How to Use Redotpay Payments | Overseas Travel | Fee Comparison | Reviews

In this blog post, we will cover how to make payments with Redotpay, how to use it when traveling abroad, a fee comparison, and reviews. Those who have received a Redotpay card will be curious about how they can use it in actual payments. The advantage of being able to directly use cryptocurrency at regular stores is attractive, but unexpected costs can occur if you don't fully understand the payment process and fee structure. When paying with Redotpay, fees and exchange rates are applied differently depending on various cases, including online shopping malls, offline stores, and use abroad. It is important to understand in advance whether it is truly economical compared to existing credit cards or debit cards, and in what situations it is most advantageous. In this article, we will provide all the information, including how to use Redotpay for actual payments, a fee comparison with various payment methods, and honest reviews from actual users, to provide you with a practical guide to effectively and economically utilize Redotpay.

How to Use Redotpay Payments

The process of using Redotpay starts with a simple procedure. First, you need to download the app, complete the membership registration, and proceed with the KYC process, including real-name verification and identity verification. If you sign up through the official partner link below, you can receive a bonus of 5 dollars.

In addition, if you sign up through this link and receive a virtual card or a physical card, you can receive a 20% discount on the issuance cost. (Physical card promotion code Redot2025, virtual card promotion code 200FF2025)

Cards are issued in two ways. Virtual cards are issued immediately in the app and are optimized for online payments. Physical cards are delivered within 5-10 days after application. However, domestic delivery is currently limited.

To charge funds, you need to purchase USDT on a domestic exchange such as Bithumb or Upbit through the TRC-20 network, and then transfer it to the Redotpay wallet address through an overseas exchange. When the deposit is complete, the card will be automatically charged.

You can use it after completing PIN registration and card activation. Online, you can pay by entering the card number, CVV, and expiration date like a regular card, and offline, you can insert the physical card and enter the PIN to complete the payment.

Features of Redotpay Payments

Redotpay is a cryptocurrency-based global payment card and wallet service that allows you to charge stablecoins such as USDT (Tether) and USDC (USD Coin) and make payments at Mastercard and Visa card merchants. This service is operated by a domestic startup or based in Hong Kong, and virtual cards (issued immediately) and physical cards (delivered) can be issued in the app.

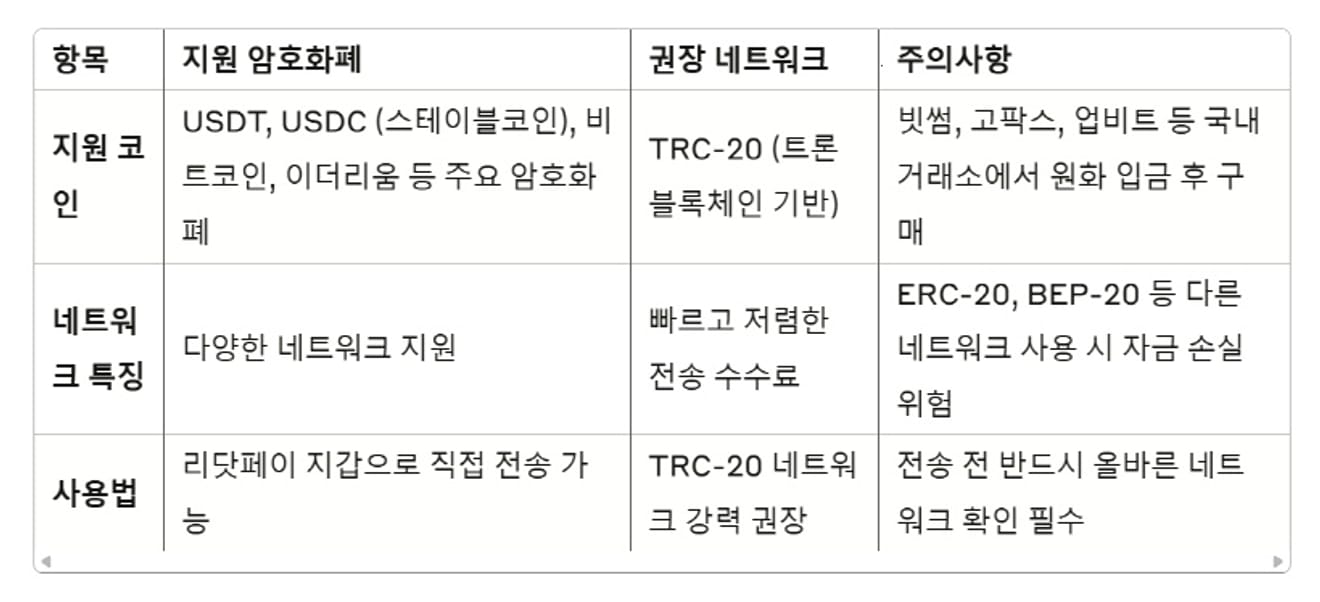

Coins that can be used when paying with Redotpay (H3)

Redotpay supports various major cryptocurrencies. You can handle widely used digital assets such as Bitcoin and Ethereum, as well as stablecoins like USDT (Tether) and USDC. When transferring cryptocurrencies, we strongly recommend using the TRC-20 network. TRC-20 is a token standard based on the Tron (TRON) blockchain, with the advantage of fast and cheap transfer fees.

There are things to be aware of when using it. If you want to trade USDT, you must deposit won into a domestic exchange such as Bithumb, Gopax, or Upbit. You must be especially careful when choosing a network. If you transfer to a network other than TRC-20, such as ERC-20 (based on Ethereum) or BEP-20 (based on Binance Smart Chain), there is a risk of losing your funds because they are not compatible. You must check and select the correct network before transferring.

Redotpay Actual Payments and Reviews

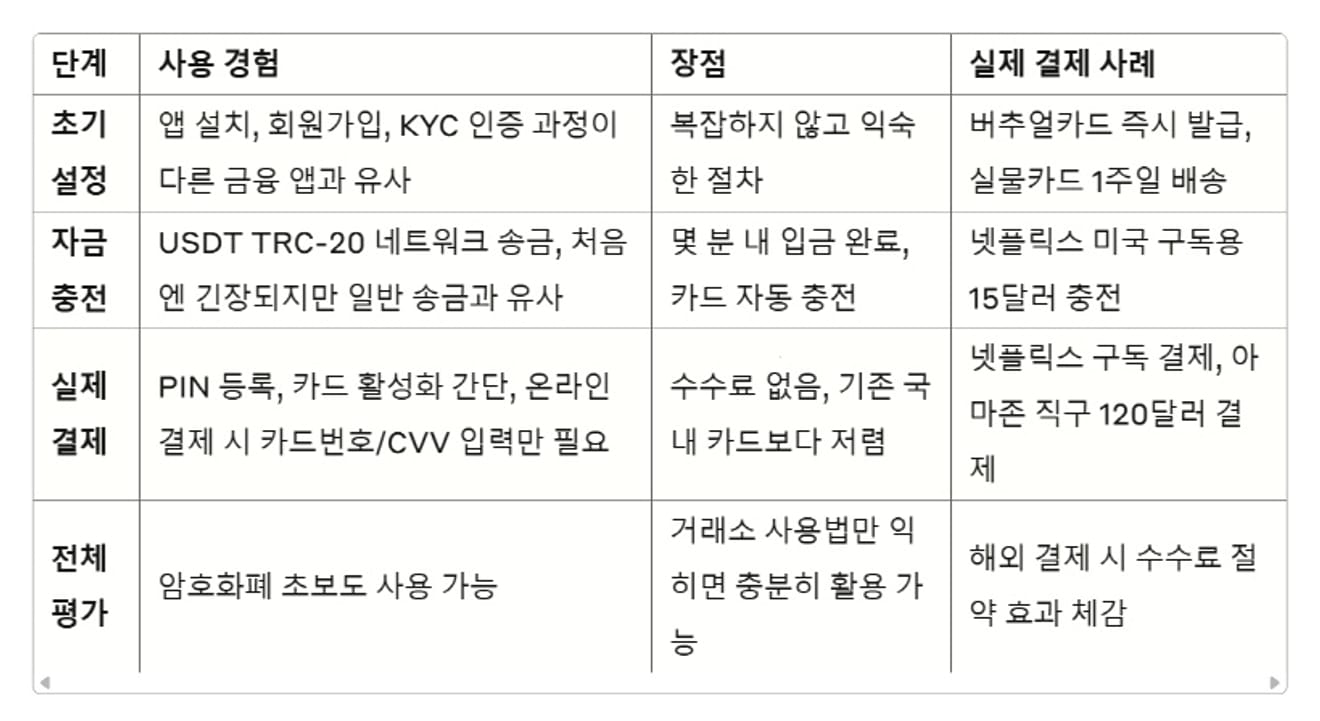

I recently used the Redotpay card myself. It was much more convenient than I thought. At first, I was worried because I had never dealt with cryptocurrency before, but it wasn't that complicated once I tried it.

The app installation, membership registration, and KYC authentication process were similar to other financial apps. After completing real-name verification and identity verification, I was able to receive a virtual card immediately. I also applied for a physical card, and I was able to receive it in about a week.

The most concerning part was charging cryptocurrency, and the process of purchasing USDT through the TRC-20 network and transferring it to the Redotpay wallet was a little nervous at first. However, once I tried it, it wasn't much different from a regular transfer, and the deposit was completed within a few minutes, and the card was automatically charged.

I actually charged 15 dollars to the virtual card to subscribe to Netflix US, and it was processed cleanly without any fees. When I purchased directly from Amazon, I paid about 120 dollars with the physical card, and the fees were definitely lower than the domestic card I used before.

The PIN registration and card activation process was also simple, and the usage was not difficult as it only required entering the card number and CVV online, just like a regular card. Even cryptocurrency beginners seem to be able to utilize it enough if they learn how to use the exchange.

Redotpay Payment Fee Comparison

The fee structure of Redotpay is applied differently depending on the type of transaction. A fee of 1% is charged for dollar payments with stablecoins, and a fee of 2.2% is applied for payments in other currencies, including won. When withdrawing cash from an ATM, a fee of about 2% occurs, and there is a minimum withdrawal amount limit.

However, there is a benefit where fees are waived for small transactions under 1 dollar. The exchange rate is almost non-existent, providing market exchange rates within the range of 0~0.5%.

This fee structure provides a significant cost reduction compared to the overseas payment fees of up to 3~4% charged by domestic cards or banks. In addition, since you can use it with an amount almost close to the actual exchange rate, you can minimize the loss due to the exchange rate margin.

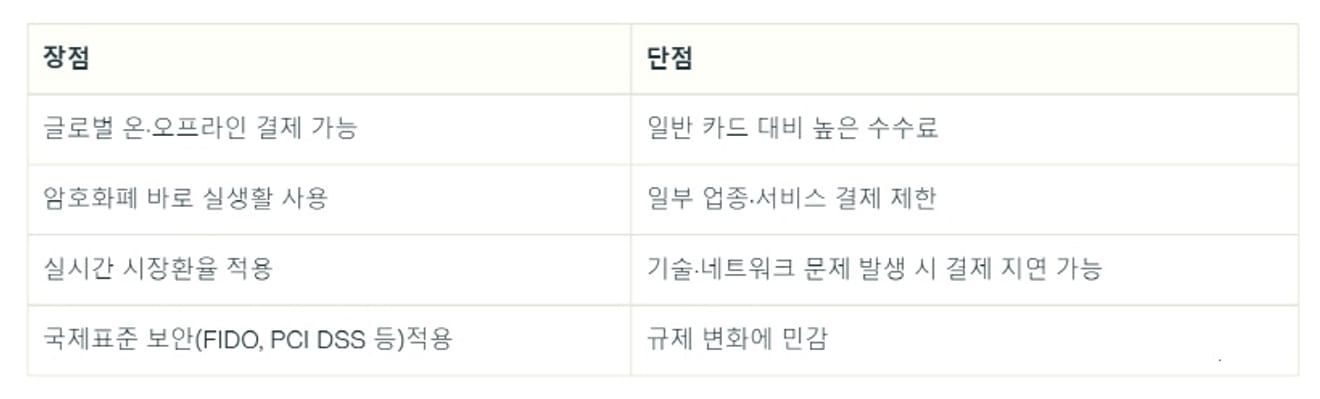

Advantages and Disadvantages of Redotpay Payments

The Redotpay card has both advantages and disadvantages. The main advantages are that you can freely make payments online and offline worldwide, and you can easily use it with the cryptocurrency you hold.

Cryptocurrencies can be applied directly without going through a separate exchange process. In addition, the real-time market exchange rate minimizes exchange rate losses, and safety is guaranteed by complying with international security standards such as FIDO and PCI DSS.

However, there are also disadvantages. The fees are higher than those of general domestic cards, and payments are not possible in certain industries such as gambling and financial services. Payments may be delayed in the event of technical problems or network failures, and it should also be kept in mind that it can be sensitive to changes in cryptocurrency-related regulations.

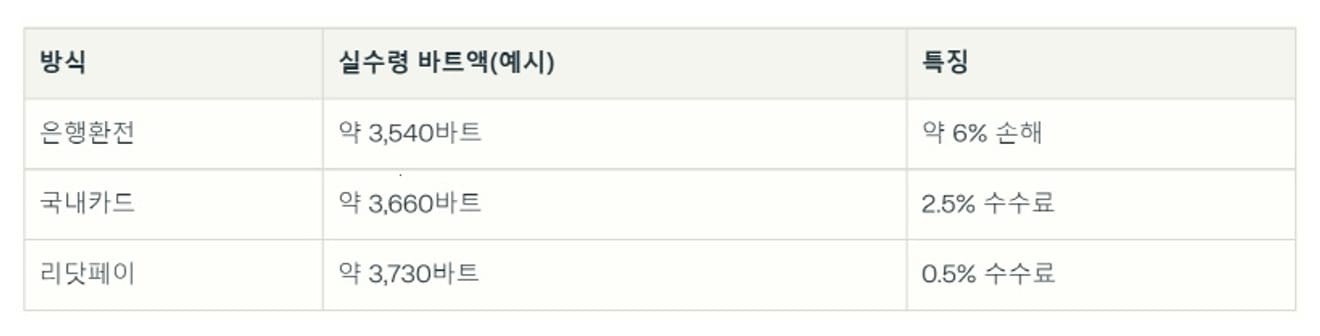

Redotpay Overseas Travel Payment Fee Comparison

When using 4,000 won worth of money in baht during a trip to Thailand, a clear difference appears when comparing the actual amount received for each payment method.

If you exchange cash through a bank, you can receive about 3,540 baht, which means a loss of about 6%. If you pay with a domestic card, you can get a value of about 3,660 baht, but a fee of 2.5% is still charged.

On the other hand, if you use a Redotpay card, you can receive about 3,730 baht, and only a fee of 0.5% occurs. This shows a much more economical result compared to cash exchange or general card use, and you can see that Redotpay is the most advantageous choice in actual use.

Redotpay is an attractive choice for global financial users, consumers who frequently use overseas payments, and cryptocurrency holders, but you need to carefully consider the regulatory environment, fees, and technical risk factors of each country. The convenience of payment and exchange is very high, and it also shows its strengths in small business owners and a large number of overseas transactions.