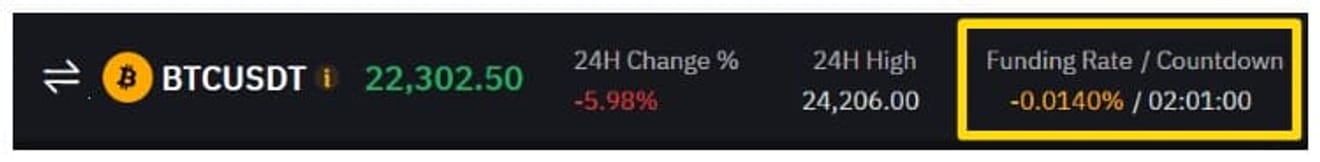

You need to know the Funding Rate before trading. This is a cost for market balance, and the dominant position pays a fee to the other party. For example, if the funding rate is negative, the short position pays the cost.

Select Isolated for the margin mode and set the leverage to 3x. Specify the order method as Market, enter 100% of the quantity, and click 'Open Short'.

- Isolated: The margin is fixed, and the liquidation price does not change.

- Cross: The entire balance of the wallet serves as collateral, and the liquidation price fluctuates.

You can choose the order method from Limit, Market, Order by Qty (quantity-based), and Order by Cost (amount-based).

TP/SL is a function to pre-specify the take-profit and stop-loss prices.

- TP (Take Profit): Automatic take profit when the target price is reached.

- SL (Stop Loss): Automatic termination when the stop-loss price is reached.

You can reduce the risk of volatility with this feature.

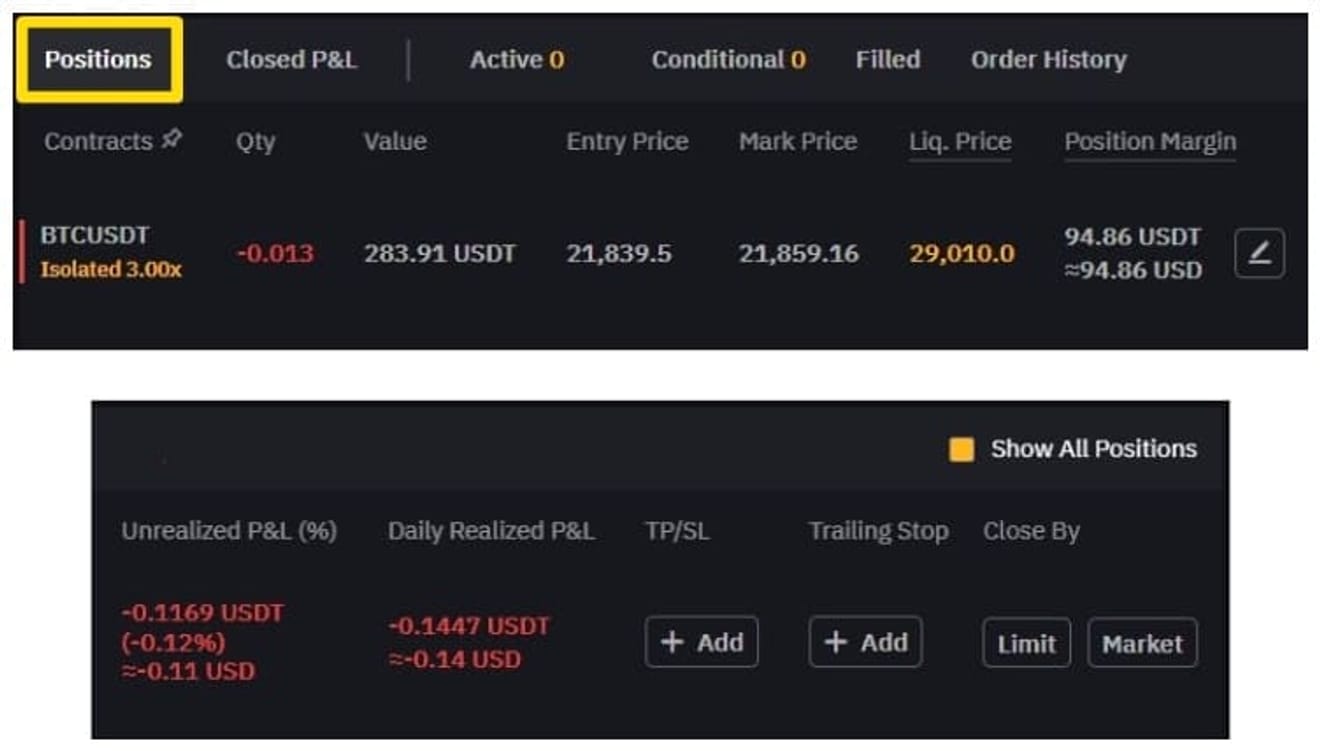

Check position information in the 'Position' tab.

- Example: BTCUSDT Isolated 3x short position.

- Quantity: -0.013 BTC (approx. $286) → ‘-’ means short position.

- Entry Price: Entry price.

- Mark Price: Similar to the market price, the liquidation price standard.

- Liq. Price: Liquidation price.

- Position Margin: Collateral. Can be added/removed.

- Unrealized P&L: Unrealized profit and loss.

Position termination is possible from the 'Close By' menu.

When closing at Limit, enter the price and quantity, and then press Confirm.

If you turn on the Post-Only option, executions other than the specified price will be canceled. Market termination is executed immediately.

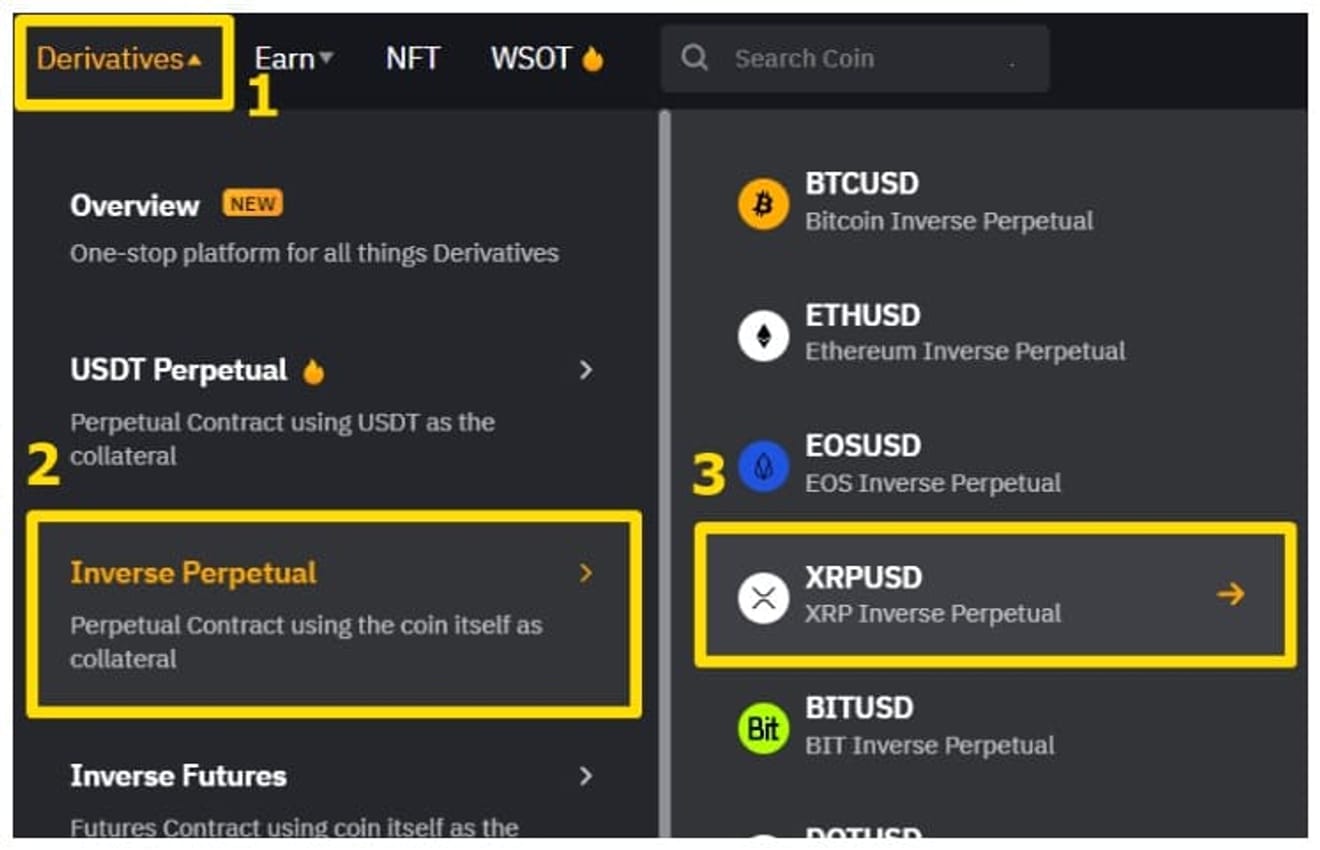

4. Entering the Inverse Futures (1x Short) Market

This is a method of using assets with volatility such as BTC, ETH, and XRP as collateral instead of USDT. It is used for hedging 보유 자산 and for funding fee trading.

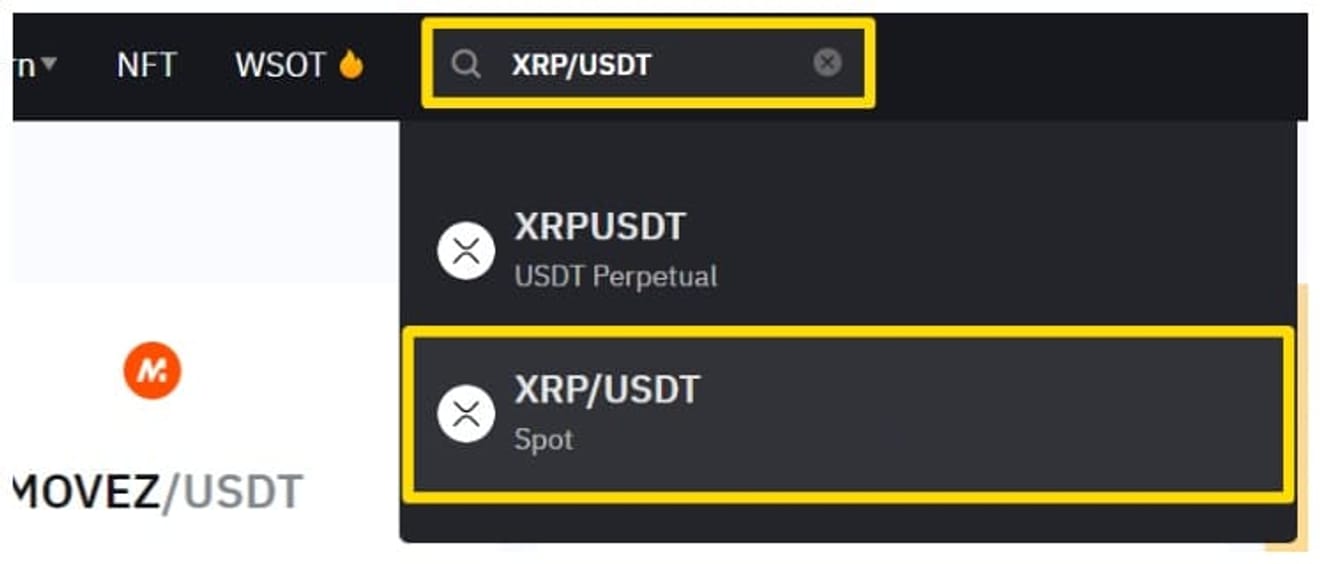

Proceed with XRP as an example.

Purchase about 300 XRP in the Spot market, then send it to the derivatives wallet via Transfer.

After selecting Derivatives → Inverse Perpetual → XRPUSD, open an Isolated 1x short position.

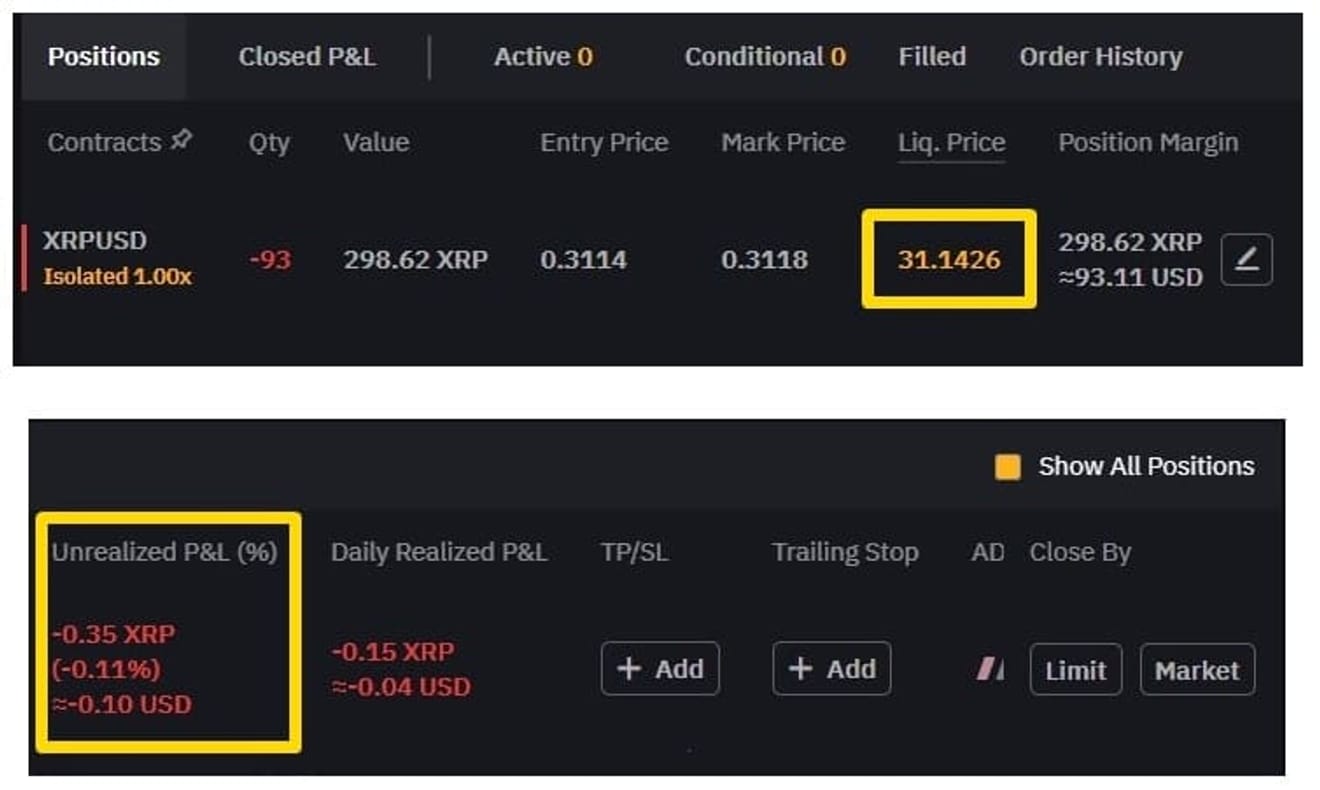

Position information is displayed as follows.

The liquidation price appears high because it used spot XRP as collateral. The value of the spot and the profit/loss of the short position move in opposite directions, allowing you to hedge your asset value.

In the Inverse market, the profit and loss are reflected in the quantity of the collateral asset (XRP). If the price goes up, the amount of collateral decreases, and if it goes down, it increases. This is different from USDT futures.

Position termination is immediately possible with a Market order.

Bybit Fees

- Spot trading fee: Basic 0.1% (maker and taker are the same).

- Futures trading fee: Maker 0.02%, Taker 0.055%.

The fee is divided into VIP 0 (general) to Supreme VIP according to the grade. As VIP increases, maker/taker fees are reduced. It is more advantageous for investors who make many transactions to receive VIP benefits.